Not surprisingly, the market reversed most of Friday's losses in somewhat volatile trade today. And the pundits are pointing to an agreement on austerity measures out of Greece as the reason.

The broader market shot higher right at the open, but there was some selling pressure not long after that erased much of those early gains. But the dip buyers were an unrelenting group today. They stepped in not long after the market began heading lower and helped the major averages chop their way to some decent gains by the close.

Not much else happened today so let's go to the charts:

NAMO and NYMO picked up some today, but remain in sell conditions.

NAHL and NYHL managed to get back to their 6 day EMAs, although NAHL stopped just short and remained on a sell, while NYHL flipped to a buy.

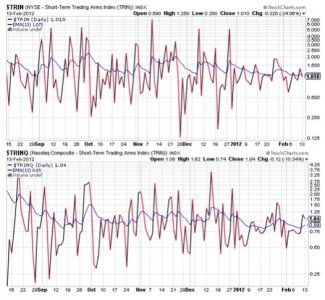

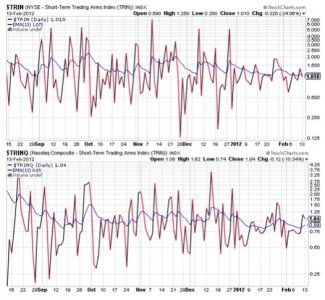

TRIN is on a buy, while TRINQ is on a sell.

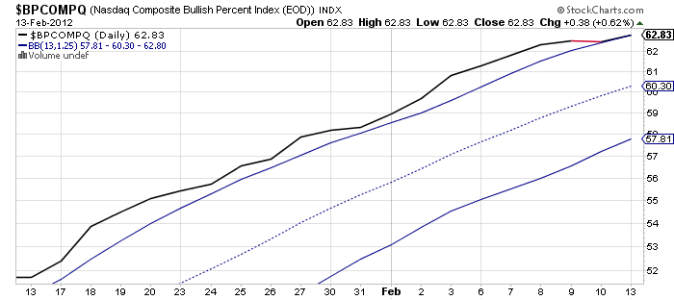

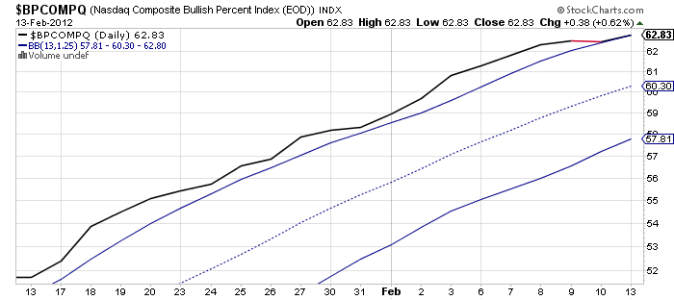

BPCOMPQ is now traveling right over the upper bollinger band. It remains on a buy.

So the signals are mixed, and that keeps the system on a buy.

I was looking for volatility this week and we got a bit today, although it wasn't bad. I believe the market will continue to move higher, but I'm not so sure we won't see another shot lower this week. Still, between bearish sentiment and OPEX I expect any downside will be limited.

The broader market shot higher right at the open, but there was some selling pressure not long after that erased much of those early gains. But the dip buyers were an unrelenting group today. They stepped in not long after the market began heading lower and helped the major averages chop their way to some decent gains by the close.

Not much else happened today so let's go to the charts:

NAMO and NYMO picked up some today, but remain in sell conditions.

NAHL and NYHL managed to get back to their 6 day EMAs, although NAHL stopped just short and remained on a sell, while NYHL flipped to a buy.

TRIN is on a buy, while TRINQ is on a sell.

BPCOMPQ is now traveling right over the upper bollinger band. It remains on a buy.

So the signals are mixed, and that keeps the system on a buy.

I was looking for volatility this week and we got a bit today, although it wasn't bad. I believe the market will continue to move higher, but I'm not so sure we won't see another shot lower this week. Still, between bearish sentiment and OPEX I expect any downside will be limited.