Obviously, the Santa Claus rally remains intact with one more day to go. More follow through? My guess is yes. More on that in a moment.

The stock market took its lead from the overseas markets and kept the SC rally going. There wasn't a lot to drive the action, but there were some data points.

The December ISM Manufacturing Index rose to 53.9 from November's 52.7 reading and was also a bit higher than expected.

Construction spending in November increased by 1.2%, which handily beat estimates looking for a 0.5% increase.

The FOMC minutes were released in the afternoon session, but offered little new information on the Fed's expectations. More on the FOMC minutes can be found here.

Here's the charts:

NAMO and NYMO both moved higher and remain on buys.

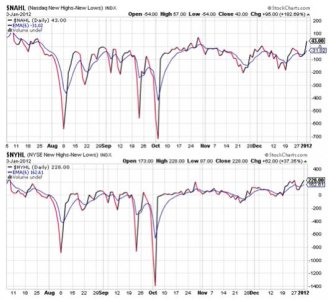

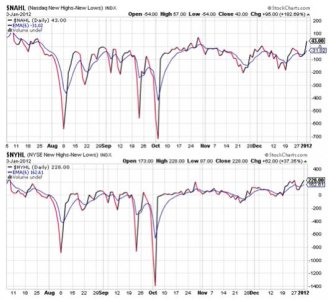

Same with NAHL and NYHL.

TRIN and TRINQ are both on buys as well. Neither is suggesting an overbought market, which adds to the bullish appearance of theses charts.

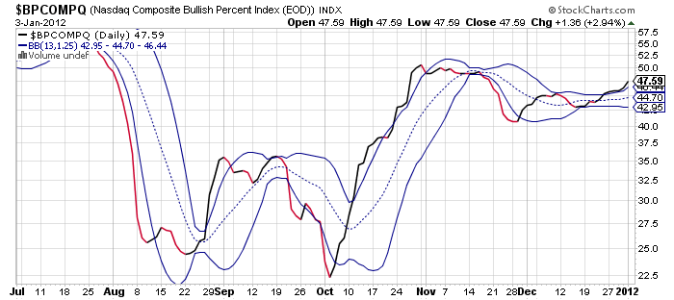

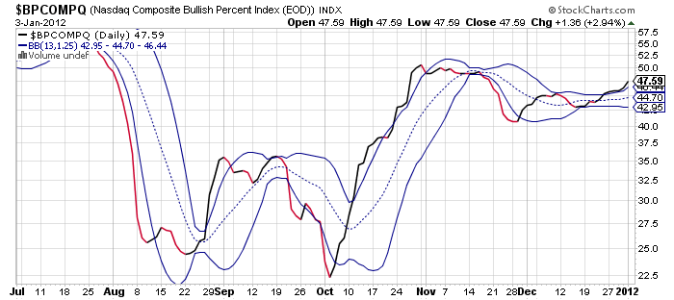

BPCOMPQ is lifting away from that upper bollinger band. This also could mean higher prices in the short term. Longer term it's suggesting an overbought market.

So all signals are on buys, which keeps the system in a buy condition.

Overall, the charts look bullish for the short term. Longer term, not so much as I suspect there will be some weakness in the days or weeks ahead. Today is officially the last day of the Santa Claus rally time frame, so it will be interesting to see where we go in the days ahead.

I lost my internet connectivity last night, so this post is late getting out.

The stock market took its lead from the overseas markets and kept the SC rally going. There wasn't a lot to drive the action, but there were some data points.

The December ISM Manufacturing Index rose to 53.9 from November's 52.7 reading and was also a bit higher than expected.

Construction spending in November increased by 1.2%, which handily beat estimates looking for a 0.5% increase.

The FOMC minutes were released in the afternoon session, but offered little new information on the Fed's expectations. More on the FOMC minutes can be found here.

Here's the charts:

NAMO and NYMO both moved higher and remain on buys.

Same with NAHL and NYHL.

TRIN and TRINQ are both on buys as well. Neither is suggesting an overbought market, which adds to the bullish appearance of theses charts.

BPCOMPQ is lifting away from that upper bollinger band. This also could mean higher prices in the short term. Longer term it's suggesting an overbought market.

So all signals are on buys, which keeps the system in a buy condition.

Overall, the charts look bullish for the short term. Longer term, not so much as I suspect there will be some weakness in the days or weeks ahead. Today is officially the last day of the Santa Claus rally time frame, so it will be interesting to see where we go in the days ahead.

I lost my internet connectivity last night, so this post is late getting out.