Yesterday, my new short term system gave me a buy signal, but my intermediate term system (Seven Sentinels) gave me a sell, albeit not confirmed. I was pretty sure the bearish sentiment would limit technical damage, but I was expecting a bit more pressure to the downside to shake weak-handed bulls. Well, bearish sentiment limited the damage alright, but there was no way the bulls were going to let anyone back into the market without paying a higher price.

The catalyst? It would seem Japan’s plan for a 5 trillion yen fund to purchase bonds and other asset backed securities translated into the notion that the U.S. may conduct further quantitative easing after all.

The dollar paid a price for Japan's announcement as it dropped 0.8% against competing currencies, but the stock market benefited as close to 98% of the companies comprising the S&P 500 closed higher. And this was on volume too, so it would seem institutions are participating in this rally.

And the Sentinels? Here's what I said before the open this morning in my account talk thread:

"If traders try to short this expected gap up at the open we may end up with a big price advance for the bulls by the close. It's entirely possible that the SS could flip back to a buy under these circumstances."

Not only "could" they flip back to a buy, they did just that. Bearish sentiment strikes again.

But now that the S&P has convincingly closed above resistance, sentiment will need to be assessed again. Do the bears think this is another shorting opportunity, or are they beginning to capituate? I suspect bull converts will be difficult to come by.

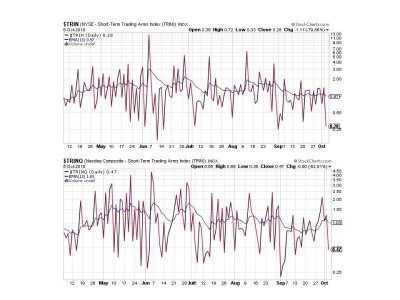

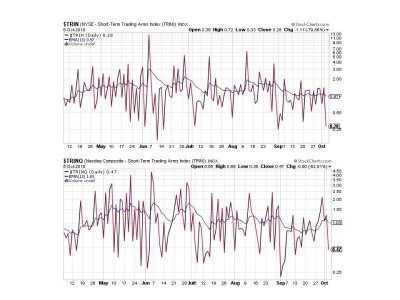

Here's the charts:

Back to buys here.

Looking bullish again here too. Two more buys.

Two more buys.

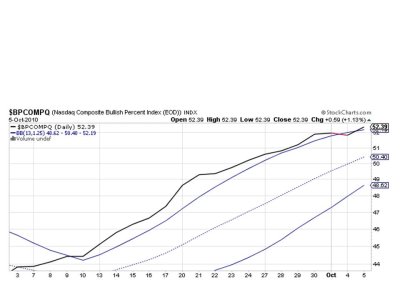

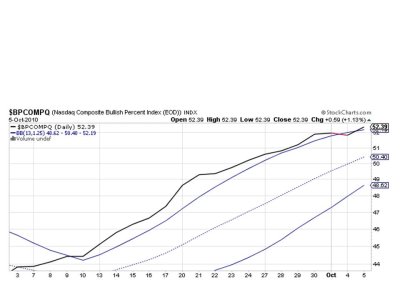

And BPCOMPQ crossed back above the upper bollinger band, flipping it back to a buy.

So all seven are once again flashing buys, which puts the system back on a buy.

This market continues to impress to the upside and after today's rout of the bears one would think bullishness would start to creep in, but that's not a given as the world economy has not really changed. It's all about emotion right now...bearish emotion, and until that changes, or something occurs to spook the market, the upside will probably continue.

The catalyst? It would seem Japan’s plan for a 5 trillion yen fund to purchase bonds and other asset backed securities translated into the notion that the U.S. may conduct further quantitative easing after all.

The dollar paid a price for Japan's announcement as it dropped 0.8% against competing currencies, but the stock market benefited as close to 98% of the companies comprising the S&P 500 closed higher. And this was on volume too, so it would seem institutions are participating in this rally.

And the Sentinels? Here's what I said before the open this morning in my account talk thread:

"If traders try to short this expected gap up at the open we may end up with a big price advance for the bulls by the close. It's entirely possible that the SS could flip back to a buy under these circumstances."

Not only "could" they flip back to a buy, they did just that. Bearish sentiment strikes again.

But now that the S&P has convincingly closed above resistance, sentiment will need to be assessed again. Do the bears think this is another shorting opportunity, or are they beginning to capituate? I suspect bull converts will be difficult to come by.

Here's the charts:

Back to buys here.

Looking bullish again here too. Two more buys.

Two more buys.

And BPCOMPQ crossed back above the upper bollinger band, flipping it back to a buy.

So all seven are once again flashing buys, which puts the system back on a buy.

This market continues to impress to the upside and after today's rout of the bears one would think bullishness would start to creep in, but that's not a given as the world economy has not really changed. It's all about emotion right now...bearish emotion, and until that changes, or something occurs to spook the market, the upside will probably continue.