It wasn't a gap and go kind of day, but in spite of the volatility buying eventually outweighed selling as the major averages posted decent gains for the second day in a row.

Yesterday I mentioned that while gold fell 1.4% yesterday, Treasuries were relatively flat. I surmised that the out-sized gains we saw in the stock market didn't appear to be correlating to an equal sell-off in gold or treasury action.

I should have waited one more day because gold fell a whopping 5.5% to $1757.30 per ounce after trading at almost $1920 per ounce earlier this week.

And after yesterdays flat action in treasuries, they too were hit with serious selling pressure in today's session. The 10-year Note fell more than a point, raising its yield to almost 2.30%.

The market action so far this week seems to be in anticipation of the potential outcome of the Fed's meeting this week at Jackson Hole, Wyoming. Many are expecting the Fed to come to the rescue once again, but I'm not so sure rescue is the right word after the last round of QE, which really didn't affect the economy in a measurable way.

Interestingly, utilities scored a 2% gain, which suggests that while gold and treasuries were shunned, some safe havens were still seen as attractive investment opportunities.

Overseas, Moody's announced a downgrade in Japan's debt rating to Aa3, while on the domestic front durable good spiked 4%, which was more than twice the increase economists were expecting. Take out transportation and durable goods increased by 0.7%, which still handily beat expectations of a 0.6% decline.

Here's today's charts:

It's beginning to get interesting again. Both NAMO and NYMO continue to rise, with NYMO now less than 12 points from hitting a fresh 28 day trading high. That could potentially flip the Seven Sentinels to an intermediate term buy condition should NYMO eclipse that reading.

NAHL and NYHL also rose on today's action and remain on buys.

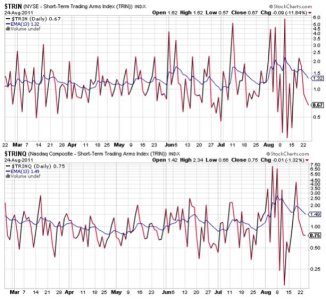

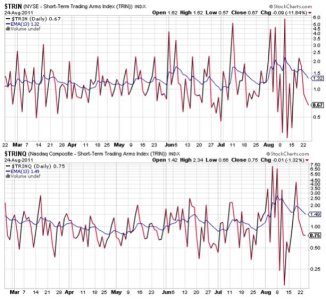

TRIN and TRINQ remained in buy conditions and still suggest this rally may have more room to move higher. Neither signal is showing a particularly overbought market, although it is modestly so in the short term.

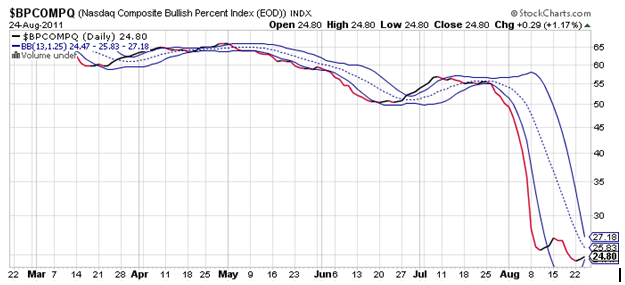

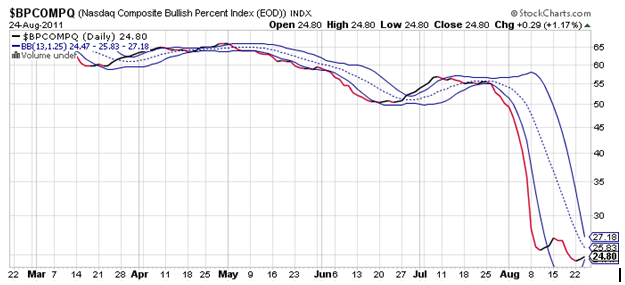

BPCOMPQ ebbed a bit higher today and is looking a bit more bullish. Those bollinger bands are beginning to tighten however, which would make it easier for this signal to flip to a sell condition should this market reverse in the days ahead. But for now, it's suggesting higher prices are yet to come.

So the Seven Sentinels remain in an "unconfirmed" buy condition pending confirmation of a new uptrend by NYMO posting a fresh 28 day trading high. It could happen any day now should this rally continue.

The week still has two days left, and the Fed chair speaks Friday so anything can happen between now and then, but so far the Top 50 were wrong for the second week in a row given they got bulled up last week only to see the market decline sharply, and now this week starting out with only a 13% stock allocation only to see some impressive gains thus far.

Our sentiment survey was overly bearish for this week, so it's not a complete surprise that this market has found a pulse, but this rally is only two days old, so I'm not jumping on the bull wagon just yet. In fact, I won't make a move this week with a new fed policy statement possibly hitting the market on Friday. And Monday could have a surprise too, after the market makes whatever move it's going to make at the end of this week.

Yesterday I mentioned that while gold fell 1.4% yesterday, Treasuries were relatively flat. I surmised that the out-sized gains we saw in the stock market didn't appear to be correlating to an equal sell-off in gold or treasury action.

I should have waited one more day because gold fell a whopping 5.5% to $1757.30 per ounce after trading at almost $1920 per ounce earlier this week.

And after yesterdays flat action in treasuries, they too were hit with serious selling pressure in today's session. The 10-year Note fell more than a point, raising its yield to almost 2.30%.

The market action so far this week seems to be in anticipation of the potential outcome of the Fed's meeting this week at Jackson Hole, Wyoming. Many are expecting the Fed to come to the rescue once again, but I'm not so sure rescue is the right word after the last round of QE, which really didn't affect the economy in a measurable way.

Interestingly, utilities scored a 2% gain, which suggests that while gold and treasuries were shunned, some safe havens were still seen as attractive investment opportunities.

Overseas, Moody's announced a downgrade in Japan's debt rating to Aa3, while on the domestic front durable good spiked 4%, which was more than twice the increase economists were expecting. Take out transportation and durable goods increased by 0.7%, which still handily beat expectations of a 0.6% decline.

Here's today's charts:

It's beginning to get interesting again. Both NAMO and NYMO continue to rise, with NYMO now less than 12 points from hitting a fresh 28 day trading high. That could potentially flip the Seven Sentinels to an intermediate term buy condition should NYMO eclipse that reading.

NAHL and NYHL also rose on today's action and remain on buys.

TRIN and TRINQ remained in buy conditions and still suggest this rally may have more room to move higher. Neither signal is showing a particularly overbought market, although it is modestly so in the short term.

BPCOMPQ ebbed a bit higher today and is looking a bit more bullish. Those bollinger bands are beginning to tighten however, which would make it easier for this signal to flip to a sell condition should this market reverse in the days ahead. But for now, it's suggesting higher prices are yet to come.

So the Seven Sentinels remain in an "unconfirmed" buy condition pending confirmation of a new uptrend by NYMO posting a fresh 28 day trading high. It could happen any day now should this rally continue.

The week still has two days left, and the Fed chair speaks Friday so anything can happen between now and then, but so far the Top 50 were wrong for the second week in a row given they got bulled up last week only to see the market decline sharply, and now this week starting out with only a 13% stock allocation only to see some impressive gains thus far.

Our sentiment survey was overly bearish for this week, so it's not a complete surprise that this market has found a pulse, but this rally is only two days old, so I'm not jumping on the bull wagon just yet. In fact, I won't make a move this week with a new fed policy statement possibly hitting the market on Friday. And Monday could have a surprise too, after the market makes whatever move it's going to make at the end of this week.