-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

S-fund Challenge! Guesses

- Thread starter ebbnflow

- Start date

RealMoneyIssues

TSP Legend

- Reaction score

- 101

4-16-14 down

Party pooper

ebbnflow

Ebbchart

- Reaction score

- 30

Re: S-fund Challenge!

Unofficial: C +0.68%; S +0.47%; I -0.54% (MSCI EAFE). Close call on the FV, so we'll have to wait.

Dented the I-fund in the morning, then road shotgun with the S-fund in the afternoon.

'Twas written in the patterns, pattern 1/grn-grn-grn that is.

Short Patterns (S-fund): 2/grn-grn-red (51.7%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.8%); 6/red-red-grn (54.1%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.5%); 3/grn-red-red (56.7%); 5/red-red-red (60.1%).

S&P 500: 54.9% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 54.9%; long > 54.9%.

Wednesday: Pattern 7/red-grn-grn. 7-yr. Win Percentage (CSI 51.9%): C 54.1%, S 53.1%, I 48.3%.

Forecast: cash C-fund; cash S-fund; short I-fund.

Unofficial: C +0.82%; S +0.36%; I -0.20%.

Wow, what a rebound! It helped the S-fund but not the I-fund.

By the way, the win in the S-fund today switched pattern 7 from short to cash.

Short Patterns (S-fund): 2/grn-grn-red (51.7%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.8%); 6/red-red-grn (54.1%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.5%); 3/grn-red-red (56.7%); 5/red-red-red (60.1%).

S&P 500: 54.9% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 54.9%; long > 54.9%.

Tuesday: Pattern 1/grn-grn-grn. 7-yr. Win Percentage (CSI 52.7%): C 52.9%, S 55.5%, I 49.6%.

Forecast: short C-fund; long S-fund; short I-fund.

Unofficial: C +0.68%; S +0.47%; I -0.54% (MSCI EAFE). Close call on the FV, so we'll have to wait.

Dented the I-fund in the morning, then road shotgun with the S-fund in the afternoon.

'Twas written in the patterns, pattern 1/grn-grn-grn that is.

Short Patterns (S-fund): 2/grn-grn-red (51.7%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.8%); 6/red-red-grn (54.1%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.5%); 3/grn-red-red (56.7%); 5/red-red-red (60.1%).

S&P 500: 54.9% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 54.9%; long > 54.9%.

Wednesday: Pattern 7/red-grn-grn. 7-yr. Win Percentage (CSI 51.9%): C 54.1%, S 53.1%, I 48.3%.

Forecast: cash C-fund; cash S-fund; short I-fund.

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

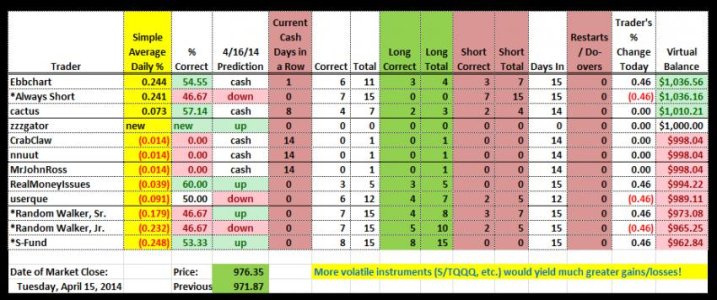

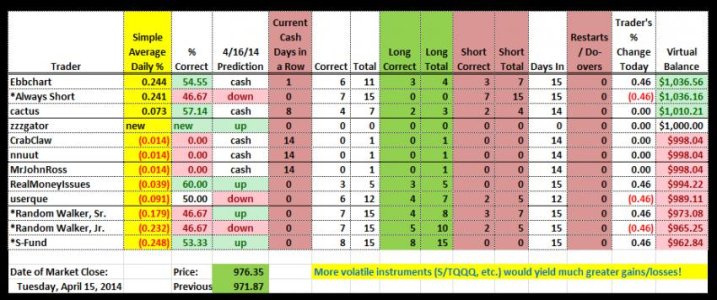

View attachment 28182

Though the interface looks the same, this is from the new spreadsheet. All closing price corrections have been incorporated. Anyone wishing to see a post of their trades along side the date, percentages, etc., post to that effect.

View attachment 28182

Though the interface looks the same, this is from the new spreadsheet. All closing price corrections have been incorporated. Anyone wishing to see a post of their trades along side the date, percentages, etc., post to that effect.

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

Good question.:blink: He predicted 'up' for 3-27, While rushing to finish the sheet for today's debut , I mistakenly entered him as predicting 3-28 will be up. Good catch again! I have updated the spreadsheet. I can repost the chart or just let it reflect on the new chart tomorrow and going forward. Let me know if you want it reposted.

, I mistakenly entered him as predicting 3-28 will be up. Good catch again! I have updated the spreadsheet. I can repost the chart or just let it reflect on the new chart tomorrow and going forward. Let me know if you want it reposted.

UPDATE:

Just noticed that all 'days in' are the same. Will correct and repost a new chart today

Userque, how come you have MrJohnRoss at 1/1 on this chart when the other charts show 0-1? Curious minds wanna know.

Good question.:blink: He predicted 'up' for 3-27, While rushing to finish the sheet for today's debut

UPDATE:

Just noticed that all 'days in' are the same. Will correct and repost a new chart today

userque

TSP Legend

- Reaction score

- 36

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

'u welcome . Adding some new traders now..."Always Short," and one or two Random Walkers. Always Shorts is....opposite the S-Fund Trader. The Random Walkers will trade based on the outcome of the NY and/or Chicago lotteries.

. Adding some new traders now..."Always Short," and one or two Random Walkers. Always Shorts is....opposite the S-Fund Trader. The Random Walkers will trade based on the outcome of the NY and/or Chicago lotteries. They should prove to be some real tough competitors.

They should prove to be some real tough competitors.

Thanks for the updates!

'u welcome

Last edited:

userque

TSP Legend

- Reaction score

- 36

Stoplight

TSP Pro

- Reaction score

- 17

Re: S-fund Challenge!

Userque,

Dude ? I just LIKE your sense of humor ! I'm not gonna get in this dog fight, but I'm enjoying reading the posts !

There was a guy here a few years ago that touted his "Neural Network"...but he seems to have come and gone...I'm curious to see how THIS "Competition" works out !

Now, I have no clue what a "neural network" is, or the mathematics/spreadsheet/software wizardry that goes into it...hey...I'm just an old dumb civil engineer ! Reminds me of an old joke that's not applicable to your case :

Q: What's the difference between a mechanical engineer and a civil engineer ?

A: A mechanical engineer builds bullets, tanks, "smart" bombs, and rockets...a civil engineer builds targets

Stoplight...

'u welcome. Adding some new traders now..."Always Short," and one or two Random Walkers. Always Shorts is....opposite the S-Fund Trader. The Random Walkers will trade based on the outcome of the NY and/or Chicago lotteries.

They should prove to be some real tough competitors.

Userque,

Dude ? I just LIKE your sense of humor ! I'm not gonna get in this dog fight, but I'm enjoying reading the posts !

There was a guy here a few years ago that touted his "Neural Network"...but he seems to have come and gone...I'm curious to see how THIS "Competition" works out !

Now, I have no clue what a "neural network" is, or the mathematics/spreadsheet/software wizardry that goes into it...hey...I'm just an old dumb civil engineer ! Reminds me of an old joke that's not applicable to your case :

Q: What's the difference between a mechanical engineer and a civil engineer ?

A: A mechanical engineer builds bullets, tanks, "smart" bombs, and rockets...a civil engineer builds targets

Stoplight...

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

LOL...thanks Yep, I'm a dude. I understand you not wanting to enter the cage; it ain't for everybody

Yep, I'm a dude. I understand you not wanting to enter the cage; it ain't for everybody Glad you like the posts, I'll be here all week. Oh, and uh, try the veal.

Glad you like the posts, I'll be here all week. Oh, and uh, try the veal.

As best I can tell, that guy has changed his handle and is now known for trading moon/planetary cycles (which I researched and seem to have some validity).

This competition is making me do what I should have done long ago. I'm am using it to develop NN's and find the best parameters for them to trade the markets. There are some 'rules,' but perfecting the networks requires a lot of trial-and-error, experience, artistic ability, and of course, logic. I can 'splain it better if you're interested.

That's a good engineering joke! Hadn't heard it before

Enjoy the show!

Que

Userque,

Dude ? I just LIKE your sense of humor ! I'm not gonna get in this dog fight, but I'm enjoying reading the posts !

There was a guy here a few years ago that touted his "Neural Network"...but he seems to have come and gone...I'm curious to see how THIS "Competition" works out !

Now, I have no clue what a "neural network" is, or the mathematics/spreadsheet/software wizardry that goes into it...hey...I'm just an old dumb civil engineer ! Reminds me of an old joke that's not applicable to your case :

Q: What's the difference between a mechanical engineer and a civil engineer ?

A: A mechanical engineer builds bullets, tanks, "smart" bombs, and rockets...a civil engineer builds targets

Stoplight...

LOL...thanks

As best I can tell, that guy has changed his handle and is now known for trading moon/planetary cycles (which I researched and seem to have some validity).

This competition is making me do what I should have done long ago. I'm am using it to develop NN's and find the best parameters for them to trade the markets. There are some 'rules,' but perfecting the networks requires a lot of trial-and-error, experience, artistic ability, and of course, logic. I can 'splain it better if you're interested.

That's a good engineering joke! Hadn't heard it before

Enjoy the show!

Que

Stoplight

TSP Pro

- Reaction score

- 17

Re: S-fund Challenge!

Still pushing the veal, eh ? "Management" must like you !

From what little I understand, NN is just too alien to me...although I'm interested, I suspect my head would explode if you tried to explain it to me...just like it does while trying to understand Ebb's "patterns" Just show me what works, and what doesn't work ! That's why this "competition" is interesting to me !

Just show me what works, and what doesn't work ! That's why this "competition" is interesting to me !

RE: the old engineering joke...Would you believe my Grand-Niece asked me that EXACT question the other night ? Made me LOL !!! I think she went out on a date with a mechanical engineer...poor Woman !

Stoplight...

...I'll be here all week. Oh, and uh, try the veal.

...This competition is making me do what I should have done long ago. I'm am using it to develop NN's and find the best parameters for them to trade the markets. There are some 'rules,' but perfecting the networks requires a lot of trial-and-error, experience, artistic ability, and of course, logic. I can 'splain it better if you're interested.

That's a good engineering joke! Hadn't heard it before

Enjoy the show!

Que

Still pushing the veal, eh ? "Management" must like you !

From what little I understand, NN is just too alien to me...although I'm interested, I suspect my head would explode if you tried to explain it to me...just like it does while trying to understand Ebb's "patterns"

RE: the old engineering joke...Would you believe my Grand-Niece asked me that EXACT question the other night ? Made me LOL !!! I think she went out on a date with a mechanical engineer...poor Woman !

Stoplight...

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

Depends upon how the NN is explained as to whether your head explodes

The 'competition' will separate the wheat from the chaff...over time.

IMO, Ebb doesn't explain his charts well...at least not how I would explain them if I understood them. (Hint, Hint, Ebb ) Ebb would have to be willing to undergo my rigorous cross-examination (not many can handle such questioning) before I could say I understand his charts.

) Ebb would have to be willing to undergo my rigorous cross-examination (not many can handle such questioning) before I could say I understand his charts. After that, I would be willing to post a user-friendly description/explanation of the charts on behalf of Ebb.

After that, I would be willing to post a user-friendly description/explanation of the charts on behalf of Ebb.

Still pushing the veal, eh ? "Management" must like you !

From what little I understand, NN is just too alien to me...although I'm interested, I suspect my head would explode if you tried to explain it to me...just like it does while trying to understand Ebb's "patterns"Just show me what works, and what doesn't work ! That's why this "competition" is interesting to me !

RE: the old engineering joke...Would you believe my Grand-Niece asked me that EXACT question the other night ? Made me LOL !!! I think she went out on a date with a mechanical engineer...poor Woman !

Stoplight...

Depends upon how the NN is explained as to whether your head explodes

The 'competition' will separate the wheat from the chaff...over time.

IMO, Ebb doesn't explain his charts well...at least not how I would explain them if I understood them. (Hint, Hint, Ebb

ebbnflow

Ebbchart

- Reaction score

- 30

Re: S-fund Challenge!

I keep telling folks it's not rocket science. I just tally the results of the C, S, and I-fund for the patterns (been doing it for 7 years). I only use addition, honest! Only one pattern gets updated every day. Has anyone tried comparing the difference between yesterday's chart and today's updated chart? Does anyone understand how I get the signals (short, cash, or long) by just looking at the Strategy parameters?

Depends upon how the NN is explained as to whether your head explodes

The 'competition' will separate the wheat from the chaff...over time.

IMO, Ebb doesn't explain his charts well...at least not how I would explain them if I understood them. (Hint, Hint, Ebb) Ebb would have to be willing to undergo my rigorous cross-examination (not many can handle such questioning) before I could say I understand his charts.

After that, I would be willing to post a user-friendly description/explanation of the charts on behalf of Ebb.

I keep telling folks it's not rocket science. I just tally the results of the C, S, and I-fund for the patterns (been doing it for 7 years). I only use addition, honest! Only one pattern gets updated every day. Has anyone tried comparing the difference between yesterday's chart and today's updated chart? Does anyone understand how I get the signals (short, cash, or long) by just looking at the Strategy parameters?

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

Thought I would help Tom out by deleting old 'attachments' via my settings and reducing my server footprint ...had no idea doing that would delete the attachments in my prior posts:blink: (Thought they were redundant.)

...had no idea doing that would delete the attachments in my prior posts:blink: (Thought they were redundant.)

Here's the latest post again. I have the older ones stored locally if anyone in interested.

Thought I would help Tom out by deleting old 'attachments' via my settings and reducing my server footprint

Here's the latest post again. I have the older ones stored locally if anyone in interested.

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

Wow, missed this post earlier:blink:

Ebb, I'm certain your charts are simple, you just haven't explained them well. 40,000 Frenchmen aren't wrong. If you're game, I will read your explanatory material, and ask you about what doesn't make sense to me until I understand it or you say "UNCLE!"

I keep telling folks it's not rocket science. I just tally the results of the C, S, and I-fund for the patterns (been doing it for 7 years). I only use addition, honest! Only one pattern gets updated every day. Has anyone tried comparing the difference between yesterday's chart and today's updated chart? Does anyone understand how I get the signals (short, cash, or long) by just looking at the Strategy parameters?

Wow, missed this post earlier:blink:

Ebb, I'm certain your charts are simple, you just haven't explained them well. 40,000 Frenchmen aren't wrong. If you're game, I will read your explanatory material, and ask you about what doesn't make sense to me until I understand it or you say "UNCLE!"

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

I hope this simple analogy doesn't 'splode your brain:worried: I looked briefly on the net for one, but couldn't find one simple enough, imo.

There have been some great recent posts here regarding April 15 statistics going back to, let's say 1955 or so. Typical statistics will add all the percentage changes for April 15 (or for where April 15th falls on a Tuesday, etc. etc.) for all those years and achieve a bias for that day. An average. I think Ebb does something similar.

Someone willing to put in a lot more work could work out the averages for each year, individually, from 1955-2013, analyse the data, and possibly determine that the bias varies by a predictable amount each year, and then formulate an algorithm or formula to predict the bias as it relates to each year. Such a person would have an advantage over someone simply using a simple average over all the years to predict a 2014 bias for April 15, given only prior years data without an algorithm explaining how the bias is changing over the years.

Suppose differently that someone looks at the averages based upon what day of the week April 15 falls. Like above, this can easily be done with simple statistics. They would conclude to the effect of: bias when it falls on a Monday is this....on a Tuesday is that, or the other....

Now suppose they wanted to know the bias when the previous close was 'up' versus 'down,' AND when the close before that was up or down; OR instead of just up or down; when its up 0-0.5%, versus 0.5-1.0%, versus ....., 0-0.1%, (as the percentage divisions approach infinity and the size of each division approaches zero). A realistically impossible task for a human.

Humans typically only compare one or two inputs at a time in these sort of cases: April 15th bias, April 15th and Monday bias, etc.

A NN, like above, could factor in the year as well as the day of the week as well as infinite price 'divisions' as well as the closes of the last several days as well as ...lunar cycles... etc. A NN running on a typical home computer can effectively handle scores of inputs, with thousands of samples/examples to analysis. Virtually impossible for a human with Excel or even an advance trading platform to accomplish (unless it properly utilizes some extremely customizable machine learning technology).

A NN is statistics on steroids...

I could go on: Why they don't "work" for some folks. Why they do work for some folks. Etc.

Hope this helps, if not, I can try again if you like.

IMO,

Q

Still pushing the veal, eh ? "Management" must like you !

From what little I understand, NN is just too alien to me...although I'm interested, I suspect my head would explode if you tried to explain it to me...just like it does while trying to understand Ebb's "patterns"Just show me what works, and what doesn't work ! That's why this "competition" is interesting to me !

RE: the old engineering joke...Would you believe my Grand-Niece asked me that EXACT question the other night ? Made me LOL !!! I think she went out on a date with a mechanical engineer...poor Woman !

Stoplight...

I hope this simple analogy doesn't 'splode your brain:worried: I looked briefly on the net for one, but couldn't find one simple enough, imo.

There have been some great recent posts here regarding April 15 statistics going back to, let's say 1955 or so. Typical statistics will add all the percentage changes for April 15 (or for where April 15th falls on a Tuesday, etc. etc.) for all those years and achieve a bias for that day. An average. I think Ebb does something similar.

Someone willing to put in a lot more work could work out the averages for each year, individually, from 1955-2013, analyse the data, and possibly determine that the bias varies by a predictable amount each year, and then formulate an algorithm or formula to predict the bias as it relates to each year. Such a person would have an advantage over someone simply using a simple average over all the years to predict a 2014 bias for April 15, given only prior years data without an algorithm explaining how the bias is changing over the years.

Suppose differently that someone looks at the averages based upon what day of the week April 15 falls. Like above, this can easily be done with simple statistics. They would conclude to the effect of: bias when it falls on a Monday is this....on a Tuesday is that, or the other....

Now suppose they wanted to know the bias when the previous close was 'up' versus 'down,' AND when the close before that was up or down; OR instead of just up or down; when its up 0-0.5%, versus 0.5-1.0%, versus ....., 0-0.1%, (as the percentage divisions approach infinity and the size of each division approaches zero). A realistically impossible task for a human.

Humans typically only compare one or two inputs at a time in these sort of cases: April 15th bias, April 15th and Monday bias, etc.

A NN, like above, could factor in the year as well as the day of the week as well as infinite price 'divisions' as well as the closes of the last several days as well as ...lunar cycles... etc. A NN running on a typical home computer can effectively handle scores of inputs, with thousands of samples/examples to analysis. Virtually impossible for a human with Excel or even an advance trading platform to accomplish (unless it properly utilizes some extremely customizable machine learning technology).

A NN is statistics on steroids...

I could go on: Why they don't "work" for some folks. Why they do work for some folks. Etc.

Hope this helps, if not, I can try again if you like.

IMO,

Q

Last edited:

userque

TSP Legend

- Reaction score

- 36

Re: S-fund Challenge!

The tally now includes additional virtual traders. Virtual traders now have an '*' in front of their handle for easy identification. These traders are:

*Always Short: This trader is always short the market. I added it to balance *S-Fund, who is always long the market. Can you beat them?

*Random Walker, Sr./Jr.: Sr. trades based upon the NY Numbers game. If the midday drawing for that trading day falls >=500, then he predicts the next day close to be up, else he predicts down. Jr. likewise bases his predictions on the Illinois Pick 3 Midday drawing. Shouldn't they break even if the market is random? Can you beat them? They won't be around forever; just long enough to show whether the walk is random.

I've also added a column, "Current Cash Days in a Row." This column tracks the number of days a trader has currently been in cash. It can help observers decide for themselves whether a trader is actively trading their account.

Q

S-Fund Challenge Tally Legend, Update

The tally now includes additional virtual traders. Virtual traders now have an '*' in front of their handle for easy identification. These traders are:

*Always Short: This trader is always short the market. I added it to balance *S-Fund, who is always long the market. Can you beat them?

*Random Walker, Sr./Jr.: Sr. trades based upon the NY Numbers game. If the midday drawing for that trading day falls >=500, then he predicts the next day close to be up, else he predicts down. Jr. likewise bases his predictions on the Illinois Pick 3 Midday drawing. Shouldn't they break even if the market is random? Can you beat them? They won't be around forever; just long enough to show whether the walk is random.

I've also added a column, "Current Cash Days in a Row." This column tracks the number of days a trader has currently been in cash. It can help observers decide for themselves whether a trader is actively trading their account.

Q

Last edited:

ebbnflow

Ebbchart

- Reaction score

- 30

Re: S-fund Challenge!

Thanks for the NN explanation. What line of work did you say you're in?

I think that's what the Seasonality Chart does and I've seen JTH average out particular days in relation to some other stuff, also. The patterns I get from the C, S, and I-fund don't depend on dates. So it won't matter if we transition into a bear market, the ebbchart patterns will know and adjust accordingly. I have a chart that shows the performance of the patterns during the bear market crash of 2008. In the chart below, pretty much every pattern behaved as it should except for pattern 3. I can just imagine being long and short with these patterns in 2008. :nuts:

Bearish green patterns (CSI win percentages): 1 (27%), 2 (39%), 4 (53%), 7 (53%).

Bullish red patterns (CSI win percentages): 3 (37%), 5 (55%); 6 (63%), 8 (58%).

I hope this simple analogy doesn't 'splode your brain:worried: I looked briefly on the net for one, but couldn't find one simple enough, imo.

There have been some great recent posts here regarding April 15 statistics going back to, let's say 1955 or so. Typical statistics will add all the percentage changes for April 15 (or for where April 15th falls on a Tuesday, etc. etc.) for all those years and achieve a bias for that day. An average. I think Ebb does something similar.

Someone willing to put in a lot more work could work out the averages for each year, individually, from 1955-2013, analyse the data, and possibly determine that the bias varies by a predictable amount each year, and then formulate an algorithm or formula to predict the bias as it relates to each year. Such a person would have an advantage over someone simply using a simple average over all the years to predict a 2014 bias for April 15, given only prior years data without an algorithm explaining how the bias is changing over the years.

Suppose differently that someone looks at the averages based upon what day of the week April 15 falls. Like above, this can easily be done with simple statistics. They would conclude to the effect of: bias when it falls on a Monday is this....on a Tuesday is that, or the other....

Now suppose they wanted to know the bias when the previous close was 'up' versus 'down,' AND when the close before that was up or down; OR instead of just up or down; when its up 0-0.5%, versus 0.5-1.0%, versus ....., 0-0.1%, (as the percentage divisions approach infinity and the size of each division approaches zero). A realistically impossible task for a human.

Humans typically only compare one or two inputs at a time in these sort of cases: April 15th bias, April 15th and Monday bias, etc.

A NN, like above, could factor in the year as well as the day of the week as well as infinite price 'divisions' as well as the closes of the last several days as well as ...lunar cycles... etc. A NN running on a typical home computer can effectively handle scores of inputs, with thousands of samples/examples to analysis. Virtually impossible for a human with Excel or even an advance trading platform to accomplish (unless it properly utilizes some extremely customizable machine learning technology).

A NN is statistics on steroids...

I could go on: Why they don't "work" for some folks. Why they do work for some folks. Etc.

Hope this helps, if not, I can try again if you like.

IMO,

Q

Thanks for the NN explanation. What line of work did you say you're in?

I think that's what the Seasonality Chart does and I've seen JTH average out particular days in relation to some other stuff, also. The patterns I get from the C, S, and I-fund don't depend on dates. So it won't matter if we transition into a bear market, the ebbchart patterns will know and adjust accordingly. I have a chart that shows the performance of the patterns during the bear market crash of 2008. In the chart below, pretty much every pattern behaved as it should except for pattern 3. I can just imagine being long and short with these patterns in 2008. :nuts:

Bearish green patterns (CSI win percentages): 1 (27%), 2 (39%), 4 (53%), 7 (53%).

Bullish red patterns (CSI win percentages): 3 (37%), 5 (55%); 6 (63%), 8 (58%).

Similar threads

- Replies

- 0

- Views

- 100

- Replies

- 0

- Views

- 97

- Replies

- 0

- Views

- 86

- Replies

- 0

- Views

- 121