We had a quick drop in the indexes this morning, but it wasn't deep and it didn't last long. I've been expecting some selling for days, but it's been quite fleeting when it finally occurs. And there doesn't seem to be any indication that we will get a meaningful correction any time soon either. Oh, the selling may come any day, but will it be enough to trigger a sell signal from the Seven Sentinels? And even if it did, would it be meaningful? The last two sell signals were pretty tame given the scale of this up-leg off the March low. This has been one impressive, powerful bull run.

I bought into this market on the last Seven Sentinels buy signal and once again it is paying off. Here's today's charts:

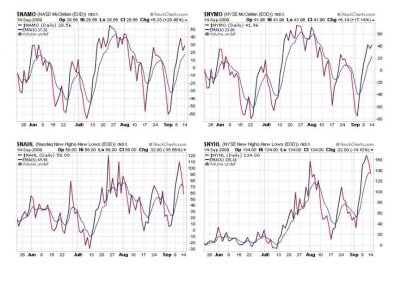

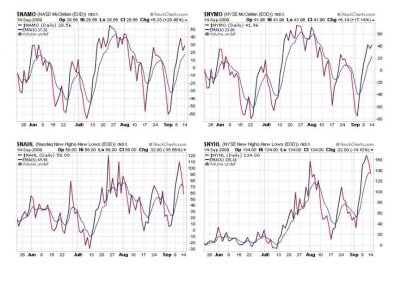

Believe it or not, we did get two new sell signals today in NAHL and NYHL. But NAMO and NYMO are holding their ground.

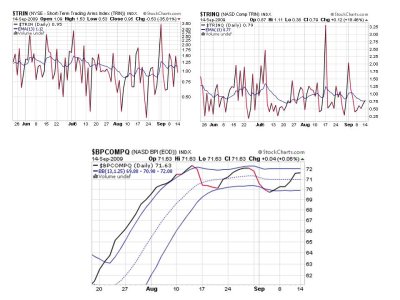

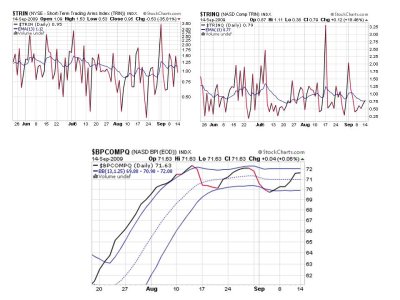

In this chart, TRIN, which was on a sell yesterday, is now on a buy. But TRINQ, which has been on a buy for days, is now on a sell. BPCOMPQ remains on a buy, but as I suspected is turning a bit now. But it would have to drop below the lower bollinger band before it would flash a sell signal.

So we have 3 out of 7 signals on a sell. We need all 7 indicators to simultaneously give sell signals to get a valid sell signal for the system. So we remain on a buy in C,S, and I until that happens.

Our top 25% made no meaningful changes today, so I won't bother posting those charts at this time. They remain bullish.

I bought into this market on the last Seven Sentinels buy signal and once again it is paying off. Here's today's charts:

Believe it or not, we did get two new sell signals today in NAHL and NYHL. But NAMO and NYMO are holding their ground.

In this chart, TRIN, which was on a sell yesterday, is now on a buy. But TRINQ, which has been on a buy for days, is now on a sell. BPCOMPQ remains on a buy, but as I suspected is turning a bit now. But it would have to drop below the lower bollinger band before it would flash a sell signal.

So we have 3 out of 7 signals on a sell. We need all 7 indicators to simultaneously give sell signals to get a valid sell signal for the system. So we remain on a buy in C,S, and I until that happens.

Our top 25% made no meaningful changes today, so I won't bother posting those charts at this time. They remain bullish.