You have to go back to December 2008 to see this much carnage in one day. And it's not about the downgrade anymore. It's about the economic climate moving forward.

There's little reason to go into any kind of daily economic read. The charts will easily speak to that. But I will point out that the Volatility Index spiked 50% to 48.0. You have to go back to May of last year for that kind of reading. Gold surged 4% and looks to continue to extend its climb. It's over $1720 now in after-hours trading.

The charts are very telling this evening.

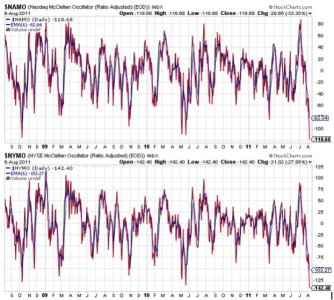

I'm posting 3 year charts for NAMO and NYMO tonight. You can see that both are at significant lows with no indication that they've bottomed. This is troubling.

NAHL and NYHL don't look like they're done falling either.

TRIN managed to remain on a buy today, but TRINQ spiked well into sell territory. It is highly suggestive of a bounce, but with fear still rising in this market there's little reason to expect one. But it could come.

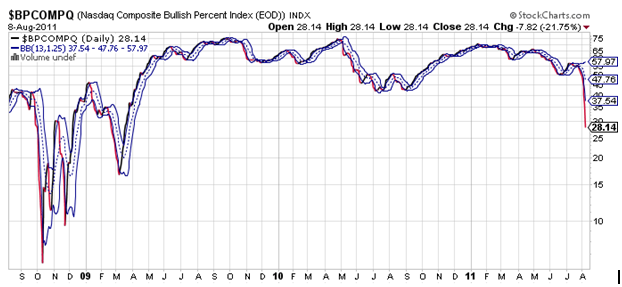

BPCOMPQ continues its plunge as well. Again, you can see where we are in relation to the last 3 years.

The sell signal triggered by the Seven Sentinels on July 27th was quite prophetic. But the highly volatile nature of this market had too often triggered signals that were reversed before too long, so following this one appeared to be somewhat risky given the charts were in an oversold condition. But the game changed, and with it market character.

It just can't get much more bearish than these charts indicate. The market is falling off a cliff and it no longer looks like a simple, albeit painful, correction. Without trying to be alarmist, these charts say we have big problems. I hope that's not the case, but this sell off didn't happen in a particularly bullish environment. Not the kind that mark major tops anyway. And that's why it's taking so many by surprise.

So until these charts show some inclination of reversing, I'd stay out of the market if already on the sidelines. It's a much harder decision for those still in.

I am waiting for a relief rally to lighten up on, but I'm not so sure we'll get one anytime soon. So I anticipate that I'll be changing my strategy to a longer term view.