The Thrift Savings Plan (TSP) and the IRS have different methods for calculating Required Minimum Distributions (RMDs), which can lead to discrepancies in the estimated amounts. Here's why you might be seeing a difference between the TSP estimate and the IRS RMD tables:

Assumed lifespan and calculation method:

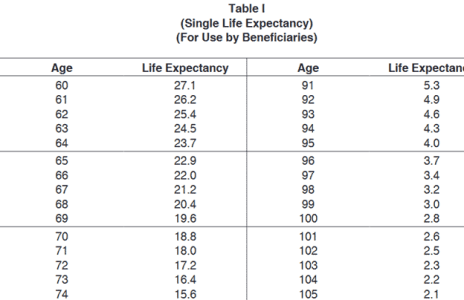

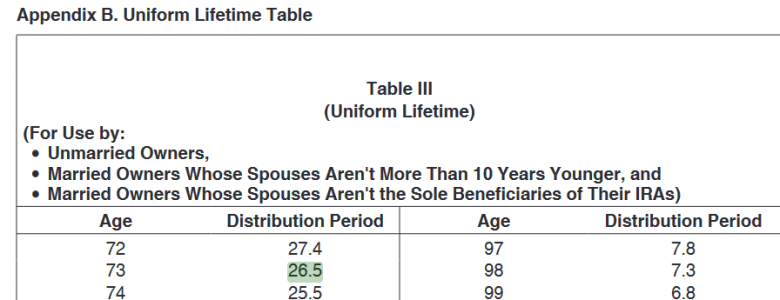

The TSP may use a different assumed lifespan or distribution calculation method than the IRS. The IRS typically uses the Uniform Lifetime Table to calculate RMDs, which considers the account holder's age and life expectancy. TSP might use a different actuarial table or methodology that results in higher RMD amounts.

Withdrawal options:

The TSP might offer different withdrawal options or methods than those prescribed by the IRS RMD tables. Certain withdrawal methods might result in higher distributions than those calculated using the IRS tables.

Account-specific factors:

The TSP might take into account specific factors related to your account, such as the type of TSP account you have, beneficiary designations, or other unique circumstances, which can impact the calculated RMD amount.

Updates and changes:

IRS regulations and tax laws might change over time. The TSP and the IRS may not always align their methodologies, which could lead to variations in the RMD estimates.

Frequency of calculation:

The TSP and IRS may update their RMD calculations at different intervals, leading to differences in the estimated amounts.

To ensure that you're complying with the IRS RMD requirements accurately, it's essential to use the IRS RMD tables and guidelines for your specific age and account balance. The IRS tables are widely accepted as the standard for RMD calculations, and they are used by most retirement account providers to determine RMD amounts.

If you're concerned about the difference in RMD amounts between the TSP estimate and the IRS tables, you should consult with a financial advisor or tax professional who can review your specific situation and provide guidance based on the most current regulations and IRS guidelines. They can help you navigate the requirements and plan your withdrawals in a tax-efficient manner while ensuring compliance with the IRS rules.