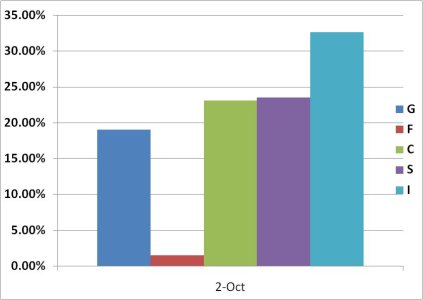

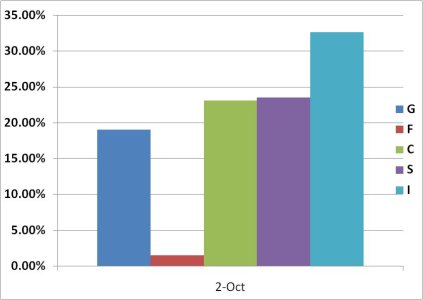

As ugly as this mornings data was, and as ugly as the futures were prior to the open, this trading day could have been a lot worse. But it never truly got ugly. Our domestic market closed down moderately, although the I fund took it on the chin in more severe measure. And the dollar was down today too. That's a bit disconcerting.

We didn't get low enough on the S&P to fill the gap at 1016, so that remains a target and raises the likelihood that today's selling may bleed over into next week. My expectation for a reversal by mid to end of week is still on track, but sentiment has to be more supportive or it may take more time, assuming we haven't begun a more significant decline and/or turned the trend altogether.

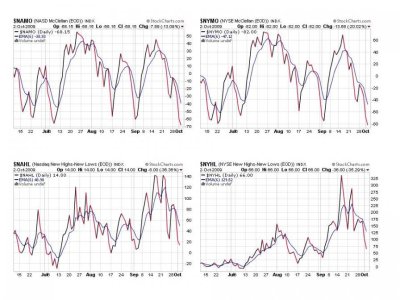

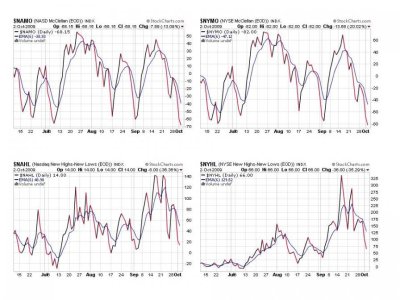

Today's charts didn't really improve the short term picture, but we did pick up two buy signals.

These charts all deteriorated a bit more and will now take some hard buying pressure to turn back up again. But in this market it's not a difficult prospect if conditions are right.

TRIN and TRINQ flipped to buys today, while BPCOMPQ dropped some more.

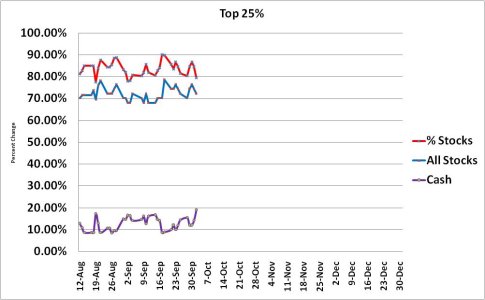

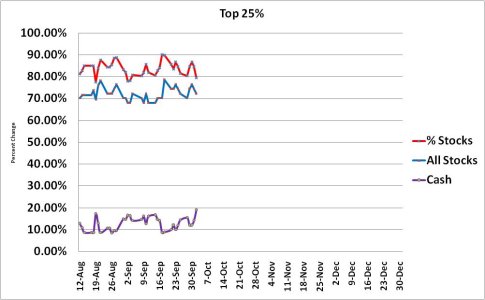

Our top 25% are holding the largest cash position they've held since I began tracking their performance almost two months ago. It still isn't enough to convince me of a trend reversal though. I'm not sure what percentage would do that, and may not even be so much a percentage as a trend over a given number of days. I have not developed a metric for this yet as I need to compile much more data for it to be meaningful, but I think it's still useful information in a longer term context.

We can see the same thing here. We are almost at a 20% cash level, while equities has dipped just under 80%. Still bullish for now.

So we are at a bit of a crossroad here. The market is certainly under pressure, but we haven't broken the 50dma. We might early next week though, and I'll be looking for a turn fairly soon if we do break it. If we break it and don't turn and selling begets more selling, then we have a much bigger problem. This is where sentiment will be key next week. We need to see more bearishness to provide support for the market. I'll be trying to ascertain the overall sentiment picture this weekend and let you know how it looks. But the bottom line right now is that the Seven Sentinels remains on a sell. That's what matters most.

We didn't get low enough on the S&P to fill the gap at 1016, so that remains a target and raises the likelihood that today's selling may bleed over into next week. My expectation for a reversal by mid to end of week is still on track, but sentiment has to be more supportive or it may take more time, assuming we haven't begun a more significant decline and/or turned the trend altogether.

Today's charts didn't really improve the short term picture, but we did pick up two buy signals.

These charts all deteriorated a bit more and will now take some hard buying pressure to turn back up again. But in this market it's not a difficult prospect if conditions are right.

TRIN and TRINQ flipped to buys today, while BPCOMPQ dropped some more.

Our top 25% are holding the largest cash position they've held since I began tracking their performance almost two months ago. It still isn't enough to convince me of a trend reversal though. I'm not sure what percentage would do that, and may not even be so much a percentage as a trend over a given number of days. I have not developed a metric for this yet as I need to compile much more data for it to be meaningful, but I think it's still useful information in a longer term context.

We can see the same thing here. We are almost at a 20% cash level, while equities has dipped just under 80%. Still bullish for now.

So we are at a bit of a crossroad here. The market is certainly under pressure, but we haven't broken the 50dma. We might early next week though, and I'll be looking for a turn fairly soon if we do break it. If we break it and don't turn and selling begets more selling, then we have a much bigger problem. This is where sentiment will be key next week. We need to see more bearishness to provide support for the market. I'll be trying to ascertain the overall sentiment picture this weekend and let you know how it looks. But the bottom line right now is that the Seven Sentinels remains on a sell. That's what matters most.