The S fund doesn't match the Wilshire 4500 when it is up. But it matches when it's down. What gives?

Nordic is right. But there is still more. Like most of the technical questions about the TSP Funds, your best source is TSP.gov itself. Under Funds Overview/Fund Management it says:

F,C,S, and I Funds

The Federal Retirement Thrift Investment Board currently contracts BlackRock Institutional Trust Company, N.A. (BlackRock) to manage the F, C, S, and I Fund assets. The F and C Fund assets are held in

separate accounts and the S and I Fund assets are invested in Collective Funds. These trust funds are comprised of investments by tax-exempt institutions like the TSP, such as pension plans and endowments. Investing collectively in this way can be advantageous because it reduces trading costs. The

securities held in these commingled funds are held in trust and they are not assets of BlackRock, nor can they be used to meet the financial obligations of BlackRock.

The F, C, S, and I Funds are

index funds, each of which is invested in order to replicate the risk and return characteristics of its appropriate benchmark index. For example, the C Fund is invested in a stock index fund that fully replicates the Standard and Poor's 500 (S&P 500) Index, a broad market index made up of the stocks of 500 large to medium-sized U.S. companies. The C Fund's objective is to match the performance of the S&P 500. The F, C, S, and I Funds remain invested regardless of the performance of the securities markets or the overall economy.

BlackRock Funds

Although the BlackRock Collective Funds operate in a manner similar to mutual funds, they are not, in fact, mutual funds and are not open to individual investors. Furthermore, they are trust funds that are regulated by the Comptroller of the Currency, not by the Securities and Exchange Commission, and therefore do not have ticker symbols.

And under Fund Comparison Matrix it says:

The chart below provides a comparison of the available TSP funds. You can learn more information about each fund by clicking on the fund name.

[TABLE="class: tableRegular"]

[TR]

[TH][/TH]

[TH]

G Fund[/TH]

[TH]

F Fund*[/TH]

[TH]

C Fund*[/TH]

[TH]

S Fund*[/TH]

[TH]

I Fund*[/TH]

[TH]

L Funds**[/TH]

[/TR]

[TR]

[TH="class: rowHeading"]Description of Investments[/TH]

[TD]Government securities (specially issued to the TSP)[/TD]

[TD]Government, corporate, and mortgage-backed bonds[/TD]

[TD]Stocks of large and medium-sized U.S. companies[/TD]

[TD]Stocks of small to medium-sized U.S. companies (not included in the C Fund)[/TD]

[TD]International stocks of 22 developed countries[/TD]

[TD]Invested in the G, F, C, S, and I Funds[/TD]

[/TR]

[TR]

[TH="class: rowHeading"]Objective of Fund[/TH]

[TD]Interest income without risk of loss of principal[/TD]

[TD]To match the performance of the Barclays Capital U.S. Aggregate Bond Index[/TD]

[TD]To match the performance of the Standard & Poor's 500 (S&P 500) Index[/TD]

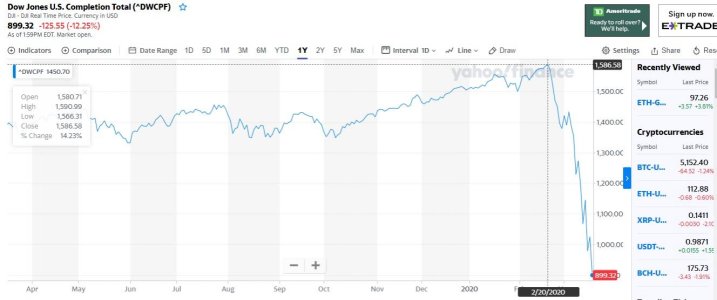

[TD]To match the performance of the Dow Jones U.S. Completion TSM Index[/TD]

[TD]To match the performance of the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index[/TD]

[TD]To provide professionally diversified portfolios based on various time horizons, using the G, F, C, S, and I Funds[/TD]

[/TR]

[TR]

[TH="class: rowHeading"]Risk[/TH]

[TD]Inflation risk[/TD]

[TD]Market risk, Credit risk, Prepayment risk, Inflation risk[/TD]

[TD]Market risk, Inflation risk[/TD]

[TD]Market risk, Inflation risk[/TD]

[TD]Market risk, Currency risk, Inflation risk[/TD]

[TD]Exposed to all of the types of risk to which the individual TSP funds are exposed - but total risk is reduced through diversification among the five individual funds[/TD]

[/TR]

[TR]

[TH="class: rowHeading"]Volatility[/TH]

[TD]Low[/TD]

[TD]Low to moderate[/TD]

[TD]Moderate[/TD]

[TD]Moderate to high — historically more volatile than C Fund[/TD]

[TD]Moderate to high — historically more volatile than C Fund[/TD]

[TD]Asset allocation shifts as time horizon approaches to reduce volatility[/TD]

[/TR]

[TR]

[TH="class: rowHeading"]Types of Earnings***[/TH]

[TD]Interest[/TD]

[TD]Change in market prices

Interest[/TD]

[TD]Change in market prices

Dividends[/TD]

[TD]Change in market prices

Dividends[/TD]

[TD]Change in market prices

Change in relative value of currency

Dividends[/TD]

[TD]Composite of earnings in the underlying funds[/TD]

[/TR]

[TR]

[TH="class: rowHeading"]2012 Administrative Expenses****[/TH]

[TD="class: right"]0.027%[/TD]

[TD="class: right"]0.027%[/TD]

[TD="class: right"]0.027%[/TD]

[TD="class: right"]0.027%[/TD]

[TD="class: right"]0.027%[/TD]

[TD="class: right"]0.027%[/TD]

[/TR]

[TR]

[TH="class: rowHeading"]Inception Date[/TH]

[TD="class: bold right"]04/01/87[/TD]

[TD="class: bold right"]01/29/88[/TD]

[TD="class: bold right"]01/29/88[/TD]

[TD="class: bold right"]05/01/01[/TD]

[TD="class: bold right"]05/01/01[/TD]

[TD="class: bold right"]08/01/05[/TD]

[/TR]

[/TABLE]

And finally, under Share Price Calculation:

Share Price Calculation

The TSP is a daily valued plan which means the value of your account is determined each business day based on the daily share price and the number of shares you hold in each fund.

At the end of each business day, after the stock and bond markets have closed, the total value of the funds' holdings (net of accrued administrative expenses) is divided by the total number of shares outstanding to determine the share price for that day.

Dividends and Capital Gains

BlackRock Institutional Trust Company, N.A, which manages the index funds in which the F, C, S, and I Funds are invested, credits interest and dividend income each business day. This income is then reflected in the TSP share prices.

The daily change in TSP share prices reflects all investment income (interest on short-term investments, dividends, capital gains or losses, and securities lending income) net of TSP administrative expenses.

Since BlackRock is a private fund (not open to public), you will not find those funds in public fund quotes. And of course, there are all the other above adjustments included in the daily valuation as well. But the objective of the fund is to match Dow Jones U.S. Completion Total: so

^DWCPF is the closest. But it just SEEMS to side with the downs and not the ups.....it should go both ways! (Apologies to Burro.....did you finish lunch yet?!? :laugh: )