The market started off at the open with a hard gap down, only this time it never made a serious bid to recover. As a result, the major averages closed not far off their lows of the day.

The reason? Nothing new if you listen to the mainstream press. A concern about global economic growth and the eurozone debt bomb.

My personal choice is that it's more likely a reaction to QE2 winding down. That has a far more reaching effect on the global market that will reverberate for years. And the big money knows it. And so far the Fed has not said all that much about it other than they will continue to provide support the foreseeable future.

The dollar continued it ascent and closed near two month highs with a gain of 0.6% against a basket of competing currencies.

Of course, as the dollar rose commodities fell. The CRB Commodity Index dropped more than 1% as a result.

So it was an ugly day all around, but one potential positive was that the gaps in the major averages finally got filled. I guess that means it's safe to jump back in, right?

Under the current circumstances, I'm not a bull. But that doesn't mean we won't have some rallies while this weakness plays out. Let's take a look at the charts:

NAMO and NYMO dove today and are well into negative territory. These are levels where the market typically bounced during this bull market, but we may not get the same result this time. Both signals are in a sell condition.

NAHL and NYHL are also in negative territory and on sells.

TRIN and TRINQ are also flashing sells, but TRIN is suggesting an oversold market (TRINQ is not), which could mean we see some measure of a rally soon.

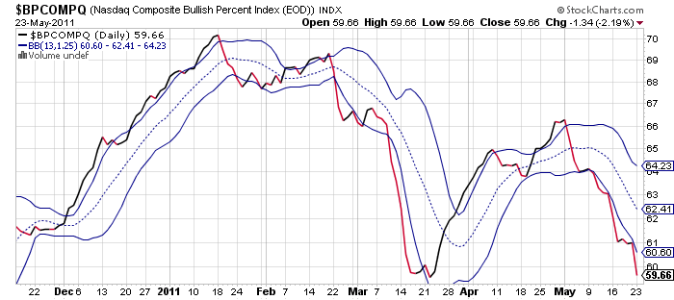

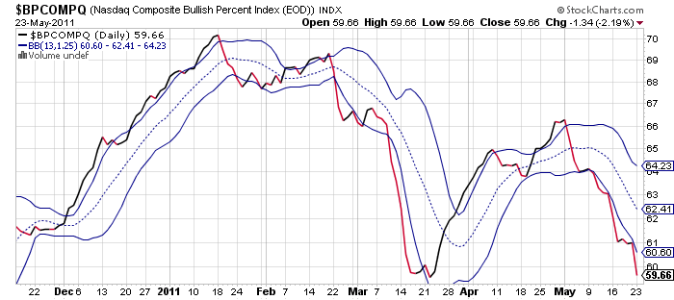

Another nasty spike lower for BPCOMPQ. Not good if one is looking for a reason to get invested again. It too remains in a sell condition.

So if you've been counting you'll know that all signals are once again in a sell condition, but there's a difference with this one. NYMO hit a fresh 28 day trading low today, which means the Seven Sentinels are now in a CONFIRMED SELL CONDITION.

I'd been expecting this for some time now, but the bulls were well conditioned to buy the dips, and the end of QE2 was still far enough out so as to keep risk seemingly low, so it took time for this sell signal to develop. As for myself, I am not inclined to be in too much of a hurry to buy any dips too soon. I believe lower prices are still ahead, and I'm thinking this decline will be somewhat controlled so as to entice dip buyers to get invested along the way. That's my guess. But this is my intermediate term view. We'll probably see another up-leg later this year, but I doubt it comes as quickly as the last ones did.

The reason? Nothing new if you listen to the mainstream press. A concern about global economic growth and the eurozone debt bomb.

My personal choice is that it's more likely a reaction to QE2 winding down. That has a far more reaching effect on the global market that will reverberate for years. And the big money knows it. And so far the Fed has not said all that much about it other than they will continue to provide support the foreseeable future.

The dollar continued it ascent and closed near two month highs with a gain of 0.6% against a basket of competing currencies.

Of course, as the dollar rose commodities fell. The CRB Commodity Index dropped more than 1% as a result.

So it was an ugly day all around, but one potential positive was that the gaps in the major averages finally got filled. I guess that means it's safe to jump back in, right?

Under the current circumstances, I'm not a bull. But that doesn't mean we won't have some rallies while this weakness plays out. Let's take a look at the charts:

NAMO and NYMO dove today and are well into negative territory. These are levels where the market typically bounced during this bull market, but we may not get the same result this time. Both signals are in a sell condition.

NAHL and NYHL are also in negative territory and on sells.

TRIN and TRINQ are also flashing sells, but TRIN is suggesting an oversold market (TRINQ is not), which could mean we see some measure of a rally soon.

Another nasty spike lower for BPCOMPQ. Not good if one is looking for a reason to get invested again. It too remains in a sell condition.

So if you've been counting you'll know that all signals are once again in a sell condition, but there's a difference with this one. NYMO hit a fresh 28 day trading low today, which means the Seven Sentinels are now in a CONFIRMED SELL CONDITION.

I'd been expecting this for some time now, but the bulls were well conditioned to buy the dips, and the end of QE2 was still far enough out so as to keep risk seemingly low, so it took time for this sell signal to develop. As for myself, I am not inclined to be in too much of a hurry to buy any dips too soon. I believe lower prices are still ahead, and I'm thinking this decline will be somewhat controlled so as to entice dip buyers to get invested along the way. That's my guess. But this is my intermediate term view. We'll probably see another up-leg later this year, but I doubt it comes as quickly as the last ones did.