Oversold conditions, thin trading, and a pre-holiday bias are helping the major averages retrace some of their recent losses.

This upward bias is in spite of the fact that the second estimate of first quarter GDP revealed growth of 1.8%. This is less than the 2% economists were looking for and not particularly good news for the overall economy.

Initial jobless claims rose once again to a total of 424,000 and is well above estimates of 400,000.

Volume was anemic today and tomorrow promises more of the same in front of this holiday weekend.

The Friday before Memorial Day tends to be lackluster, but on the day after MD the DOW has been up 8 of the last 11 years. And the first trading day of June the DOW has been up 10 of the last 12 years. But on weekly basis, the DOW has only been up 7 of the last 14 years. FWIW.

Here's today's charts:

NAMO and NYMO are now near the neutral line again and continue to flash buy signals. Yesterday I had mentioned that the strength of these signals has been waning, so today I drew a line to illustrate that decline.

NAHL and NYHL managed to move higher and both flipped to a buy as they crossed their respective 6 day EMAs. These charts also show a decline in strength of upside moves.

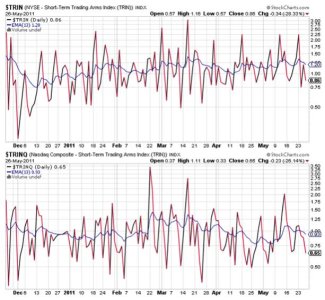

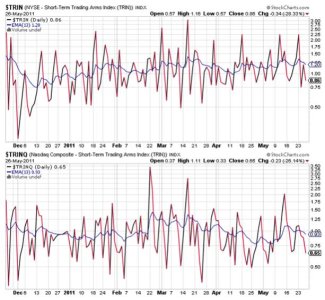

TRIN and TRINQ are both in buy conditions.

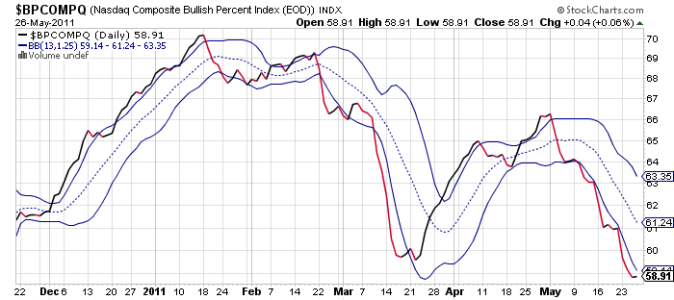

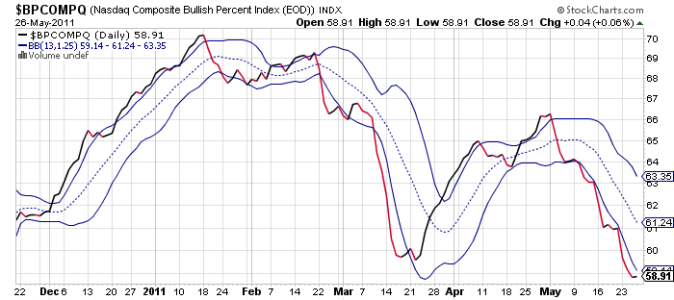

BPCOMPQ moved a bit sideways today, but remains in a sell condition. This is an initial clue that a turn may be coming, but one day is not nearly enough to be sure. The system remains in a sell status regardless.

I'm still looking for lower prices, and the charts above (NAMO/NYMO/NAHL/NYHL) suggest we may have seen a very short term top today or tomorrow at the latest. We'll have to see if that's in fact the case.

This upward bias is in spite of the fact that the second estimate of first quarter GDP revealed growth of 1.8%. This is less than the 2% economists were looking for and not particularly good news for the overall economy.

Initial jobless claims rose once again to a total of 424,000 and is well above estimates of 400,000.

Volume was anemic today and tomorrow promises more of the same in front of this holiday weekend.

The Friday before Memorial Day tends to be lackluster, but on the day after MD the DOW has been up 8 of the last 11 years. And the first trading day of June the DOW has been up 10 of the last 12 years. But on weekly basis, the DOW has only been up 7 of the last 14 years. FWIW.

Here's today's charts:

NAMO and NYMO are now near the neutral line again and continue to flash buy signals. Yesterday I had mentioned that the strength of these signals has been waning, so today I drew a line to illustrate that decline.

NAHL and NYHL managed to move higher and both flipped to a buy as they crossed their respective 6 day EMAs. These charts also show a decline in strength of upside moves.

TRIN and TRINQ are both in buy conditions.

BPCOMPQ moved a bit sideways today, but remains in a sell condition. This is an initial clue that a turn may be coming, but one day is not nearly enough to be sure. The system remains in a sell status regardless.

I'm still looking for lower prices, and the charts above (NAMO/NYMO/NAHL/NYHL) suggest we may have seen a very short term top today or tomorrow at the latest. We'll have to see if that's in fact the case.