-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sensei's account talk

- Thread starter Sensei

- Start date

Sensei

TSP Pro

- Reaction score

- 27

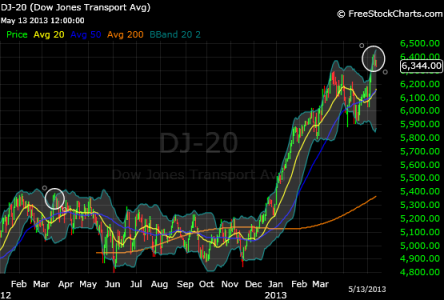

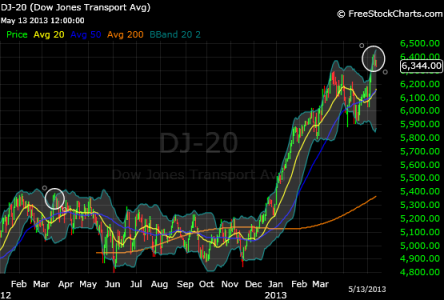

The trannies violated the upper BB in a major way. Over the past 2 years, most times that's happened has been right before a short-term pullback. Although it kind of happened to a lesser extent in January, and just consolidated a little and pushed higher. But, later if I can post a chart, you'll see that the current setup looks a lot like mid-March 2012.

I just might "cluck" to the sidelines soon. Chart later.

I just might "cluck" to the sidelines soon. Chart later.

Sensei

TSP Pro

- Reaction score

- 27

Welcome to the dark side ... wahaaahaaahaaa

Yeah. The dip buyers were relentless, and the strength at the end of the day just scary. Definitely second-guessing myself, but I'm happy with a 16% return in May. I considered going 60F/20C/20S. Would have been a more conservative allocation than all or nothing. We'll see how it goes. I'm not looking for a deep pullback - maybe a test of the 20 day SMA, then jump back in.

Since Coolhand's commentary this weekend, I've been watching the herd on Ocean's List. The numbers are slightly different from Coolhands, but here are the %ages of their stock holdings recently:

5/3(Fri) 39.11%

5/6(Mon) 39.53%

5/7(Tue) 39.29%

5/8(Wed) 39.91%

So, no huge shifts, but getting close to 40% in stocks. I don't know how bullish or overbought you can consider that, but it would seem that people are slowly capitulating.

Sensei

TSP Pro

- Reaction score

- 27

I haven't had much to contribute lately. I left stocks at SPX 1632, and it is currently just below 1634. S fund, however, climbed a little. What really hurts is that I went into the F fund - a violation of my unwritten rule to never play bonds during a bull market. I should have just gone G. Oh well, no sweat. I have 28 years to work the mistake off.

Here's a chart of the transports. I got out because I thought we might have a repeat of the pullback I circled from March 2012. The problem is, the C&S funds didn't pullback until later on in April. So, the danger of trading based on the leader is that you'll make your move too soon. However, if the patterns do play out the same way, we'll be in for a rough patch over the next couple months.

Here's a chart of the transports. I got out because I thought we might have a repeat of the pullback I circled from March 2012. The problem is, the C&S funds didn't pullback until later on in April. So, the danger of trading based on the leader is that you'll make your move too soon. However, if the patterns do play out the same way, we'll be in for a rough patch over the next couple months.

Last edited:

Sensei

TSP Pro

- Reaction score

- 27

Nope. Not tweezers. G'night.Anyone else see tweezers?

Sensei

TSP Pro

- Reaction score

- 27

I sold CSCO at $23.98. It went on to close at 24.24. After Thursday's 12% gap up, I was up 36% on my investment. It had been one of my DCAs over the past two years. So now I have a little cash on hand in the Shareholder account. I set an alert for CSCO at $22.00. That would be close to a gap fill, and a good time to start DCAing into it again, IMO.

So, now just waiting and watching my position slip down the Auto Tracker. Hohum.

So, now just waiting and watching my position slip down the Auto Tracker. Hohum.

Sensei

TSP Pro

- Reaction score

- 27

Perhaps this is neither here nor there on the scale of bullish-bearish, but I just found it an interesting read.

Nikkei Crosses the Dow - MoneyBeat - WSJ

Nikkei Crosses the Dow - MoneyBeat - WSJ

Sensei

TSP Pro

- Reaction score

- 27

Any opinions on this gap getting filled?

After the 2011 tsunami and nuclear disaster in Japan, I started DCAing into CCJ, a mining company that primarily mines uranium. You can see the huge open gap that the disaster left in this chart. I've been upside down on the stock for most of the time. It seems to keep hitting resistance around the $22 area, where it currently stands.

I know the greater indices tend to fill open gaps, but was wondering how likely this is to happen with an individual stock. Any opinions?

After the 2011 tsunami and nuclear disaster in Japan, I started DCAing into CCJ, a mining company that primarily mines uranium. You can see the huge open gap that the disaster left in this chart. I've been upside down on the stock for most of the time. It seems to keep hitting resistance around the $22 area, where it currently stands.

I know the greater indices tend to fill open gaps, but was wondering how likely this is to happen with an individual stock. Any opinions?

maverick06

Investor

- Reaction score

- 3

Uranium mining stocks are something I have been looking at getting into as well. My thought process here is relatively simplistic.

1) power demands are increasing

2) nuclear is a power option that is likely more desirable at this point than fossil fuel plants.

3) the "megatons to megawatts" program is ending soon. ( Megatons to Megawatts Program - Wikipedia, the free encyclopedia ) In short, from 1995 we have been burning huge volumes of old soviet weapons, almost 19,000 of them. Thats a lot of fuel. The program is set to stop this year and additional sources of the fuel will be needed.

It seems that this should drive the stocks up as uranium demand will increase. However, whenever I look at it, the uranium ore prices are static.

Logic tells me its a safe long term buy, but what do I know, not much.

1) power demands are increasing

2) nuclear is a power option that is likely more desirable at this point than fossil fuel plants.

3) the "megatons to megawatts" program is ending soon. ( Megatons to Megawatts Program - Wikipedia, the free encyclopedia ) In short, from 1995 we have been burning huge volumes of old soviet weapons, almost 19,000 of them. Thats a lot of fuel. The program is set to stop this year and additional sources of the fuel will be needed.

It seems that this should drive the stocks up as uranium demand will increase. However, whenever I look at it, the uranium ore prices are static.

Logic tells me its a safe long term buy, but what do I know, not much.

Sensei

TSP Pro

- Reaction score

- 27

Thanks for the thoughts, Maverick. I originally bought CCJ with the thought in mind that it would take several years after the Fukushima meltdown for cooler heads to prevail and countries to start embracing nuclear energy again. Therefore, the approach should be to DCA into it regularly while it flatlines. That plan should have worked in theory, except I started to despair at always seeing it go lower and lower. Like Birchtree says - "...but we should have been buying more". I think this one will eventually fill that gap. I think I'll resume light DCAs into it until I someday see it fill that gap.

Sensei

TSP Pro

- Reaction score

- 27

Well, crap. It looks like I stepped in it. I think today the SPX will crash through the 20 day SMA. Downside will probably continue to the 50 day. The question is, will price be higher or lower on Tuesday of next week? If I jump to G today, that would be the first day I'd be able to buy back in. And, of course, if I use an IFT to buy in on the 2nd of the month, I don't get a chance to buy again in June. So, what'll it be...?

- Reaction score

- 821

June last year did very well (check my thread). But the previous years did real bad. Overall since about 1999 June has been a poor month.Well, crap. It looks like I stepped in it. I think today the SPX will crash through the 20 day SMA. Downside will probably continue to the 50 day. The question is, will price be higher or lower on Tuesday of next week? If I jump to G today, that would be the first day I'd be able to buy back in. And, of course, if I use an IFT to buy in on the 2nd of the month, I don't get a chance to buy again in June. So, what'll it be...?

Sensei

TSP Pro

- Reaction score

- 27

I got mentioned in Tom's daily commentary!

Unfortunately, I'm in stocks and feeling rather indecisive. I see the futures are down quite a bit, but I'll be watching the transports to see if the neckline holds. If it does, I'm going to look for a bounce to sell in the next couple days. If it doesn't...well, I guess I'll think about cutting my losses and getting out for a while. Either way, I guess you could say I'm not feeling very bullish.

Unfortunately, I'm in stocks and feeling rather indecisive. I see the futures are down quite a bit, but I'll be watching the transports to see if the neckline holds. If it does, I'm going to look for a bounce to sell in the next couple days. If it doesn't...well, I guess I'll think about cutting my losses and getting out for a while. Either way, I guess you could say I'm not feeling very bullish.

Sensei

TSP Pro

- Reaction score

- 27

It's not that my entry last Tuesday was bad, it's that I failed to exit immediately and hold on to my gains. Now, they appear hopelessly lost with the specter of a major nosedive on Monday. Oh well.

On the bright side, I did my first triathlon today. It was a sprint triathlon - 5k run, 15k bike, and 400m swim. I finished it in an hour and eight minutes. My bike cost about $100 three years ago, and I smoked about 2/3 of the competition on their $2000 road bikes. That was a good feeling. So, not winning so much in my TSP this week, but definitely winning in life.

On the bright side, I did my first triathlon today. It was a sprint triathlon - 5k run, 15k bike, and 400m swim. I finished it in an hour and eight minutes. My bike cost about $100 three years ago, and I smoked about 2/3 of the competition on their $2000 road bikes. That was a good feeling. So, not winning so much in my TSP this week, but definitely winning in life.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

So, not winning so much in my TSP this week, but definitely winning in life.

sensei, no matter how big your tsp grows or how fast you run, you're always a winner to us.

Similar threads

- Replies

- 0

- Views

- 169

- Replies

- 7

- Views

- 987

- Replies

- 0

- Views

- 86