It was a relatively quiet trading day today and the market took the opportunity to digest recent gains and begin to alleviate an overbought condition.

The July Consumer Confidence Index came in at 50.4, which was well below the 61.0 that had been expected, but for the most part the market didn't have a strong reaction to this bit of data.

In my view it was a good day, as we needed to reestablish support at higher levels by doing some backing and filling. I don't think this will last long though as many traders who got left behind the initial rally will probably view this modest weakness as a buying opportunity.

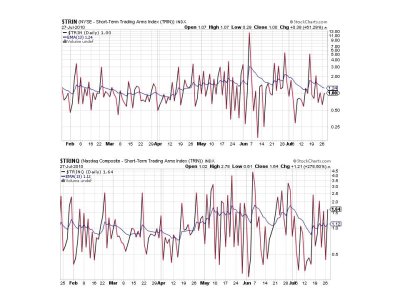

Here's today's charts:

Still on buys here.

Same here.

TRIN remained on a buy, while TRINQ flipped to a sell.

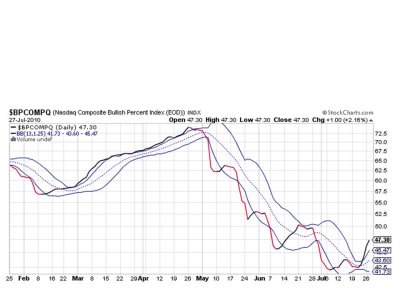

BPCOMPQ ebbed a bit higher today and remains on a buy.

So we have 6 of 7 signals on a buy, which keeps the system on a buy.

Not much to add here. Today's action did not diminish what appears to be a bullish picture moving forward. See you tomorrow.

The July Consumer Confidence Index came in at 50.4, which was well below the 61.0 that had been expected, but for the most part the market didn't have a strong reaction to this bit of data.

In my view it was a good day, as we needed to reestablish support at higher levels by doing some backing and filling. I don't think this will last long though as many traders who got left behind the initial rally will probably view this modest weakness as a buying opportunity.

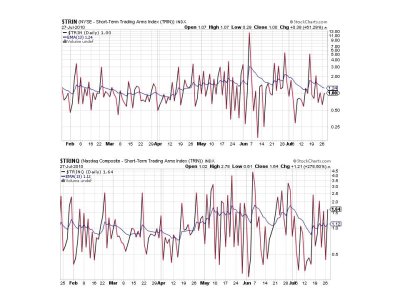

Here's today's charts:

Still on buys here.

Same here.

TRIN remained on a buy, while TRINQ flipped to a sell.

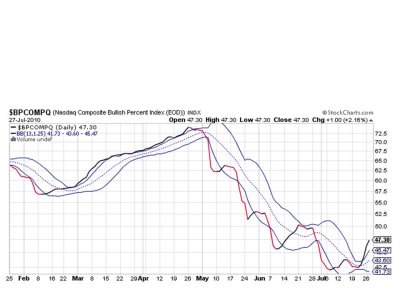

BPCOMPQ ebbed a bit higher today and remains on a buy.

So we have 6 of 7 signals on a buy, which keeps the system on a buy.

Not much to add here. Today's action did not diminish what appears to be a bullish picture moving forward. See you tomorrow.