The big money has certainly made their point. In thin trading they can do pretty much what they want to do, when they want to do it. September is off to a robust start and I won't deny the charts are looking bullish.

But the charts were looking quite bearish just 4 trading days ago and we were in a bear market. Now we're probably back in a bull market and the bearish charts were blasted apart.

It's not unusual to a see a huge rally in a bear market though, so there's still room for caution.

It wasn't all good news this morning in the payrolls data. Granted, it wasn't bad per se, but the jobs picture hasn't changed much either. But hey, we're on a roll so who cares about the news.

Here's the charts:

We've covered a lot of ground here in a very short period of time. And NYMO is now sitting not far from its 28 day trading high.

Still on buys here.

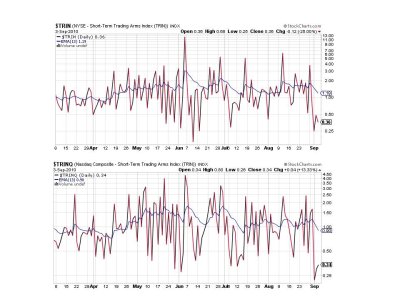

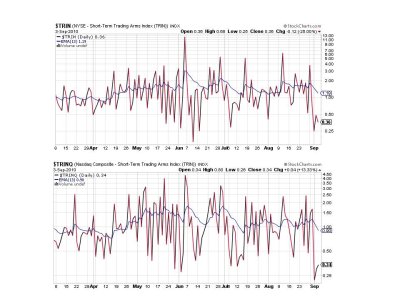

TRIN and TRINQ are staying planted in very overbought territory. That can't last forever.

BPCOMPQ moved higher and may be signaling more upside to this move.

So all Seven Sentinels are flashing buys and NYMO is within 18 points of its 28 day trading high.

What I continue to dislike is the explosiveness of not just the upside moves when they occur, but the downside moves as well. And remember, the downside usually moves faster than the upside, so after seeing this 3-day wonder rally I can't help but wonder (now that the powers that be have flipped most mechanical systems back to a buy) how much faster they'll take it down (not a question of if, but when).

But I'm not calling for a decline here. At least not yet given the recent strength.

I'm finding it amusing that some of the bulls (not so much on this MB) are saying everyone is shorting this rally, but I'm seeing no shortage of traders taking long positions here, so I suspect we see what we want to see. In any event, volume should increase next week as summer vacations expire. Should be interesting.

But the charts were looking quite bearish just 4 trading days ago and we were in a bear market. Now we're probably back in a bull market and the bearish charts were blasted apart.

It's not unusual to a see a huge rally in a bear market though, so there's still room for caution.

It wasn't all good news this morning in the payrolls data. Granted, it wasn't bad per se, but the jobs picture hasn't changed much either. But hey, we're on a roll so who cares about the news.

Here's the charts:

We've covered a lot of ground here in a very short period of time. And NYMO is now sitting not far from its 28 day trading high.

Still on buys here.

TRIN and TRINQ are staying planted in very overbought territory. That can't last forever.

BPCOMPQ moved higher and may be signaling more upside to this move.

So all Seven Sentinels are flashing buys and NYMO is within 18 points of its 28 day trading high.

What I continue to dislike is the explosiveness of not just the upside moves when they occur, but the downside moves as well. And remember, the downside usually moves faster than the upside, so after seeing this 3-day wonder rally I can't help but wonder (now that the powers that be have flipped most mechanical systems back to a buy) how much faster they'll take it down (not a question of if, but when).

But I'm not calling for a decline here. At least not yet given the recent strength.

I'm finding it amusing that some of the bulls (not so much on this MB) are saying everyone is shorting this rally, but I'm seeing no shortage of traders taking long positions here, so I suspect we see what we want to see. In any event, volume should increase next week as summer vacations expire. Should be interesting.