Good luck trying to time a short term play in this market with TSP. What started out green early in the trading day didn't take long to fall apart. And then around noon it looked like it was going to get ugly as the S&P tagged 1114.96 before taking the rest of the afternoon to fully recover and end the day at 1136.94. It wasn't much of a gain from the previous close, but it wasn't a 20+ point loss either.

The European debt crisis is far from over and China's faltering market is beginning to get a bit more attention, but it's still a far second to the EU's woes.

The turn-around helped stabilize the Seven Sentinels for now, but it's hardly clear where the market goes next. Perhaps today's recovery has put in a least a short term low. But I wouldn't bet on that just yet. Let's take a look at the charts:

Still on a sell here, and the 6 day EMA is in negative territory. Until recently I'd say these two charts look at least moderately bullish, but it's just possible a change in trend is playing out. We aren't far from turning these two signals to a buy either.

Still on sells here too, but very close to the 6 day EMAs. Close to a buy here too.

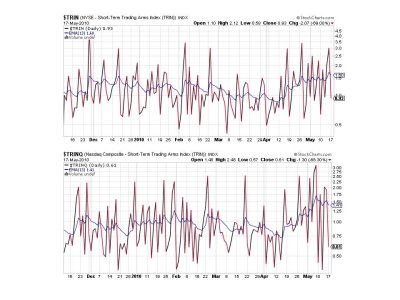

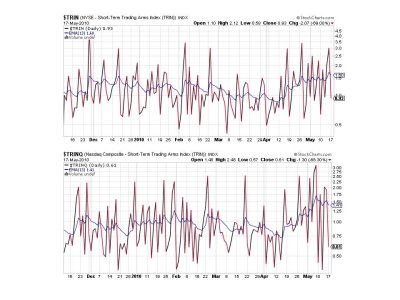

Both TRIN and TRINQ flipped to buys today.

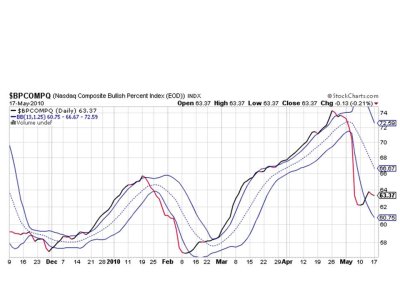

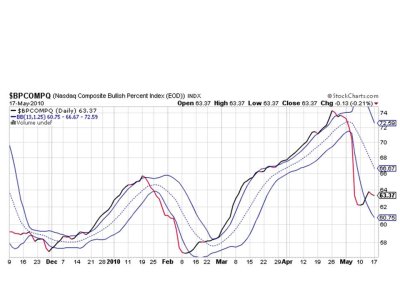

BPCOMPQ, while turning down a bit more today, is still well away from a sell signal.

So we have 4 of 7 signals flashing sells, and all 4 of those sells could flip to buys with some moderate buying pressure. But this market is tricky and scary to say the least. I like the fear, but the problems we're facing involve currencies with the possibility of unrest spreading outside of Greece. And how would China play into all this, which isn't getting quite the attention the EU is? I don't know, but that's why the markets are so unsettled.

If the last SS buy signal was a false signal, then selling into a rally might be the best play (if we get a rally). But that's a big "if". And we could trigger another buy signal on the way back up. It's also very possible some Central Bank announcement could turn this thing around in a hurry. Or maybe the Euro finds support and stops the bleeding. What might be the catalyst?

It's a tough market right now, and having only 2 IFTs will make us either more conservative or more aggressive depending on our point of view with respect to how this market plays out. If I was close to retirement I doubt I'd be too frisky here. Just some food for thought. See you tomorrow.

The European debt crisis is far from over and China's faltering market is beginning to get a bit more attention, but it's still a far second to the EU's woes.

The turn-around helped stabilize the Seven Sentinels for now, but it's hardly clear where the market goes next. Perhaps today's recovery has put in a least a short term low. But I wouldn't bet on that just yet. Let's take a look at the charts:

Still on a sell here, and the 6 day EMA is in negative territory. Until recently I'd say these two charts look at least moderately bullish, but it's just possible a change in trend is playing out. We aren't far from turning these two signals to a buy either.

Still on sells here too, but very close to the 6 day EMAs. Close to a buy here too.

Both TRIN and TRINQ flipped to buys today.

BPCOMPQ, while turning down a bit more today, is still well away from a sell signal.

So we have 4 of 7 signals flashing sells, and all 4 of those sells could flip to buys with some moderate buying pressure. But this market is tricky and scary to say the least. I like the fear, but the problems we're facing involve currencies with the possibility of unrest spreading outside of Greece. And how would China play into all this, which isn't getting quite the attention the EU is? I don't know, but that's why the markets are so unsettled.

If the last SS buy signal was a false signal, then selling into a rally might be the best play (if we get a rally). But that's a big "if". And we could trigger another buy signal on the way back up. It's also very possible some Central Bank announcement could turn this thing around in a hurry. Or maybe the Euro finds support and stops the bleeding. What might be the catalyst?

It's a tough market right now, and having only 2 IFTs will make us either more conservative or more aggressive depending on our point of view with respect to how this market plays out. If I was close to retirement I doubt I'd be too frisky here. Just some food for thought. See you tomorrow.