Sensei

TSP Pro

- Reaction score

- 27

Re: Sensei's Account Talk

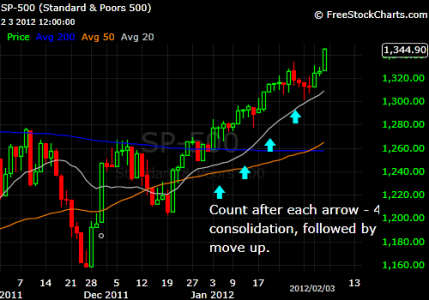

After the big gains yesterday, today's just looking a little "meh". Europe has been bouncing around the neutral line, and just made a slight break to the upside on our positive jobless report. That will be neither here nor there by the time our market closes today. I'd expect a movement of no more than half a percent either direction. Probably the same for the next 2-3 days. Then another move up or another test of the 20 day SMA. My hope is for the former, but I'll watch the SS to see how bulled up we're getting. I'd like to see SPX 1340 before I sell any of my position. For now, I'm happy to be ahead of the L funds. I'd like to keep it that way.

After the big gains yesterday, today's just looking a little "meh". Europe has been bouncing around the neutral line, and just made a slight break to the upside on our positive jobless report. That will be neither here nor there by the time our market closes today. I'd expect a movement of no more than half a percent either direction. Probably the same for the next 2-3 days. Then another move up or another test of the 20 day SMA. My hope is for the former, but I'll watch the SS to see how bulled up we're getting. I'd like to see SPX 1340 before I sell any of my position. For now, I'm happy to be ahead of the L funds. I'd like to keep it that way.

Last edited: