In the Bonus section of the previous blog I highlighted some of June's issues. Of note, Feb/Jun/Sep are the only months with a negative 63-year average return.

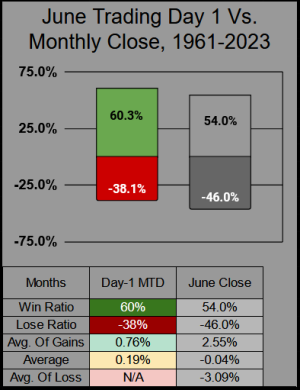

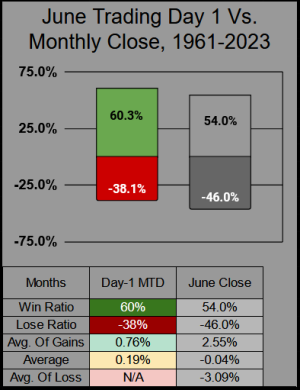

For the Month of June, our previous 42 years (1982-2003) have a 62% win ratio, for the 21-years prior (1961-1981) the win ratio was 38%. 63-years combined gives us a 54% win ratio.

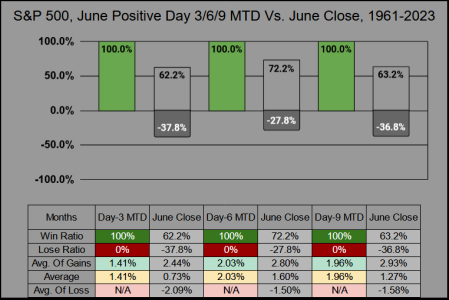

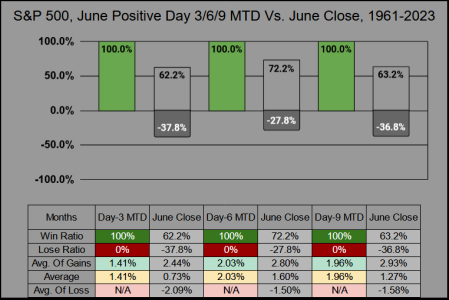

We may want to consider the 1st few days of June might set the tone for how the month plays out. When our first 3/6/9 MTD sessions were positive, the monthly close fared better. Our 54% win ratio rises to 62-72%

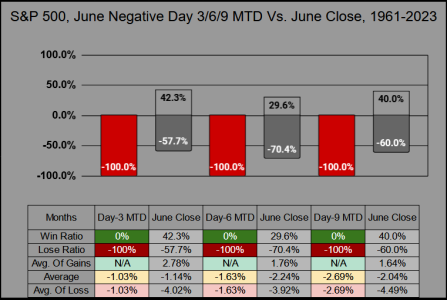

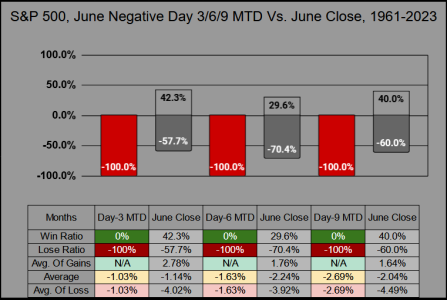

When our first 3/6/9 MTD sessions were negative, the monthly close fared worse. Our 54% win ratio drops to 30-42%

An Estimate: The 10 Best months of May averaged 5.33%. The following June averaged a lower 1.14% but did close positive 8 of 10 times. Based on the data presented, I'd estimate the month will close higher, but the gains will be lower. The good news, if I'm wrong then those first few days should serve as a good warning sign for a bumpy road ahead.

Thanks for reading... Jason

For the Month of June, our previous 42 years (1982-2003) have a 62% win ratio, for the 21-years prior (1961-1981) the win ratio was 38%. 63-years combined gives us a 54% win ratio.

We may want to consider the 1st few days of June might set the tone for how the month plays out. When our first 3/6/9 MTD sessions were positive, the monthly close fared better. Our 54% win ratio rises to 62-72%

When our first 3/6/9 MTD sessions were negative, the monthly close fared worse. Our 54% win ratio drops to 30-42%

An Estimate: The 10 Best months of May averaged 5.33%. The following June averaged a lower 1.14% but did close positive 8 of 10 times. Based on the data presented, I'd estimate the month will close higher, but the gains will be lower. The good news, if I'm wrong then those first few days should serve as a good warning sign for a bumpy road ahead.

Thanks for reading... Jason