userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

'u Welcome

Yes, I've seen JTH use three inputs! Calendar day; Month; Day of Week. Doing this requires a lot of data to get a large enough and statistically meaningful sample size...hence, going back to 1955 and such. The issue with using old data is...well...it's old. Ask and answer for yourself: do the markets move today, with Super Montage, etc., like they did in the 50's and 60's...or 70's...or 80's...or even 90's.? If not, you're using "bad" data. That's another example of where a NN does well. As I've stated earlier, it can detect and account for subtle (or gross), "hidden," or complex variances. (Of course, the better and cleaner the data; the better the results.)

Calendar day; Month; Day of Week. Doing this requires a lot of data to get a large enough and statistically meaningful sample size...hence, going back to 1955 and such. The issue with using old data is...well...it's old. Ask and answer for yourself: do the markets move today, with Super Montage, etc., like they did in the 50's and 60's...or 70's...or 80's...or even 90's.? If not, you're using "bad" data. That's another example of where a NN does well. As I've stated earlier, it can detect and account for subtle (or gross), "hidden," or complex variances. (Of course, the better and cleaner the data; the better the results.)

Basically, whatever you're doing, a NN should allow you to do it exponentially better, imo. For example:

Say you only trade using a simple moving average. Well plug several differently SMA's into the NN and see which performs best (using internal analysis tools of the software); then have the NN use it to generate your signals after you teach it what a "signal" is. (BTW, I did a study using indicators and NN's: I concluded that indicators are for humans; they simplify things. A NN would rather have the previous nine closing prices rather than a nine day SMA. Even so, NN can be bogged down by limited computer power and relatively too much data. So sometimes you can take short cuts like using indicators etc.)

Your charts seem to be working so far, but the race is long and the NN is now learning from every wrong move it makes. To the extent that the market is predictable, it can be predicted. Only time will tell.

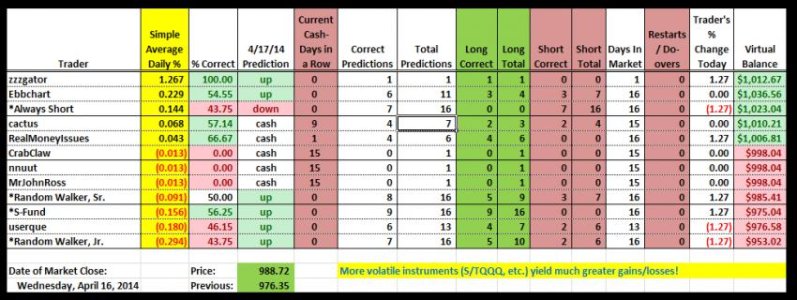

By the way, NN was showing UP day for today after final round of tweaks and adjustments. It was late so I'm letting my original guess stand. Now that I've finished the spreadsheet, Going forward, I should have more firm guesses and have them earlier.

Q

UPDATE: NN is still crunching, but target so far is 984'ish ouch for me:worried:

Thanks for the NN explanation. What line of work did you say you're in?

I think that's what the Seasonality Chart does and I've seen JTH average out particular days in relation to some other stuff, also. The patterns I get from the C, S, and I-fund don't depend on dates. So it won't matter if we transition into a bear market, the ebbchart patterns will know and adjust accordingly. I have a chart that shows the performance of the patterns during the bear market crash of 2008. In the chart below, pretty much every pattern behaved as it should except for pattern 3. I can just imagine being long and short with these patterns in 2008. :nuts:

Bearish green patterns (CSI win percentages): 1 (27%), 2 (39%), 4 (53%), 7 (53%).

Bullish red patterns (CSI win percentages): 3 (37%), 5 (55%); 6 (63%), 8 (58%).

'u Welcome

Yes, I've seen JTH use three inputs!

Basically, whatever you're doing, a NN should allow you to do it exponentially better, imo. For example:

Say you only trade using a simple moving average. Well plug several differently SMA's into the NN and see which performs best (using internal analysis tools of the software); then have the NN use it to generate your signals after you teach it what a "signal" is. (BTW, I did a study using indicators and NN's: I concluded that indicators are for humans; they simplify things. A NN would rather have the previous nine closing prices rather than a nine day SMA. Even so, NN can be bogged down by limited computer power and relatively too much data. So sometimes you can take short cuts like using indicators etc.)

Your charts seem to be working so far, but the race is long and the NN is now learning from every wrong move it makes. To the extent that the market is predictable, it can be predicted. Only time will tell.

By the way, NN was showing UP day for today after final round of tweaks and adjustments. It was late so I'm letting my original guess stand. Now that I've finished the spreadsheet, Going forward, I should have more firm guesses and have them earlier.

Q

UPDATE: NN is still crunching, but target so far is 984'ish ouch for me:worried:

Last edited: