Rod

Market Veteran

- Reaction score

- 417

'You don't have to get it back where you lost it.' A stop loss can preserve the majority of the capital invested, which can then be re-deployed to a better position which is rallying. Has to do with the time value of money, one can let funds sit in the hopes of a recovery and in the process lose the potential gains that could be had elsewhere. I've done both, many considerations to go down one path or the other.

That's why I never deploy more than 1% to 3% of my total equity in any one position and keep at least 25% cash on-hand. I currently have 40%. With that, I don't feel that I am missing out on it working elsewhere.

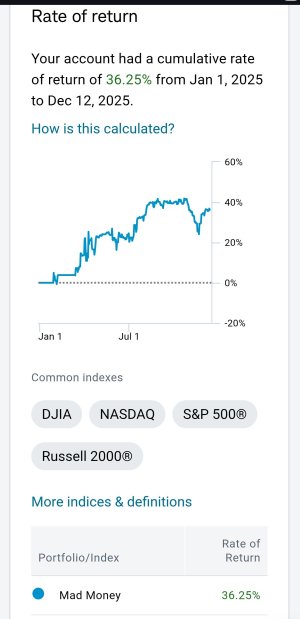

Instead of a "stop loss" trader, I am a "stop less" one. It's worked for me so far- locking in six figures of realized gains for 2025 so far, while only incurring $443.45 in realized losses. Had I set stops, those realized losses would be in the tens of thousands of dollars.

God Bless!