Yes, we didn't fall off a cliff today. Yes, it was a bullish close of sorts. No, that doesn't mean we can't drop lower. Right now an argument can be made that the charts are beginning to roll over. Or we could be consolidating.

But this week is OPEX, which generally means more market manipulation than usual as the big players "set the table" for the following month of Options trading. For this reason, one should never read too much into the action during OPEX.

In any event, I decided to sell my stock position today and went to cash. The Seven Sentinels were looking toppy and the market has not yet proved it has changed it's propensity of selling off after it breaches resistance.

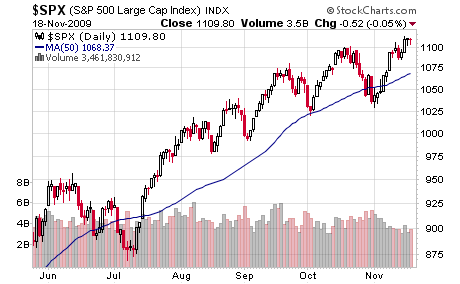

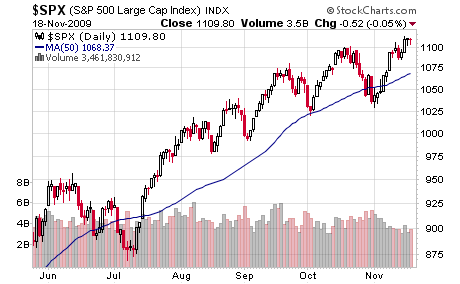

Looking at the chart of the S&P we can see this cycle very clearly as we rally to a top, then drop 5-7% or so to form a bottom. This has been happening since the July rally. Wash, rinse, repeat. I don't know how much longer this cycle will last, but I sold my position today because we may be close to another "short term" top.

Now I'm taking a chance that we won't rally the next two weeks, because I've used my last IFT, but I did not want to take that risk as I've had a hard time locking in gains for awhile. At this point I'd prefer to take my gains now and just wait for the next opportunity. After all, the next two weeks isn't going to decide my long term performance.

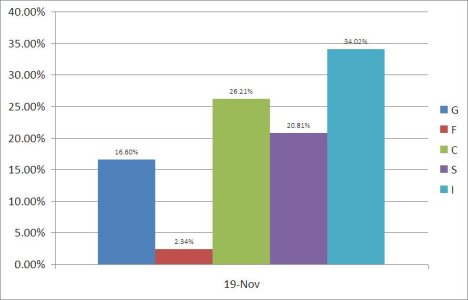

Here's today's charts:

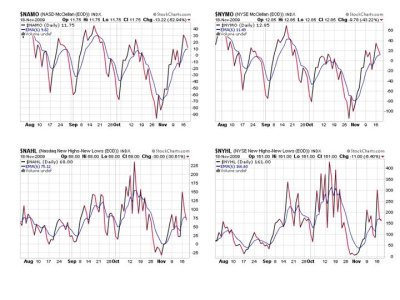

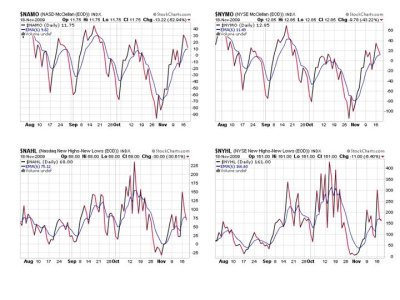

NAHL and NYHL are flashing sells here. NYMO and NAMO are close to sells. Any more weakness short term will flip them over.

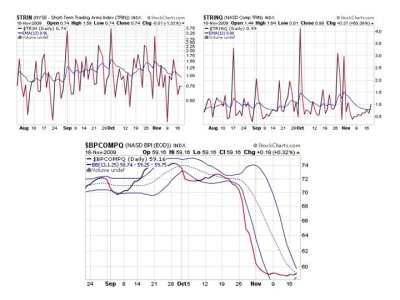

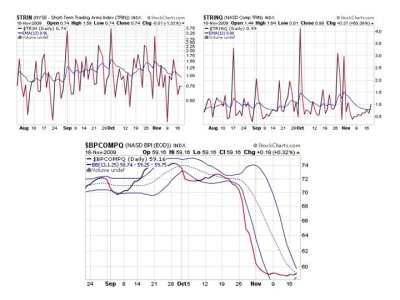

TRIN is still on a buy here, but TRINQ flipped to a sell today. BPCOMPQ actually turned up ever so slightly, but it's been moving sideways now for a number of trading days, not giving any indication at all of which direction it will eventually break.

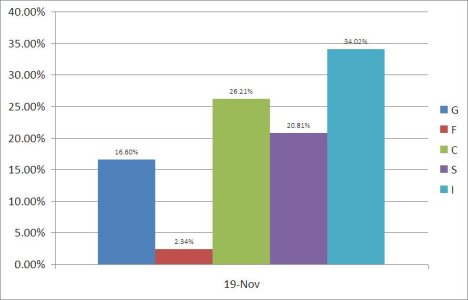

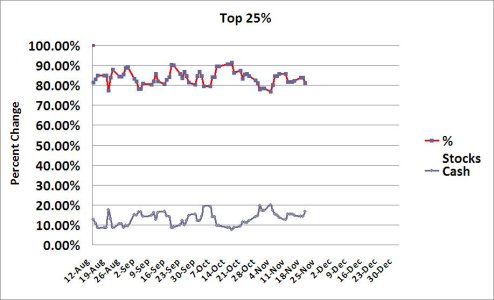

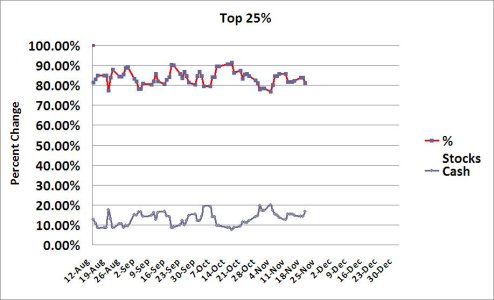

Cash is being raised in modest amounts by our top 25%, but they still seem to indicate the longer term remains up. Remember though, I have no long term data to support this position, but they have been correct since I first started tracking them in mid-August.

So we have 3 signals on a sell and 4 signals on a buy, but with the possible exception of BPCOMPQ, those buy signals are close to turning over if selling becomes more pronounced. In recent months the SS sell signals have not been confirmed until the market has already dropped several percentage points. This is why I chose to go to cash today. But with 2 weeks to go until December, a lot can happen. It's a chance I take, but at least this time I get out on a positive note. After all, this isn't a sprint, it's a marathon.

But this week is OPEX, which generally means more market manipulation than usual as the big players "set the table" for the following month of Options trading. For this reason, one should never read too much into the action during OPEX.

In any event, I decided to sell my stock position today and went to cash. The Seven Sentinels were looking toppy and the market has not yet proved it has changed it's propensity of selling off after it breaches resistance.

Looking at the chart of the S&P we can see this cycle very clearly as we rally to a top, then drop 5-7% or so to form a bottom. This has been happening since the July rally. Wash, rinse, repeat. I don't know how much longer this cycle will last, but I sold my position today because we may be close to another "short term" top.

Now I'm taking a chance that we won't rally the next two weeks, because I've used my last IFT, but I did not want to take that risk as I've had a hard time locking in gains for awhile. At this point I'd prefer to take my gains now and just wait for the next opportunity. After all, the next two weeks isn't going to decide my long term performance.

Here's today's charts:

NAHL and NYHL are flashing sells here. NYMO and NAMO are close to sells. Any more weakness short term will flip them over.

TRIN is still on a buy here, but TRINQ flipped to a sell today. BPCOMPQ actually turned up ever so slightly, but it's been moving sideways now for a number of trading days, not giving any indication at all of which direction it will eventually break.

Cash is being raised in modest amounts by our top 25%, but they still seem to indicate the longer term remains up. Remember though, I have no long term data to support this position, but they have been correct since I first started tracking them in mid-August.

So we have 3 signals on a sell and 4 signals on a buy, but with the possible exception of BPCOMPQ, those buy signals are close to turning over if selling becomes more pronounced. In recent months the SS sell signals have not been confirmed until the market has already dropped several percentage points. This is why I chose to go to cash today. But with 2 weeks to go until December, a lot can happen. It's a chance I take, but at least this time I get out on a positive note. After all, this isn't a sprint, it's a marathon.