Just like that the Grinch has been at least temporarily banished as stocks soared to their best single session gain in the month of December.

The reason for the jubilation? Lower yields for Spanish debt and good sentiment surveys in Europe for starters.

On the domestic front, November housing starts and building permits were up big to an annualized rate of 685,000 units and 681,000 permits respectively. Both number easily beat economists expectations for 627,000 units and 633,000 permits.

And while the share volume started out low it rose as the trading day worn on, which is certainly a positive sign for the bulls.

Here's today's charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL are also back on buys.

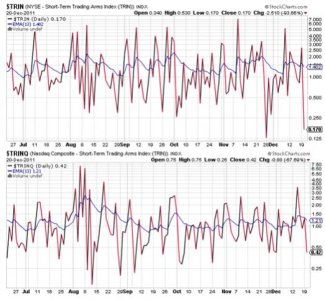

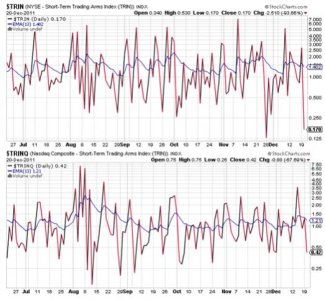

TRIN and TRINQ both spiked lower and triggered buy signals as well. TRIN is highly suggestive of an overbought market however, which usually means a reversal is imminent, but given seasonality any downside pressure may be limited in the short term. TRINQ is also suggesting an overbought market, although not to the degree of TRIN.

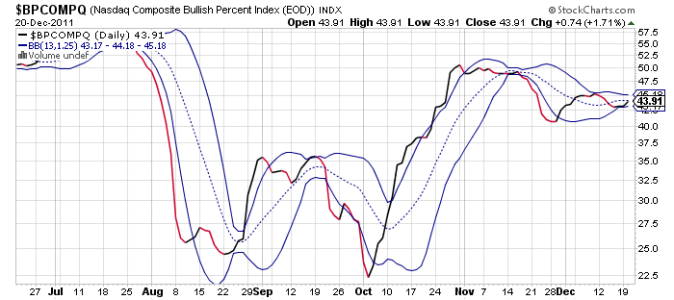

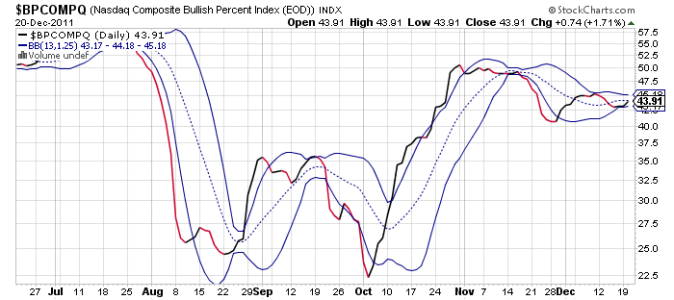

BPCOMPQ turned back up today and remains on a buy.

So all signals are back in a buy condition, but the system remains on an official sell. We had a few unconfirmed buy signals earlier in the month that never made it to an official buy signal, but if this market gets any serious follow through to the upside the system could trigger a buy signal fairly soon. The only indicator left to trigger that buy is for NYMO to hit a 28 day trading high. Right now it's sitting at 0.2 and it would have to go above a 39 to trigger that buy. That's not an unreasonable expectation given the time of year, but risk is always present in this market. We also need to see what happens as a result of the very low TRIN and TRINQ readings.

I remain 100% S fund and anticipating more upside pressure to come in the days ahead. I also admit that I am anything but complacent.

The reason for the jubilation? Lower yields for Spanish debt and good sentiment surveys in Europe for starters.

On the domestic front, November housing starts and building permits were up big to an annualized rate of 685,000 units and 681,000 permits respectively. Both number easily beat economists expectations for 627,000 units and 633,000 permits.

And while the share volume started out low it rose as the trading day worn on, which is certainly a positive sign for the bulls.

Here's today's charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL are also back on buys.

TRIN and TRINQ both spiked lower and triggered buy signals as well. TRIN is highly suggestive of an overbought market however, which usually means a reversal is imminent, but given seasonality any downside pressure may be limited in the short term. TRINQ is also suggesting an overbought market, although not to the degree of TRIN.

BPCOMPQ turned back up today and remains on a buy.

So all signals are back in a buy condition, but the system remains on an official sell. We had a few unconfirmed buy signals earlier in the month that never made it to an official buy signal, but if this market gets any serious follow through to the upside the system could trigger a buy signal fairly soon. The only indicator left to trigger that buy is for NYMO to hit a 28 day trading high. Right now it's sitting at 0.2 and it would have to go above a 39 to trigger that buy. That's not an unreasonable expectation given the time of year, but risk is always present in this market. We also need to see what happens as a result of the very low TRIN and TRINQ readings.

I remain 100% S fund and anticipating more upside pressure to come in the days ahead. I also admit that I am anything but complacent.