An initial gap down of the major averages was never seriously challenged by the bulls today as the broader market ended the week with significant losses.

There was chatter that China might raise interest rates as the specter of inflation stoked fears that higher rates could hurt growth. Such speculation dropped the Shanghai Composite Index 5.2%. The eurozone sovereign debt crisis was also a continuing concern.

The dollar managed to break it's 5 day rally, but it's 0.2% gain was not particularly noteworthy.

I had been reluctant to view the market from more than a neutral stance in spite of several indicators suggesting a minimum of short term weakness, but today the Seven Sentinels flipped to a sell, which normally means Intermediate Term weakness is upon us.

Here's today's charts:

NAMO and NYMO are now firmly in negative territory.

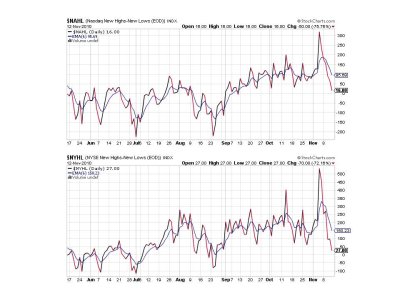

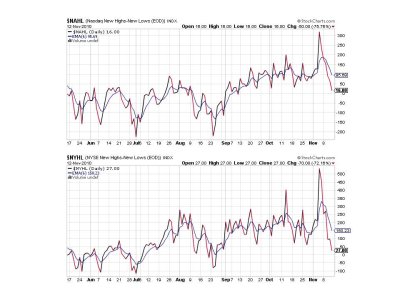

NAHL and NYHL had been suggesting weakness for the past few trading days as internals just didn't look that good. That was a correct read.

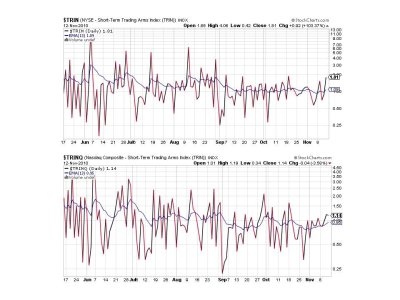

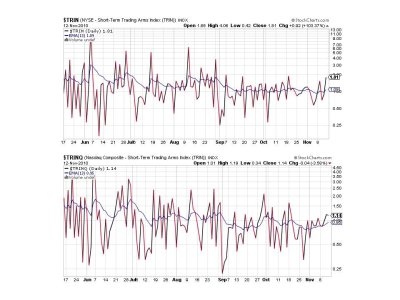

TRIN and TRINQ are now both on sells.

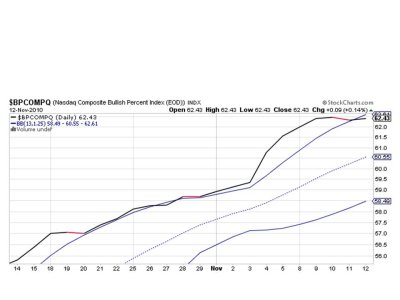

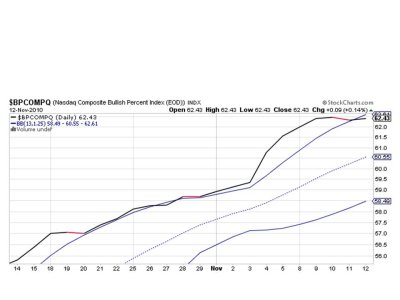

BPCOMPQ finally poked through that upper bollinger band trigging a sell signal.

So all 7 signals are now flashing sells, which flips the system to a sell. And with our Sentiment Survey also on a sell for next week, I'm not expecting to get invested again anytime soon. I have 15% still allocated to the bond fund that I'd like to move to the G fund, but that would be my last IFT for the month, and it's too early to be without an IFT.

I'm interested in seeing how many of us were "buying the dip" this week. I'll be posting that Tracker chart later this weekend. See you then.

There was chatter that China might raise interest rates as the specter of inflation stoked fears that higher rates could hurt growth. Such speculation dropped the Shanghai Composite Index 5.2%. The eurozone sovereign debt crisis was also a continuing concern.

The dollar managed to break it's 5 day rally, but it's 0.2% gain was not particularly noteworthy.

I had been reluctant to view the market from more than a neutral stance in spite of several indicators suggesting a minimum of short term weakness, but today the Seven Sentinels flipped to a sell, which normally means Intermediate Term weakness is upon us.

Here's today's charts:

NAMO and NYMO are now firmly in negative territory.

NAHL and NYHL had been suggesting weakness for the past few trading days as internals just didn't look that good. That was a correct read.

TRIN and TRINQ are now both on sells.

BPCOMPQ finally poked through that upper bollinger band trigging a sell signal.

So all 7 signals are now flashing sells, which flips the system to a sell. And with our Sentiment Survey also on a sell for next week, I'm not expecting to get invested again anytime soon. I have 15% still allocated to the bond fund that I'd like to move to the G fund, but that would be my last IFT for the month, and it's too early to be without an IFT.

I'm interested in seeing how many of us were "buying the dip" this week. I'll be posting that Tracker chart later this weekend. See you then.