-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ripper's account talk

- Thread starter ripper

- Start date

Tsunami

TSP Pro

- Reaction score

- 62

I moved to 100% G as well, but it was mostly this sort of chart and my gut that made me do it.

Observations on this chart (chart #61 for the Dow): Above the Green Line - Nov 30, 2017 Buy high, and Sell Higher: Momentum Investing - Joanne Klein - Public ChartList - StockCharts.com

1. I count six gaps starting on 11/16, and the market likes to fill gaps.

2. It's gone parabolic, almost straight up today.

3. Danger Will Robinson!

I'll be out for December 1st, but will be looking for re-entry soon, probably higher with my luck.

Observations on this chart (chart #61 for the Dow): Above the Green Line - Nov 30, 2017 Buy high, and Sell Higher: Momentum Investing - Joanne Klein - Public ChartList - StockCharts.com

1. I count six gaps starting on 11/16, and the market likes to fill gaps.

2. It's gone parabolic, almost straight up today.

3. Danger Will Robinson!

I'll be out for December 1st, but will be looking for re-entry soon, probably higher with my luck.

Hi Tsunami,I moved to 100% G as well, but it was mostly this sort of chart and my gut that made me do it.

Observations on this chart (chart #61 for the Dow): Above the Green Line - Nov 30, 2017 Buy high, and Sell Higher: Momentum Investing - Joanne Klein - Public ChartList - StockCharts.com

1. I count six gaps starting on 11/16, and the market likes to fill gaps.

2. It's gone parabolic, almost straight up today.

3. Danger Will Robinson!

I'll be out for December 1st, but will be looking for re-entry soon, probably higher with my luck.

I moved to 100% G primarily because the markets appear to be overbought at this time. Of course, that doesn't necessarily mean they can't become more overbought. :wink:

Weekly update:

Aggressive Model trades only TNA/TZA.

Conservative Model trades only SPY/SH.

Volatility Model trades only XIV/VXX.

Models will hold a 50% or 100% position or be in cash.

All returns (except TSP) are compounded.

Performance does not include current open trades.

Aggressive Model

2016 Return: +62.2%

Year-to-date:+2.6%

Current Position: Cash

Conservative Model

2016 Return: +10.4%

Year-to-date: +4.9%

Current position: 50% SH @ 31.09

Volatility Model

2016 Return (6 months): +48.0%

Year-to-date: +14.7%

Current position: 100% XIV @ 118.79

TSP Model

Year-to-date (per AutoTracker): +9.44%

Current position: 100% G

Aggressive Model trades only TNA/TZA.

Conservative Model trades only SPY/SH.

Volatility Model trades only XIV/VXX.

Models will hold a 50% or 100% position or be in cash.

All returns (except TSP) are compounded.

Performance does not include current open trades.

Aggressive Model

2016 Return: +62.2%

Year-to-date:+2.6%

Current Position: Cash

Conservative Model

2016 Return: +10.4%

Year-to-date: +4.9%

Current position: 50% SH @ 31.09

Volatility Model

2016 Return (6 months): +48.0%

Year-to-date: +14.7%

Current position: 100% XIV @ 118.79

TSP Model

Year-to-date (per AutoTracker): +9.44%

Current position: 100% G

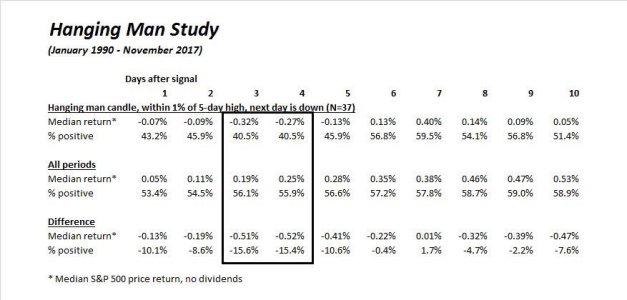

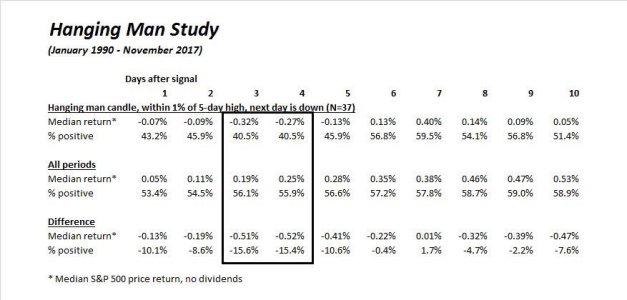

The S&P 500 had a Hanging Man candlestick on Friday. This study shows the median returns for the S&P 500 for the 10 days following a Hanging Man candlestick when it's within 1% of a five-day high.

As you can see, the five days following the candlestick have a bias to trade a bit lower - especially days three and four.

As you can see, the five days following the candlestick have a bias to trade a bit lower - especially days three and four.

weatherweenie

TSP Legend

- Reaction score

- 179

Oh wow!

Hope it turns out for you, and your family.

Hope it turns out for you, and your family.

Big day for me today.

I'm having my first CT scan since undergoing several cancer surgeries earlier this year.

Praying for good results. :smile:

Thanks! I did get a good report. :smile:Oh wow!

Hope it turns out for you, and your family.

I was diagnosed with Stage 3 Melanoma last May, about two weeks before I was scheduled to retire. I was blindsided by the news. I couldn't remember the last time I was sick and there was little history of cancer in my family.

I had several surgeries and canceled my retirement. I chose to use Sick Leave until I was recovered. I eventually retired on Oct. 27.

While the cancer can return at any time, I'm looking forward to focusing on and enjoying retirement now. :smile:

Weekly update:

Aggressive Model trades only TNA/TZA.

Conservative Model trades only SPY/SH.

Volatility Model trades only XIV/VXX.

Models will hold a 50% or 100% position or be in cash.

All returns (except TSP) are compounded.

Performance does not include current open trades.

Aggressive Model

2016 Return: +62.2%

Year-to-date:+4.3%

Current Position: 100% TNA @ 67.74

Conservative Model

2016 Return: +10.4%

Year-to-date: +4.4%

Current position: 100% SPY @ 263.24

Volatility Model

2016 Return (6 months): +48.0%

Year-to-date: +14.6%

Current position: 100% XIV @ 123.75

TSP Model

Year-to-date (per AutoTracker): +9.49%

Current position: 100% S

Aggressive Model trades only TNA/TZA.

Conservative Model trades only SPY/SH.

Volatility Model trades only XIV/VXX.

Models will hold a 50% or 100% position or be in cash.

All returns (except TSP) are compounded.

Performance does not include current open trades.

Aggressive Model

2016 Return: +62.2%

Year-to-date:+4.3%

Current Position: 100% TNA @ 67.74

Conservative Model

2016 Return: +10.4%

Year-to-date: +4.4%

Current position: 100% SPY @ 263.24

Volatility Model

2016 Return (6 months): +48.0%

Year-to-date: +14.6%

Current position: 100% XIV @ 123.75

TSP Model

Year-to-date (per AutoTracker): +9.49%

Current position: 100% S

Weekly update:

Aggressive Model trades only TNA/TZA.

Conservative Model trades only SPY/SH.

Volatility Model trades only XIV/VXX.

Models will hold a 50% or 100% position or be in cash.

All returns (except TSP) are compounded.

Performance does not include current open trades.

Aggressive Model

2016 Return: +62.2%

Year-to-date:+4.9%

Current Position: Cash

Conservative Model

2016 Return: +10.4%

Year-to-date: +5.4%

Current position: 50% SPY @ 265.00

Volatility Model

2016 Return (6 months): +48.0%

Year-to-date: +22.4%

Current position: Cash

TSP Model

Year-to-date (per AutoTracker): +9.84%

Current position: 100% S

Aggressive Model trades only TNA/TZA.

Conservative Model trades only SPY/SH.

Volatility Model trades only XIV/VXX.

Models will hold a 50% or 100% position or be in cash.

All returns (except TSP) are compounded.

Performance does not include current open trades.

Aggressive Model

2016 Return: +62.2%

Year-to-date:+4.9%

Current Position: Cash

Conservative Model

2016 Return: +10.4%

Year-to-date: +5.4%

Current position: 50% SPY @ 265.00

Volatility Model

2016 Return (6 months): +48.0%

Year-to-date: +22.4%

Current position: Cash

TSP Model

Year-to-date (per AutoTracker): +9.84%

Current position: 100% S

Similar threads

- Replies

- 0

- Views

- 783

- Replies

- 0

- Views

- 678