-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Show-me Account Talk

- Thread starter Show-me

- Start date

- Status

- Not open for further replies.

Show-me

TSP Legend

- Reaction score

- 104

This is the face of a leader tired to the socialist losers from Greece demanding more money for their bailout. lol

Germany Rejects Bigger Bailout

http://online.wsj.com/article/SB10001424052970203718504577176933077975206.html

Germany Rejects Bigger Bailout

http://online.wsj.com/article/SB10001424052970203718504577176933077975206.html

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Re: The voice of reason.

Kinda' sayin' like it is... I wonder how many non-institutional traders are hearing this?

Kinda' sayin' like it is... I wonder how many non-institutional traders are hearing this?

Show-me

TSP Legend

- Reaction score

- 104

Show-me

TSP Legend

- Reaction score

- 104

Things floating around in my head.

Bullish market, 50 sma going to cross 200 sma.

Do not put everything in the G fund in a bullish market. If your wrong about a pull back you will not gain a damn thing.

The trend is your friend no matter what you might think. You can think a pull back is coming and if it does not for another 4 weeks you feel like a heel and did not make a dime.

Don't greedy. If your kicking a$$, ladder some out to reduce risk. What's your goal for the year? Nothing goes up forever. Look for resistance levels.

Don't chase the tracker standings.

Personal observation, Tom notes the dumb money smart money index. Earnings season always gets me and I think that the dumb money is very very tired of not making money and is chasing early this year. Articles I have read state that mutual fund and retirement fund are tired of low returns and are chasing too. At some point they will take profits or the big boyz will and the dumb money will be left holding the bag. Be ready and be careful, but ride the trend.

Emotions are bad. Tracker standings are emotional. Watching the train wreak in Greece and Europe is emotional. Watching the train wreak in the US is emotional. Watch the chart and don't try to out guess the news.

Just spit balling folks.

Bullish market, 50 sma going to cross 200 sma.

Do not put everything in the G fund in a bullish market. If your wrong about a pull back you will not gain a damn thing.

The trend is your friend no matter what you might think. You can think a pull back is coming and if it does not for another 4 weeks you feel like a heel and did not make a dime.

Don't greedy. If your kicking a$$, ladder some out to reduce risk. What's your goal for the year? Nothing goes up forever. Look for resistance levels.

Don't chase the tracker standings.

Personal observation, Tom notes the dumb money smart money index. Earnings season always gets me and I think that the dumb money is very very tired of not making money and is chasing early this year. Articles I have read state that mutual fund and retirement fund are tired of low returns and are chasing too. At some point they will take profits or the big boyz will and the dumb money will be left holding the bag. Be ready and be careful, but ride the trend.

Emotions are bad. Tracker standings are emotional. Watching the train wreak in Greece and Europe is emotional. Watching the train wreak in the US is emotional. Watch the chart and don't try to out guess the news.

Just spit balling folks.

- Reaction score

- 857

Things floating around in my head.

Bullish market, 50 sma going to cross 200 sma.

Do not put everything in the G fund in a bullish market. If your wrong about a pull back you will not gain a damn thing.

The trend is your friend no matter what you might think. You can think a pull back is coming and if it does not for another 4 weeks you feel like a heel and did not make a dime.

Don't greedy. If your kicking a$$, ladder some out to reduce risk. What's your goal for the year? Nothing goes up forever. Look for resistance levels.

Don't chase the tracker standings.

Personal observation, Tom notes the dumb money smart money index. Earnings season always gets me and I think that the dumb money is very very tired of not making money and is chasing early this year. Articles I have read state that mutual fund and retirement fund are tired of low returns and are chasing too. At some point they will take profits or the big boyz will and the dumb money will be left holding the bag. Be ready and be careful, but ride the trend.

Emotions are bad. Tracker standings are emotional. Watching the train wreak in Greece and Europe is emotional. Watching the train wreak in the US is emotional. Watch the chart and don't try to out guess the news.

Just spit balling folks.

Thanks for sharing.

Show-me

TSP Legend

- Reaction score

- 104

Bullish market, 50 sma going to cross 200 sma.

Do not put everything in the G fund in a bullish market. If your wrong about a pull back you will not gain a damn thing.

The trend is your friend no matter what you might think. You can think a pull back is coming and if it does not for another 4 weeks you feel like a heel and did not make a dime.

No need to show any charts as the vapor trail tells the story but the things in my head are making sense today. I wish I had the other 30% in the S fund but I thrilled to have 70% there now.

Ride the wave!

Show-me

TSP Legend

- Reaction score

- 104

Show-me

TSP Legend

- Reaction score

- 104

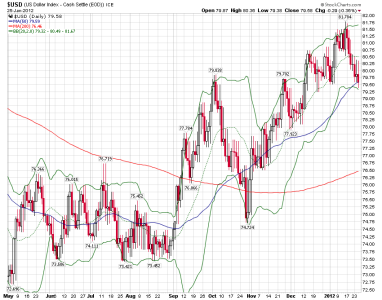

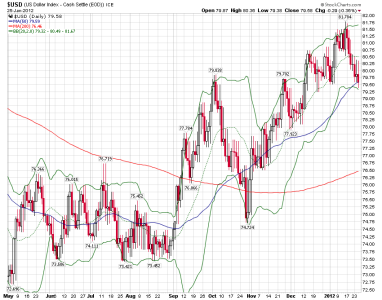

Interesting charts. Yesterday TBT ran down to the 20 sma then back up and today it sold off. AGG covered a huge range yesterday and then rallied off of the bottom of its range. Huh The dollar is pushing down hard and is breaking support. Eww. VIX keeps pushing down and testing the lower band but it is a long way from the Birch 15 range. Bears close watching.

I think the dumb money is chasing this market and that make Birch giddy. Bond yields are going up and I think the smart money is starting to look at going back to bonds. TBT is running out of steam and AGG is bouncing.

I pulled another 15% out because I'm happy with my return and I want to reduce my risk. This market is nuts and can flip at a nano. I'm keeping a core position in case the pull back never comes but I have not decided what will trigger my core position exit.

I think the dumb money is chasing this market and that make Birch giddy. Bond yields are going up and I think the smart money is starting to look at going back to bonds. TBT is running out of steam and AGG is bouncing.

I pulled another 15% out because I'm happy with my return and I want to reduce my risk. This market is nuts and can flip at a nano. I'm keeping a core position in case the pull back never comes but I have not decided what will trigger my core position exit.

Sensei

TSP Pro

- Reaction score

- 27

One other thing of note, 122 people are 100% vested in the S fund with 222 50% and greater vested in the S fund. The I fund only has 45 50% and greater vested and the C fund has 42 50% or greater vested.

How relevant do you think that is? Are we a good sample? Most people I've talked to at work just buy and hold a diversified position or one of the L funds.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

How relevant do you think that is? Are we a good sample? Most people I've talked to at work just buy and hold a diversified position or one of the L funds.

Good point. Now I have to decide if I should even keep them on my list...

Sensei

TSP Pro

- Reaction score

- 27

I mean, I was asking b/c I have 50% in C right now, and I feel like a loser. When stocks go up, S goes higher. When stocks go down, C goes lower. The grass definitely looks greener in the S & I funds right now, but does the fact that so many TSP Talkers have their money in S indicate at all that it is getting played out? Just wondering out loud.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

I mean, I was asking b/c I have 50% in C right now, and I feel like a loser. When stocks go up, S goes higher. When stocks go down, C goes lower. The grass definitely looks greener in the S & I funds right now, but does the fact that so many TSP Talkers have their money in S indicate at all that it is getting played out? Just wondering out loud.

S-fund tends to make more and lose more than C-fund because of the volatility and safety of the underlying stocks... IMO, I-fund is just too unpredictable because of the FV...

Show-me

TSP Legend

- Reaction score

- 104

How relevant do you think that is? Are we a good sample? Most people I've talked to at work just buy and hold a diversified position or one of the L funds.

900 folks on the tracker is a good sample to me. 472 of us are beating the 2.11% C fund return last year. Making money can be easy, holding on to it and out guessing the market action is the trick. I would like more input. Are we as a group dumb or smart money? I keep feeling like it is too easy and that people are chasing.

S-fund tends to make more and lose more than C-fund because of the volatility and safety of the underlying stocks... IMO, I-fund is just too unpredictable because of the FV...

I agree. I am tempted many times to jump into the I fund but in these volatile time I would hate to be on the wrong side of the dollar and equities.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Are we as a group dumb or smart money?

Yes

I keep feeling like it is too easy and that people are chasing.

I think the people who have entered in the last, say 2-3 days ARE chasing. This uptrend has been ongoing since 12/19 and is extended. I cannot say that it won't continue, but the RRR is just too low...

- Status

- Not open for further replies.

Similar threads

- Replies

- 3

- Views

- 599