Aside from some modest end-of-day profit taking, the broader market remained solidly above the neutral line for most of the trading session and tacked on some moderate gains at the close.

With the end of quarter approaching and seasonality favoring the bulls there's a good chance we'll get some follow-through action (barring any surprise headlines). And speaking of headlines, Greece's parliament will be voting on recently agreed to austerity measures tomorrow. It's expected to pass, but if it doesn't, we could be headed back down again.

Economic data was very light today, but there was one report. May's personal income was up 0.3%, but spending was flat. Both numbers were just a bit lower than economists were looking for. But core personal consumption increased 0.3%, and that was a bit better than estimates.

Volume was light today, no doubt due to the upcoming July 4th holiday. Chances are the rest of the week will also remain on the light side.

Here's today's charts:

NAMO and NYMO moved back up a bit today. Both remain on buys.

NAHL also remains on a buy, while NYHL is sitting on its trigger point. Nothing bearish about that though.

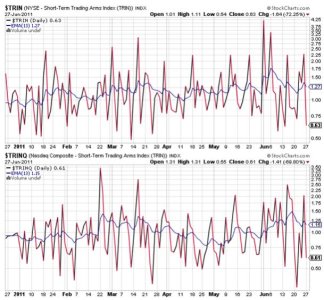

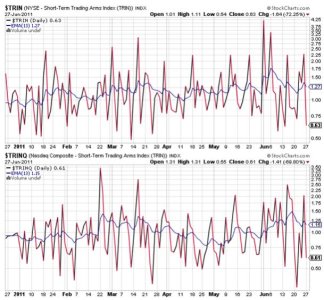

Both TRIN and TRINQ spiked lower and suggest a modestly overbought condition. That can be worked off in a choppy market, so any weakness should be modest and may not last long.

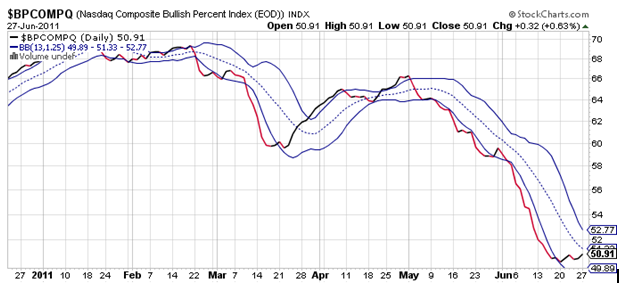

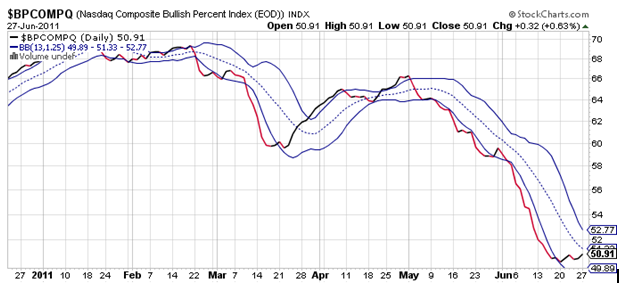

BPCOMPQ edged up a bit more today and is starting to look bullish. It also remains in a buy condition.

So the signals look good in spite of recent volatility. No change in my short term outlook, which calls for higher prices by weeks end.

With the end of quarter approaching and seasonality favoring the bulls there's a good chance we'll get some follow-through action (barring any surprise headlines). And speaking of headlines, Greece's parliament will be voting on recently agreed to austerity measures tomorrow. It's expected to pass, but if it doesn't, we could be headed back down again.

Economic data was very light today, but there was one report. May's personal income was up 0.3%, but spending was flat. Both numbers were just a bit lower than economists were looking for. But core personal consumption increased 0.3%, and that was a bit better than estimates.

Volume was light today, no doubt due to the upcoming July 4th holiday. Chances are the rest of the week will also remain on the light side.

Here's today's charts:

NAMO and NYMO moved back up a bit today. Both remain on buys.

NAHL also remains on a buy, while NYHL is sitting on its trigger point. Nothing bearish about that though.

Both TRIN and TRINQ spiked lower and suggest a modestly overbought condition. That can be worked off in a choppy market, so any weakness should be modest and may not last long.

BPCOMPQ edged up a bit more today and is starting to look bullish. It also remains in a buy condition.

So the signals look good in spite of recent volatility. No change in my short term outlook, which calls for higher prices by weeks end.