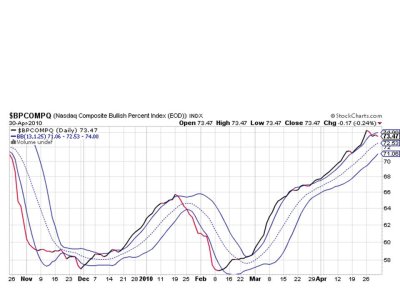

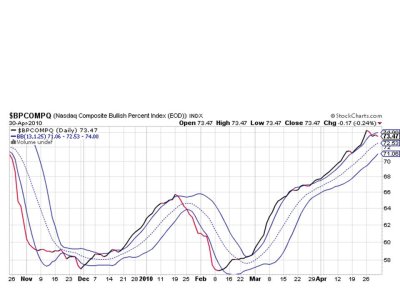

The Seven Sentinels issued a sell Friday, which was not surprising given BPCOMPQ was already on a sell while the market posted that big red candlestick.

So much to worry about. Standard & Poor's downgrades among not one, but several EU countries, the Gulf of Mexico drilling platform explosion, which continues to leak over a million gallons a week of crude, and the Goldman Sachs fraud allegations to name a few of the major current events. It's usually difficult for a market to correct for long in such a dismal news environment.

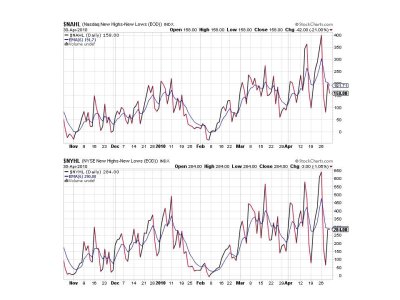

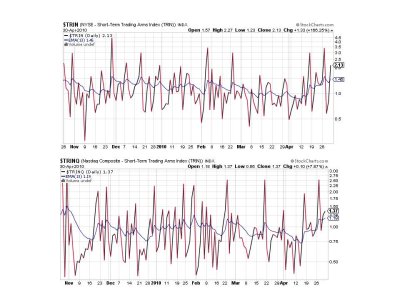

Here's the charts:

Back to a sell, but it has been a volatile ride for a while now and neither signal has been able to escape the zero line for long throughout the month of April.

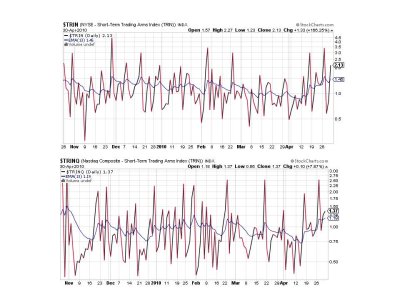

Still on a sell here too.

And here.

And BPCOMPQ makes seven.

All 7 signals are now flashing sells, which flips the system from a buy to a sell. But this is still a bull market until proven otherwise and sell signals have tended to not last long. But that will change at some point, and when it does it will catch a lot of dip buyers off guard. I will be following the SS into the G fund come Monday. But at least I have another IFT to get back in should the system flip again.

I'll be posting Top 15 and Top 50 data tomorrow. See you then.

So much to worry about. Standard & Poor's downgrades among not one, but several EU countries, the Gulf of Mexico drilling platform explosion, which continues to leak over a million gallons a week of crude, and the Goldman Sachs fraud allegations to name a few of the major current events. It's usually difficult for a market to correct for long in such a dismal news environment.

Here's the charts:

Back to a sell, but it has been a volatile ride for a while now and neither signal has been able to escape the zero line for long throughout the month of April.

Still on a sell here too.

And here.

And BPCOMPQ makes seven.

All 7 signals are now flashing sells, which flips the system from a buy to a sell. But this is still a bull market until proven otherwise and sell signals have tended to not last long. But that will change at some point, and when it does it will catch a lot of dip buyers off guard. I will be following the SS into the G fund come Monday. But at least I have another IFT to get back in should the system flip again.

I'll be posting Top 15 and Top 50 data tomorrow. See you then.