-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sensei's account talk

- Thread starter Sensei

- Start date

Sensei

TSP Pro

- Reaction score

- 27

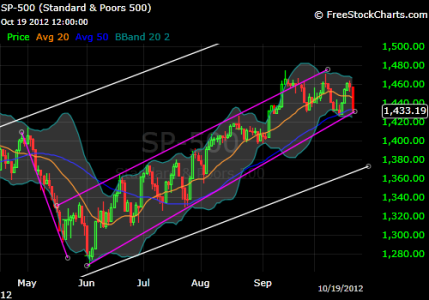

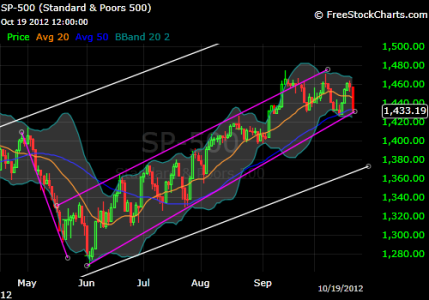

View attachment 20810

Well, I bungled the attachments and the order of the charts got all screwed up, and when I tried to preview my post it timed out and erased my commentary. My efforts posting in my thread are about as frustrating as being 100% S right now.

The long and short of what I'm thinking is that we're at the bottom of an intermediate term uptrend. If the 50 day and purple support line don't hold, we're headed for the 200 day and long-term support line (white). I'll stick around for a day or two to see how it shakes out, but this is smelling of a correction, and money can be lost quickly while trying to decide what to do.

ILoveTDs - you've been making good moves, man. My new system in 2013 just might be to follow you. :toung:

Well, I bungled the attachments and the order of the charts got all screwed up, and when I tried to preview my post it timed out and erased my commentary. My efforts posting in my thread are about as frustrating as being 100% S right now.

The long and short of what I'm thinking is that we're at the bottom of an intermediate term uptrend. If the 50 day and purple support line don't hold, we're headed for the 200 day and long-term support line (white). I'll stick around for a day or two to see how it shakes out, but this is smelling of a correction, and money can be lost quickly while trying to decide what to do.

ILoveTDs - you've been making good moves, man. My new system in 2013 just might be to follow you. :toung:

Attachments

ILoveTDs

TSP Analyst

- Reaction score

- 10

Sensei -Days like today hurt, but they are a necessary evil. As far as following me, our paths have crosses many times (usually in the top 50) and I think they will probably cross again. You should continue to follow your gut and try to forget this one, there are many on the AT that would love to be were you are at. Besides, if I only had the one IFT we would still be neighbors, as I think we'll rebound and never would have got locked out of equities for the rest of the month.

I think you made the right decision, given you only had 1 IFT. If you ask me buy and holders should buy and hold, DCA'ers should be happy and buy right now. Market timers in equities missed this one and should wait for their sale signal and not let today scare them out if they don't have the signal.

I think you made the right decision, given you only had 1 IFT. If you ask me buy and holders should buy and hold, DCA'ers should be happy and buy right now. Market timers in equities missed this one and should wait for their sale signal and not let today scare them out if they don't have the signal.

Sensei

TSP Pro

- Reaction score

- 27

As long as SPX holds 1419 we are still in a bull trend - Monday we could take it all back.

Looks like a test of 1419 is going to happen today.

Sensei

TSP Pro

- Reaction score

- 27

Another update:

Herd: 53% GF 47% stocks

Top 50: 66% GF 34% stocks

6 trading days left in October.

Bearish, but not quite as much as I'd expect after such a breakdown in the charts. Some contrarians out there, I see. I probably should have held off my panicked dump of half my stock exposure until at least COB today. Oh well. If things work out my way, we'll see the SPX hit the 200 day SMA and/or the 20 day cross below the 50 day after November 1st. That would make me feel good about buying back in. For now, I've spent my IFTs for the month, so will resign myself to being a spectator. In fact, I don't think I'll even spectate much over the next few days. I'm 50/50, so what the heck? Maybe I'll go to bed early for once. Who am I kidding? I'll be checking the site. But not so much the market action. C-ya!

Herd: 53% GF 47% stocks

Top 50: 66% GF 34% stocks

6 trading days left in October.

Bearish, but not quite as much as I'd expect after such a breakdown in the charts. Some contrarians out there, I see. I probably should have held off my panicked dump of half my stock exposure until at least COB today. Oh well. If things work out my way, we'll see the SPX hit the 200 day SMA and/or the 20 day cross below the 50 day after November 1st. That would make me feel good about buying back in. For now, I've spent my IFTs for the month, so will resign myself to being a spectator. In fact, I don't think I'll even spectate much over the next few days. I'm 50/50, so what the heck? Maybe I'll go to bed early for once. Who am I kidding? I'll be checking the site. But not so much the market action. C-ya!

Sensei

TSP Pro

- Reaction score

- 27

Another update:

Herd: 49% GF 51% stocks

Top 50: 48% GF 52% stocks

4 trading days left in October...

...but being out of IFTs, I can't buy anything but G until COB 5 business days from now. If we gap down as far today as the futures are currently suggesting, we'll be making considerable progress toward the 200 day SMA. That's when I think we'll see the next sizeable bounce. Going to have to leave my 50% right where it is in C and S. Absorb a little pain in order to buy back fully at deeply discounted prices. Note that both the herd and top 50 have more in stocks than cash/bonds, despite the fact that we're in a correction. A lot of people want to catch that falling knife.

Herd: 49% GF 51% stocks

Top 50: 48% GF 52% stocks

4 trading days left in October...

...but being out of IFTs, I can't buy anything but G until COB 5 business days from now. If we gap down as far today as the futures are currently suggesting, we'll be making considerable progress toward the 200 day SMA. That's when I think we'll see the next sizeable bounce. Going to have to leave my 50% right where it is in C and S. Absorb a little pain in order to buy back fully at deeply discounted prices. Note that both the herd and top 50 have more in stocks than cash/bonds, despite the fact that we're in a correction. A lot of people want to catch that falling knife.

Sensei

TSP Pro

- Reaction score

- 27

It's the weekend, and if you're like me, you're jonesin' for someone to post a chart. So here's my contribution before knocking off for the evening (Sunday night where I am). The VIX!

It ain't pretty, but it's kind of a bull flag. Which is bearish, since a rise in volatility usually means a drop in stock prices. For those still in stocks, the good news is that the VIX is sitting very close to the upper bollinger band, which means it will probably go down to the bottom of the flag at least once more before it makes a break above.

So with strong seasonality leading into November, I wouldn't expect a continuation of the correction this week. Probably more wishy-washy sideways action, fooling people into believing we've hit a bottom and buying back into stocks. Then, BAM! SPX 1380, here we come! It could even come at the same time as the election, which would cause everyone to exclaim that this is a "news driven market", and it's impossible to make money in these conditions. That seems to be the only kind of market I've observed since starting to watch stocks a couple years ago.

It ain't pretty, but it's kind of a bull flag. Which is bearish, since a rise in volatility usually means a drop in stock prices. For those still in stocks, the good news is that the VIX is sitting very close to the upper bollinger band, which means it will probably go down to the bottom of the flag at least once more before it makes a break above.

So with strong seasonality leading into November, I wouldn't expect a continuation of the correction this week. Probably more wishy-washy sideways action, fooling people into believing we've hit a bottom and buying back into stocks. Then, BAM! SPX 1380, here we come! It could even come at the same time as the election, which would cause everyone to exclaim that this is a "news driven market", and it's impossible to make money in these conditions. That seems to be the only kind of market I've observed since starting to watch stocks a couple years ago.

Sensei

TSP Pro

- Reaction score

- 27

Last couple months, my timing and clairvoyance have been badly off. I get out when I should just hold, and buy back in when it's too late. The smartest thing I've done lately is to always leave 50% in stocks, so at least I got a gain of .64% yesterday.

For the time being, I've got 50% in stocks, 30% in bonds, and 20% in cash. But I'm going to play with the mentality that I'm in stocks, and look to sell the current rally, then buy back in at the next dip. I'm anticipating some sort of battle at the 50 and 20 day moving averages. If we cut through those like butter, then I guess I'll have to think about chasing. But for now it's a waiting game.

How about the sentiment survey going back to a sell? And the LMBF staying in I for a third month in a row? I'm getting tired of watching the market and trying to outpace it. So much more to do in life. I've been working out and running for several months now, and would like to try a marathon some day soon. Started reading for pleasure again recently, also. I'd love to just pick the survey or the LMBF, or just plain ol' buy & hold, and free up some more space in my mind.

Good luck, folks. Get out there and make a lot of money!

For the time being, I've got 50% in stocks, 30% in bonds, and 20% in cash. But I'm going to play with the mentality that I'm in stocks, and look to sell the current rally, then buy back in at the next dip. I'm anticipating some sort of battle at the 50 and 20 day moving averages. If we cut through those like butter, then I guess I'll have to think about chasing. But for now it's a waiting game.

How about the sentiment survey going back to a sell? And the LMBF staying in I for a third month in a row? I'm getting tired of watching the market and trying to outpace it. So much more to do in life. I've been working out and running for several months now, and would like to try a marathon some day soon. Started reading for pleasure again recently, also. I'd love to just pick the survey or the LMBF, or just plain ol' buy & hold, and free up some more space in my mind.

Good luck, folks. Get out there and make a lot of money!

wavecoder

TSP Pro

- Reaction score

- 24

the waiting game is always the hardest for me haha. training for a marathon is awesome, I did one back in 2007 and although it was tough, it was totally worth it!

about timing the market with the TSP, i hear ya it's tricky especially with the IFT delay. a couple times i was almost like 'screw this im gonna sign up for intrepid timer's service' lol (although that wouldn't be necessarily a bad idea, his ETF returns are kicking my ass)

about timing the market with the TSP, i hear ya it's tricky especially with the IFT delay. a couple times i was almost like 'screw this im gonna sign up for intrepid timer's service' lol (although that wouldn't be necessarily a bad idea, his ETF returns are kicking my ass)

Handballer

Market Veteran

- Reaction score

- 12

Guess you didn't sign up for the NYC marathon. Good, its cancelled. During my time in Hawaii I ran 15 of them. Mostly Honolulu marathon (10 times) with two of them on my birthday Dec 7th. The race used to be on the first Sunday in Dec but later changed to the 2nd Sunday in Dec. I ran another one is Soul Korea (the South side).

Sensei

TSP Pro

- Reaction score

- 27

Guess you didn't sign up for the NYC marathon. Good, its cancelled. During my time in Hawaii I ran 15 of them. Mostly Honolulu marathon (10 times) with two of them on my birthday Dec 7th. The race used to be on the first Sunday in Dec but later changed to the 2nd Sunday in Dec. I ran another one is Soul Korea (the South side).

If I do it, it will be the Okinawa Marathon on Feb 17. It starts and ends right in my neighborhood and blocks all the roads, making for a miserable weekend of driving. So, if you can't beat 'em, join 'em, right?

FWIW, I bailed to the F fund COB Friday. Thought we were "starting" to head back down. Didn't realize we were pooping away Thursday's gains in their entirety. Now, I'm resigned to sit out until a test of the 200 day SMA. I might have to cry on the sidelines if the election creates a big bounce. Oh well. I don't like the looks of the charts, and from what I've read around here, we're supposed to trade the charts, and not the news.

Sensei

TSP Pro

- Reaction score

- 27

Aw crap. I was staying up to check the open, then realized you guys set your clocks back. Now the market doesn't open til 11:30 pm here. Way too late for me to stay up. More reason for me to pick a system like the Survey or LMBF. Off to brush my teeth and hit the sack. G'night.

Sensei

TSP Pro

- Reaction score

- 27

Another update:

Herd: 40% GF 60% stocks

Top 50: 35% GF 65% stocks

Pretty bullish despite a 2+% drop in C&S. 200 day moving averages still far enough south to keep me out for at least another day. Will watch the Sentiment Survey - right now it's about even. I think if we don't get a bounce, a lot of monkeys will fall out of the tree.

I've been trying to stay out of the political discussion, but can't help but get the feeling that the 1% - upset that they only get one vote like all the rest of us - decided that this is the way they're going to punish all the TSP and 401K buy-and-holders for not electing their candidate. Massive sell-off, set us back to square one, remind us who's boss.

Maybe I'm over-analyzing. :cheesy:

Herd: 40% GF 60% stocks

Top 50: 35% GF 65% stocks

Pretty bullish despite a 2+% drop in C&S. 200 day moving averages still far enough south to keep me out for at least another day. Will watch the Sentiment Survey - right now it's about even. I think if we don't get a bounce, a lot of monkeys will fall out of the tree.

I've been trying to stay out of the political discussion, but can't help but get the feeling that the 1% - upset that they only get one vote like all the rest of us - decided that this is the way they're going to punish all the TSP and 401K buy-and-holders for not electing their candidate. Massive sell-off, set us back to square one, remind us who's boss.

Maybe I'm over-analyzing. :cheesy:

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Another update:

Herd: 40% GF 60% stocks

Top 50: 35% GF 65% stocks

Pretty bullish despite a 2+% drop in C&S. 200 day moving averages still far enough south to keep me out for at least another day. Will watch the Sentiment Survey - right now it's about even. I think if we don't get a bounce, a lot of monkeys will fall out of the tree.

I've been trying to stay out of the political discussion, but can't help but get the feeling that the 1% - upset that they only get one vote like all the rest of us - decided that this is the way they're going to punish all the TSP and 401K buy-and-holders for not electing their candidate. Massive sell-off, set us back to square one, remind us who's boss.

Maybe I'm over-analyzing. :cheesy:

oh no, you're not over analyzing. they're just getting started. it has something to do with the capital gains tax that makes it prudent to sell before 01/01/2013. that way the hungry and newfound poor will work harder for bread. don't you see? a half a world away and you have no early tips for us? are you a head, or behind?

wavecoder

TSP Pro

- Reaction score

- 24

oh no, you're not over analyzing. they're just getting started. it has something to do with the capital gains tax that makes it prudent to sell before 01/01/2013. that way the hungry and newfound poor will work harder for bread. don't you see? a half a world away and you have no early tips for us? are you a head, or behind?

pretty much what happened, they blamed the big drop on europe, but the EFA wasn't even down that hard compared to the S&P and Russell 2000. definitely market manipulation going on atm. figured trouble was coming, the weekly chart is hard to fool

Sensei

TSP Pro

- Reaction score

- 27

Another update:

Herd: 40% GF 60% stocks

Top 50: 35% GF 65% stocks

Very little change in allocation of TSPTalkers. Only about 1% of each group has moved out of stocks. Yet we voted bearish on the survey. Sounds like we're undying pessimists stuck in bad trades and determined not to sell for a loss.

Futures are way up right now, but that doesn't mean squat. I'm following the survey back into stocks, hopefully for the rest of the month. Hell, hopefully for the rest of the year. I'd like to be in stocks on January 1st for once. It's been a good strategy each of the last two years. Now watch, it'll blow up in my face. Gotta finish November and December first though.

New allocation effective COB Friday: 110% S :nuts:

ILoveTDs

TSP Analyst

- Reaction score

- 10

New allocation effective COB Friday: 110% S :nuts:

110% how do get a cut at that?

Similar threads

- Replies

- 0

- Views

- 169

- Replies

- 7

- Views

- 987

- Replies

- 0

- Views

- 84