The bulls got started early today, taking the market moderately higher in the first hour of trade in spite of some late news yesterday that Moody's was threatening to downgrade the US "AAA" credit rating. Apparently, the market doesn't expect Congress to allow a US default. And with more than two weeks to go till the debt crisis deadline, why worry? And besides, Ben Bernanke has already hinted at QE3. He's got the market's back.

Okay, fair enough.

But while the bulls were flying high, Ben Bernanke was speaking to the Senate Banking Committee in which he stated that a default by the Treasury would destroy trust and confidence among investors. This was in reference to Moody's potential downgrade announcement. The market didn't seem to flinch with that comment. But then Bernanke indicated that while the Fed was willing to provide further quantitative easing, they did not yet have such a plan ready.

That's when the Bears crashed the party. The S&P dropped about 20 points from its peak of 1326.88 to an intraday low of 1306.51 over the course of the next 3 hours or so. It closed not far off that mark at 1308.87 for a 0.67% loss on the day. The Nasdaq fared worse with a loss of 1.22%.

We did get some market data early in the morning. Initial jobless claims came in at 405,000, which was a bit under the 410,000 claims that was expected. What I think is more noteworthy however, is that the prior week's count was upwardly revised to 427,000. Continuing claims rose to 3.73 million from 3.71 million.

June producer prices dropped 0.4%, while core producer prices increased 0.3%.

Retail sales for June rose 0.1%, which beat estimates of a 0.2% decline.

Here's today's charts:

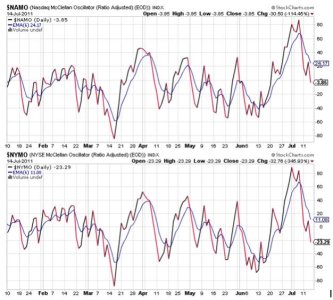

NAMO and NYMO moved back down on today's action with both now below the neutral line. They also remain in sell conditions.

NAHL and NYHL also turned lower and remain on sells.

TRIN remained on a buy, while TRINQ just did flip to a sell.

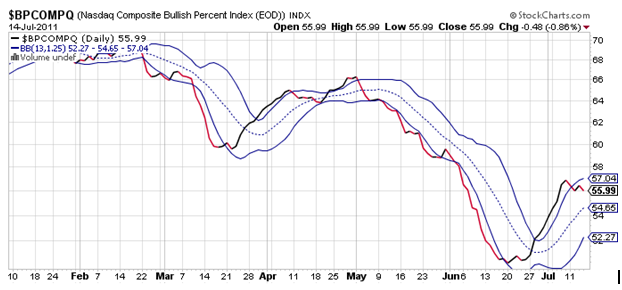

BPCOMPQ turned back down after today and remains in a sell condition.

So all but one signal are in sell conditions, which keeps the system on an intermediate term buy. But it won't take much more selling pressure to flip the system to an unconfirmed sell condition. NYMO would have to drop below -68 to trigger an official sell signal, and that would take significant downside pressure yet.

So rallies continue to be sold and the economic picture remains quite uncertain in terms of a possible US default. I still don't think many are anticipating a default will become a reality, and I only give it about a 20% chance myself, but I also don't think the market can get much traction to the upside while this situation plays out.

As I mentioned yesterday, the Top 50 had dropped their collective stock allocation to 30% after Tuesday's trading, which was a 14% drop from Friday. They now hold a 32% allocation after Wednesday. Today's numbers haven't been posted yet, but it's obvious risk is perceived to be much higher than in previous months.

I said I expected lower prices this week, and so far that's what we got. I have no reason to think we've bottomed yet either. The tricky part is guessing when Congress will come to an agreement over the debt ceiling. If the market continues to tick lower while the debate rages on, I would think that once an agreement is reached we would quickly reverse course. Or would we? Hard to be certain of anything at this point, but I don't think the bull market is over. I just think we're going through a transitory period. :laugh: