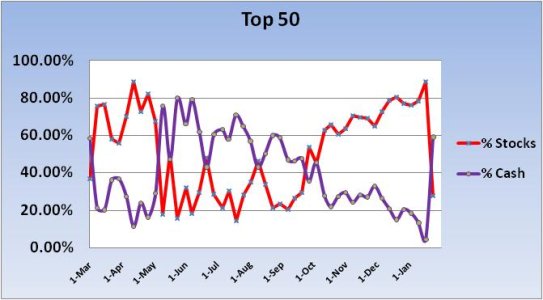

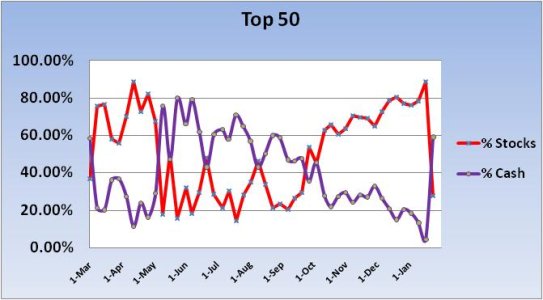

Since our tracker resets every year, it tends to produce significant swings in the Top 50. This is because we all start out at zero with respect to our performance (gain/loss percentage). As time goes on the percent separation from top to bottom gets more pronounced, which reduces volatility with respect to where one's position on the tracker is. This is especially evident in this weeks Top 50.

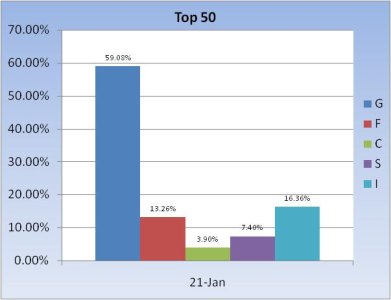

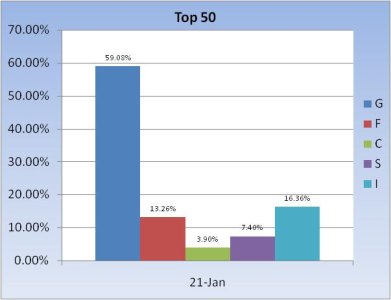

What a difference a week (and a little market weakness) makes. What started out as a big lead for S funders (the fund of choice this month) has quickly faded, and as a result we see a much different picture in terms of stock allocations at the top. Just look at how each of our main funds performed this past week and you will be able to see how we got here:

G fund +0.06%

F fund -0.24%

C fund -0.75%

S fund -3.09%

I fund +0.02%

The S fund underperformed all funds by a wide margin. As a result, those who held that fund dropped in the rankings. And the bigger allocation one had in the S fund, the bigger the hit.

So in a matter of one week, the G fund now leads total allocations be a wide margin in the Top 50.

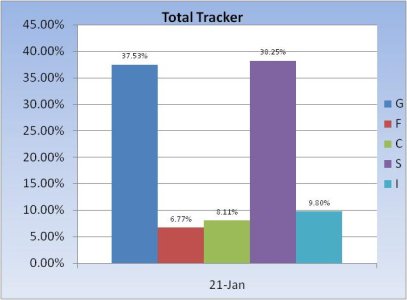

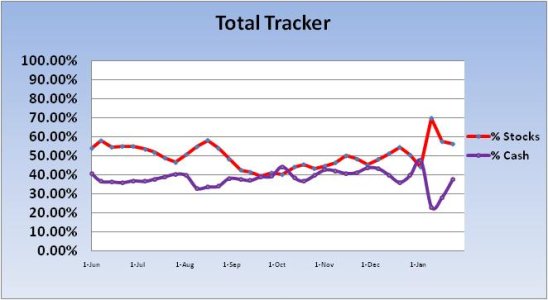

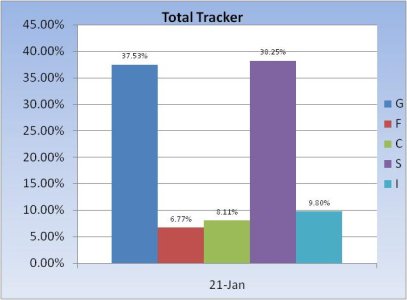

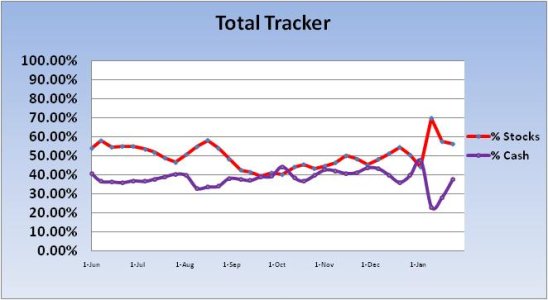

The tracker however, is not as inclined to volatility. The S fund is still the fund of choice and there's a sizable allocation in the G fund too. Overall, we dipped modestly in our stock allocations and got more defensive as a group.

Given our sentiment survey is on a buy for this week, I suspect the downside may be limited. But I don't think the bulls will be having a banner week either. I'm thinking we chop around for a few days before the next big move. Which way will that be? Since the Sentinels are on a sell, my guess is it'll be down.

What a difference a week (and a little market weakness) makes. What started out as a big lead for S funders (the fund of choice this month) has quickly faded, and as a result we see a much different picture in terms of stock allocations at the top. Just look at how each of our main funds performed this past week and you will be able to see how we got here:

G fund +0.06%

F fund -0.24%

C fund -0.75%

S fund -3.09%

I fund +0.02%

The S fund underperformed all funds by a wide margin. As a result, those who held that fund dropped in the rankings. And the bigger allocation one had in the S fund, the bigger the hit.

So in a matter of one week, the G fund now leads total allocations be a wide margin in the Top 50.

The tracker however, is not as inclined to volatility. The S fund is still the fund of choice and there's a sizable allocation in the G fund too. Overall, we dipped modestly in our stock allocations and got more defensive as a group.

Given our sentiment survey is on a buy for this week, I suspect the downside may be limited. But I don't think the bulls will be having a banner week either. I'm thinking we chop around for a few days before the next big move. Which way will that be? Since the Sentinels are on a sell, my guess is it'll be down.