I've never explained these yet, so...fwiw:

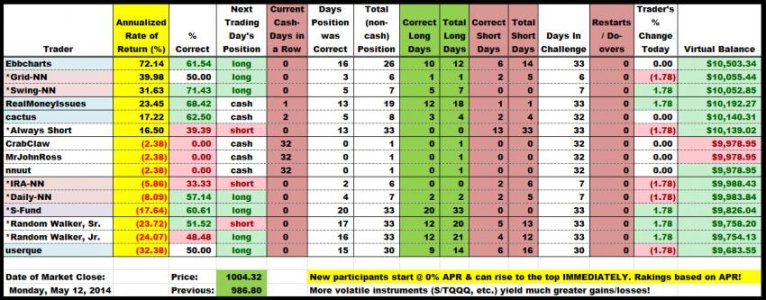

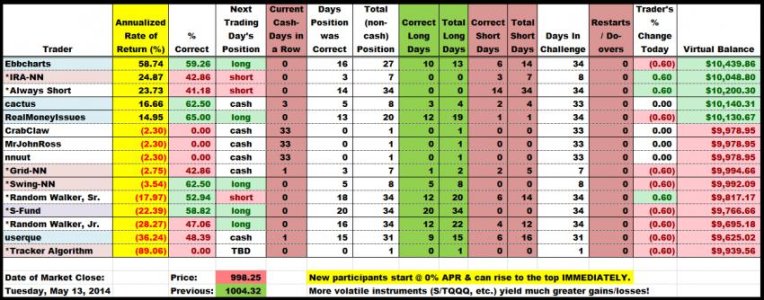

Grid-NN (NN=artificial neural network) is an innovative (imo) spin on the typical, text-book, everybody-does-it, time-series NN design. I've never read about its design anywhere. It's working the best so far.

IRA-NN wants to day trade as well, but the "No Freeriding" and "Pattern Day Trader" restrictions won't let it. It trades as though it's in a typical IRA account. It's based upon Daily-NN and Grid-NN. I will eventually create additional Grid NN's to totally replace Daily-NN. After that, IRA-NN should do even better (less worse).

Daily-NN is based upon tried and "true," text-book NN design. There are many, many, many parameters and variables associated with any NN. Though based on the text-books, I've added my own special sauce. Even so, my Grid NN is currently outperforming this design.

Swing-NN is derived from my personal TSP NN's. I have recently discovered some truths about NN's that has allowed me to increase the accuracy of long-term NN forecasts. While Swing-NN is now currently working under this new directive, it will let its last trade play out. It simply bought too soon under the old system. But, the new system will tell it when to exit. Its purpose is to compare swing trading to day trading. This NN will be more meaningful when trading fees are implemented.