The Seven Sentinels remain on a buy after today, but I need to raise the caution flag given their current condition. More on that in a bit.

It was a lackluster day on Wall Street as the major averages closed mix, with the DOW, S&P 500, and Wilshire 4500 (S fund) closing modestly lower at 0.22%, 0.21%, and 0.21% respectively. The Nasdaq ended the trading session with a 0.28% gain. The EAFE (I fund) was down a more substantial 1.15% in large measure due to another rally in the dollar.

On the data front, initial jobless claims came in at 409,000, which was not far off the estimated 405,000, while initial claims were up 18,000 and continuing claims were down 50,000.

Retails were punished as expectations for December same-store sales are largely not being met. In particular, Target (TGT) had its worse one day loss in more than a year after reporting less than a 1% increase in sales during the month of December. I wonder how that happened considering all those rosy media reports of shoppers packing the malls last month?

The dollar was up again against the euro, which saw pressure as a result of a report detailing measures to be taken in the event of future eurozone bank failures.

There are still plenty of warning signs that this market is ripe for a correction, but that's been the case for several months now. Perhaps even the past 2 years, but taking a bearish position has been a prescription for pain in most cases. There has been numerous times since this past September when the market was looking very vulnerable, and then would come alive just as it hit the tipping point and make new highs.

While I know a correction will eventually come, I still don't think we're quite there yet. With that, let's look at the charts:

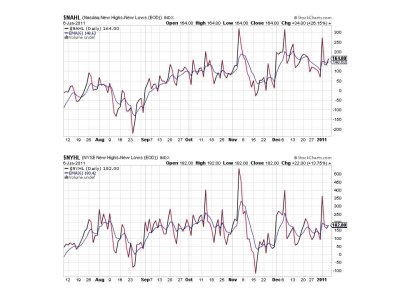

Both NAMO and NYMO are flashing sells. Still, these signals look neutral more than anything else and an upward bias has persisted with readings like this for some time now.

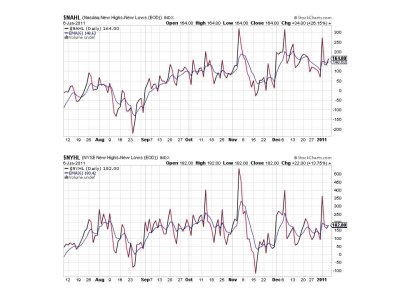

NAHL and NYHL actually flipped to buys today, but only barely. Not really a concern here.

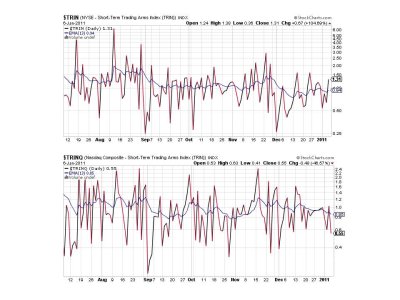

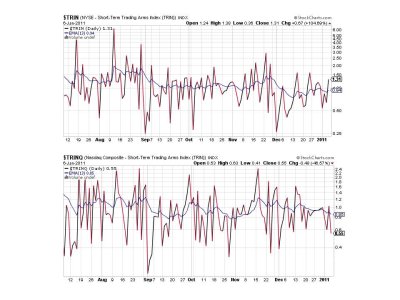

TRIN flipped to a sell, but TRINQ flipped to a buy.

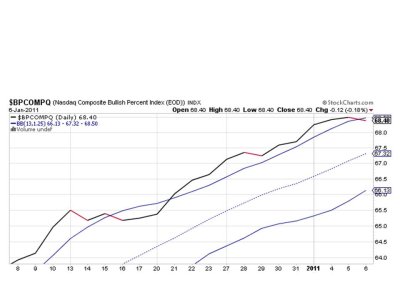

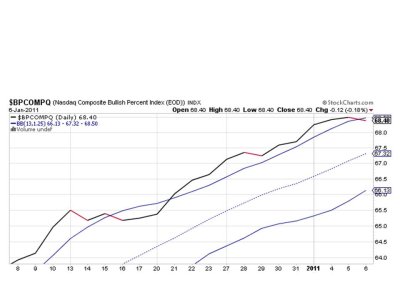

Here's where the caution flag comes in. BPCOMPQ dropped below the upper bollinger band today and that flips it to a sell. Usually this is the last signal to cause a change in the buy or sell condition of the Seven Sentinels.

So 3 of the signals remain on a buy and that keeps the system on a buy. Two of those signals (NAHL and NYHL) are only barely a buy, while TRINQ (or TRIN for that matter) can flip back and forth between buy and sell readily.

Overall the Sentinels are telling me the market may be vulnerable again (given BPCOMPQ went to a sell), but as I mentioned earlier, we've seen this situation before only to see the market shrug off weakness and continue higher. Take a look at the BPCOMPQ chart again and you can see some modest dips in previous weeks that didn't end up in full blown declines. But it bears watching regardless as we can't be sure when the next correction might begin.

I remain cautiously bullish.

It was a lackluster day on Wall Street as the major averages closed mix, with the DOW, S&P 500, and Wilshire 4500 (S fund) closing modestly lower at 0.22%, 0.21%, and 0.21% respectively. The Nasdaq ended the trading session with a 0.28% gain. The EAFE (I fund) was down a more substantial 1.15% in large measure due to another rally in the dollar.

On the data front, initial jobless claims came in at 409,000, which was not far off the estimated 405,000, while initial claims were up 18,000 and continuing claims were down 50,000.

Retails were punished as expectations for December same-store sales are largely not being met. In particular, Target (TGT) had its worse one day loss in more than a year after reporting less than a 1% increase in sales during the month of December. I wonder how that happened considering all those rosy media reports of shoppers packing the malls last month?

The dollar was up again against the euro, which saw pressure as a result of a report detailing measures to be taken in the event of future eurozone bank failures.

There are still plenty of warning signs that this market is ripe for a correction, but that's been the case for several months now. Perhaps even the past 2 years, but taking a bearish position has been a prescription for pain in most cases. There has been numerous times since this past September when the market was looking very vulnerable, and then would come alive just as it hit the tipping point and make new highs.

While I know a correction will eventually come, I still don't think we're quite there yet. With that, let's look at the charts:

Both NAMO and NYMO are flashing sells. Still, these signals look neutral more than anything else and an upward bias has persisted with readings like this for some time now.

NAHL and NYHL actually flipped to buys today, but only barely. Not really a concern here.

TRIN flipped to a sell, but TRINQ flipped to a buy.

Here's where the caution flag comes in. BPCOMPQ dropped below the upper bollinger band today and that flips it to a sell. Usually this is the last signal to cause a change in the buy or sell condition of the Seven Sentinels.

So 3 of the signals remain on a buy and that keeps the system on a buy. Two of those signals (NAHL and NYHL) are only barely a buy, while TRINQ (or TRIN for that matter) can flip back and forth between buy and sell readily.

Overall the Sentinels are telling me the market may be vulnerable again (given BPCOMPQ went to a sell), but as I mentioned earlier, we've seen this situation before only to see the market shrug off weakness and continue higher. Take a look at the BPCOMPQ chart again and you can see some modest dips in previous weeks that didn't end up in full blown declines. But it bears watching regardless as we can't be sure when the next correction might begin.

I remain cautiously bullish.