JTH

TSP Legend

- Reaction score

- 1,158

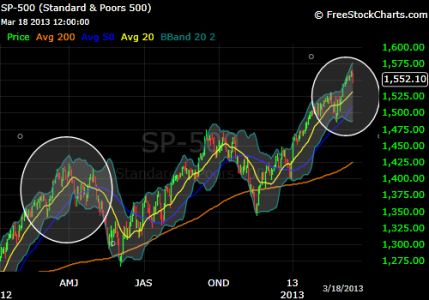

According to Ocean's List, almost 58% of TSPTalkers are in G or F. Why so defensive? If that's representative of the average Joe investor's position, I think there could be a bit more hurt to the upside.

Many folks are still burned from the 2008 bear market, plus some folks are gearing up for retirement hence they are less willing to assume risk. Those number usually are within the 50% range +/- 10 so those stats are well within the normal operating range.