The major averages spent all or most of the day below the neutral line, posting moderate losses across the board by the close. And just like yesterday, a late session rally helped the averages close well off their lows of the days.

Volume was again a bit higher on the NYSE than had been typical for the month of April. It almost feels like this is a stealth melt-down. The fact that commodities are being hit hard (the CRB Commodity Index fell 1.8%), with Silver in particular seeing some significant selling pressure also suggests the game may be changing.

Perhaps the catalyst that set the tone for today's trading was the April ISM Non-Manufacturing Index, which saw a significant drop from 57.3 to 52.8. Economists were looking for little change.

Here's today's charts:

Momentum is picking up to the downside as NAMO and NYMO show in these charts. Both remain in a sell condition. We can see in these 1 year charts that momentum could go lower. For most of the past year these signals would turn by the time they hit about -60. But if the game is changing, we could get a different outcome.

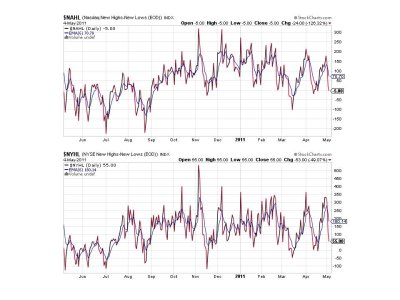

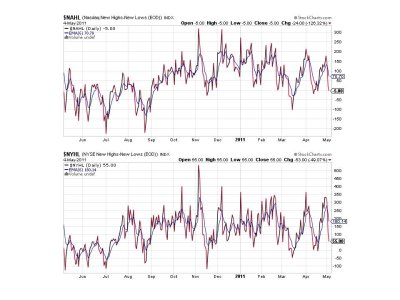

NAHL and NYHL also fell and remain in sell conditions.

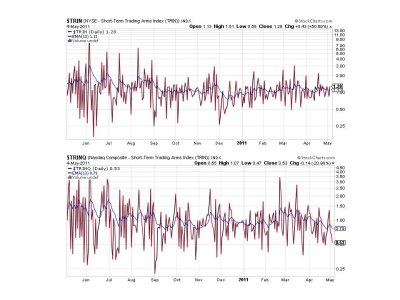

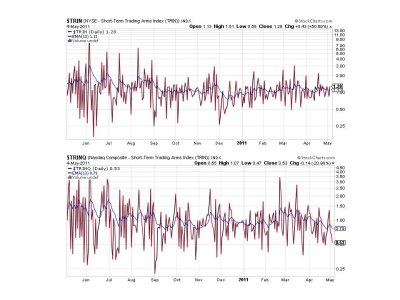

TRIN flipped to a sell today, while TRINQ remained on a buy.

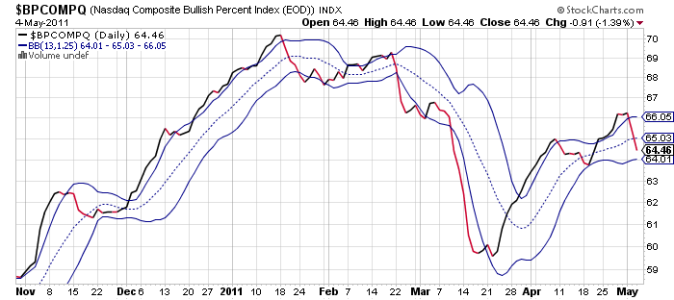

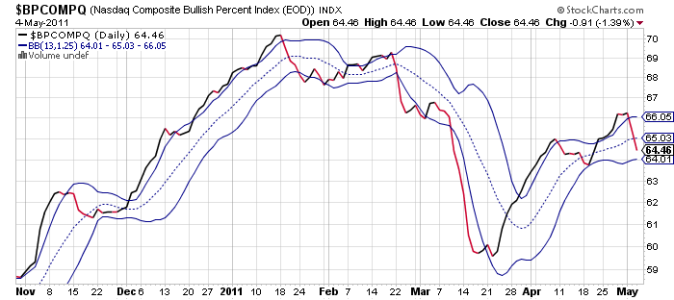

More downward movement from BPCOMPQ, which remains on a sell. As I mentioned yesterday, this is a trend indicator and it's not looking too healthy at the moment. But it could come back quickly depending on where the market finds support.

So all but one signal are flashing sells, which still keeps the system on a buy, but I'm less bullish today than I was yesterday. We are now in the weakest 6 month period and QE2 is less than 2 months away from ending. I doubt the big money is going to hang around until the last minute if the punch bowl is taken away. And those in high places will know before we will if that proves to be the case. But a market crash isn't likely either. That's why I'm wondering if this could be the start of a controlled correction.

It could be too early to get bearish here, but there are signs that suggest risk is rising.

Volume was again a bit higher on the NYSE than had been typical for the month of April. It almost feels like this is a stealth melt-down. The fact that commodities are being hit hard (the CRB Commodity Index fell 1.8%), with Silver in particular seeing some significant selling pressure also suggests the game may be changing.

Perhaps the catalyst that set the tone for today's trading was the April ISM Non-Manufacturing Index, which saw a significant drop from 57.3 to 52.8. Economists were looking for little change.

Here's today's charts:

Momentum is picking up to the downside as NAMO and NYMO show in these charts. Both remain in a sell condition. We can see in these 1 year charts that momentum could go lower. For most of the past year these signals would turn by the time they hit about -60. But if the game is changing, we could get a different outcome.

NAHL and NYHL also fell and remain in sell conditions.

TRIN flipped to a sell today, while TRINQ remained on a buy.

More downward movement from BPCOMPQ, which remains on a sell. As I mentioned yesterday, this is a trend indicator and it's not looking too healthy at the moment. But it could come back quickly depending on where the market finds support.

So all but one signal are flashing sells, which still keeps the system on a buy, but I'm less bullish today than I was yesterday. We are now in the weakest 6 month period and QE2 is less than 2 months away from ending. I doubt the big money is going to hang around until the last minute if the punch bowl is taken away. And those in high places will know before we will if that proves to be the case. But a market crash isn't likely either. That's why I'm wondering if this could be the start of a controlled correction.

It could be too early to get bearish here, but there are signs that suggest risk is rising.