It would seem the market makers are intent on shaking weak handed bulls loose before turning things back up again. At least that's my perspective.

The market is shrugging off a pretty rosy earnings picture and is instead focusing on the negatives such as this mornings disappointing June durable goods number, which was down 1% vice up an anticipated 1%.

The Fed's latest Beige Book didn't inspire buyers either.

But then again this is exactly what the doctor ordered given we were in an overbought condition.

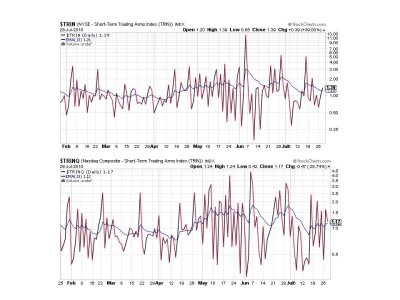

Here's today's charts:

Two sells here, but I see no reason for concern given the previous overbought condition.

Two more sells, but the same holds true here.

Two sells, but staying close to the 13 day EMA.

BPCOMPQ still looks good and remains on a buy.

So we have only 1 signal flashing a buy, but I'm convinced the market is consolidating and trying to shake loose the weak hands in the process. The system remains on a buy and I am looking for a resumption of an upward bias soon.

The market is shrugging off a pretty rosy earnings picture and is instead focusing on the negatives such as this mornings disappointing June durable goods number, which was down 1% vice up an anticipated 1%.

The Fed's latest Beige Book didn't inspire buyers either.

But then again this is exactly what the doctor ordered given we were in an overbought condition.

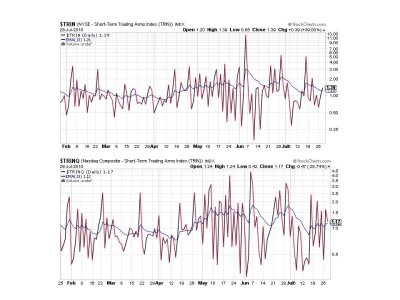

Here's today's charts:

Two sells here, but I see no reason for concern given the previous overbought condition.

Two more sells, but the same holds true here.

Two sells, but staying close to the 13 day EMA.

BPCOMPQ still looks good and remains on a buy.

So we have only 1 signal flashing a buy, but I'm convinced the market is consolidating and trying to shake loose the weak hands in the process. The system remains on a buy and I am looking for a resumption of an upward bias soon.