We're closing out the year this week and guess what's #1 on the TSP Tracker list? Yep...the Sentiment Survey.

One of the best tools we have available is sentiment, and our own survey has showed its worth in spades this year.

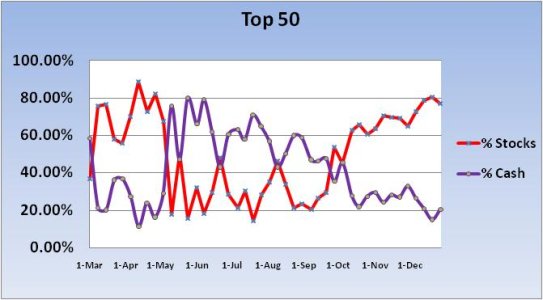

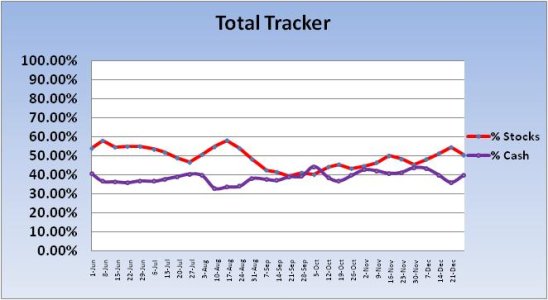

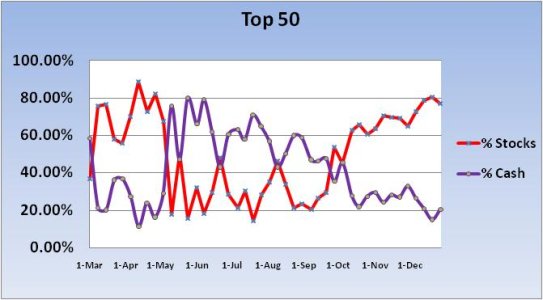

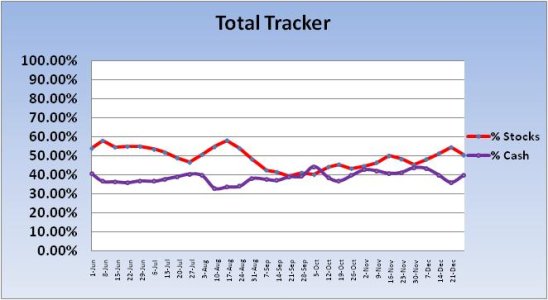

It looks like some TSPers closed out their positions going into the new year as cash levels rose while stock allocations dipped. I was expecting light trade this coming week with a probable upward bias, but China unexpectedly raised it's interest rate by 0.25%, which could affect trading to some extent. Especially in commodities.

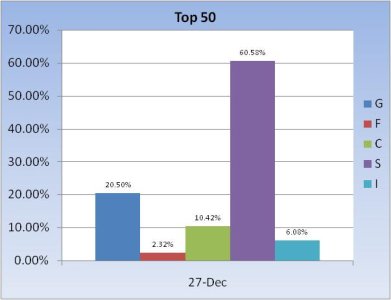

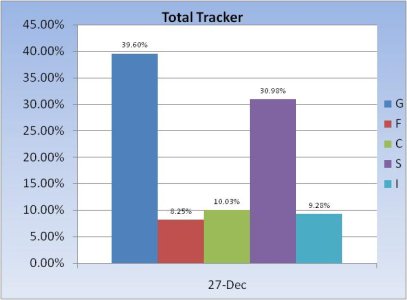

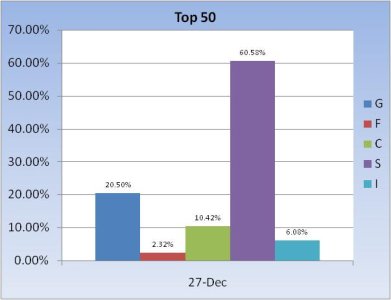

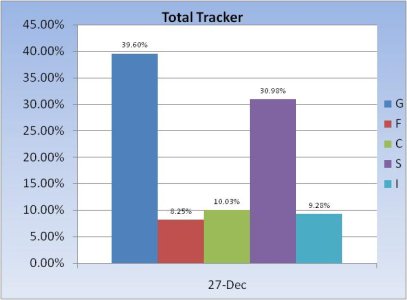

Here's the final tracker charts for 2010. Not much has changed other than end-of-year profit taking for some.

Currently, the Seven Sentinels are in buy mode, but our sentiment survey is on a sell. I'd have to side with the sentiment survey for this week given bullish levels and its performance for the year. I certainly hope it can continue its dominant performance for 2011.

One of the best tools we have available is sentiment, and our own survey has showed its worth in spades this year.

It looks like some TSPers closed out their positions going into the new year as cash levels rose while stock allocations dipped. I was expecting light trade this coming week with a probable upward bias, but China unexpectedly raised it's interest rate by 0.25%, which could affect trading to some extent. Especially in commodities.

Here's the final tracker charts for 2010. Not much has changed other than end-of-year profit taking for some.

Currently, the Seven Sentinels are in buy mode, but our sentiment survey is on a sell. I'd have to side with the sentiment survey for this week given bullish levels and its performance for the year. I certainly hope it can continue its dominant performance for 2011.