Pre-Bell  Brief

Brief

Time: 29-Oct-2025 07:22 (ET)

Key Takeaway

Key Takeaway

• Fresh highs Tuesday: SPX +0.23% with tech leadership; tone hinges on Fed cut odds and Big Tech tonight. [1]

• 10-year sits near 4.0% heading into the decision, a key check on multiples. [2]

• Dollar a touch firmer premarket, a small headwind if it persists. [3]

What Moved Overnight

What Moved Overnight

• Futures slightly higher as AI bellwethers stay bid; VIX mixed; oil and gold firm. Link

• Nvidia gains again and nudges futures up, while traders eye a likely Fed cut this afternoon. Link

• Dollar index edges up and the 10-year hovers just under 4.0% into the open. Link

How the Prior Session Closed

How the Prior Session Closed

• SPX +0.23% to 6,890.89 as UPS and PayPal paced winners; small caps lagged. Link

• IXIC +0.80% to 23,827.49, third straight record close. Link

• DJI +0.34% to 47,706.37, steady ahead of the Fed. Link

• Top SPX Winner: UPS (United Parcel Service) +8.0% (Industrials: Air Freight & Logistics) Link

• Bottom SPX Loser: RCL (Royal Caribbean Group) −8.5% (Consumer Discretionary: Hotels, Restaurants & Leisure) Link

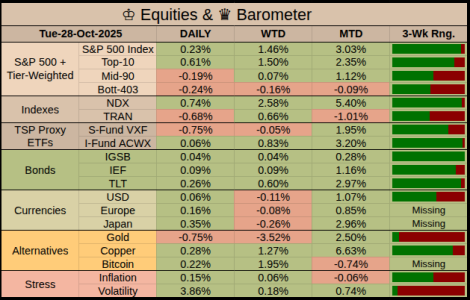

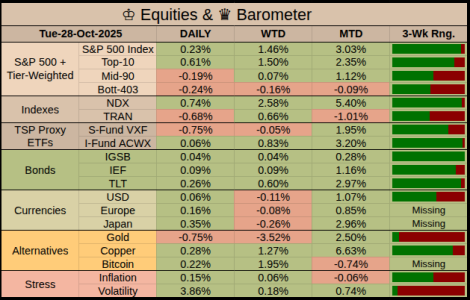

♔ Equities & ♛ Barometer

• Prior Session: SPX added +0.23% with megacaps leading; 10-year near 4.0%, VIX steady, DXY firmed slightly.

• WTD: Risk-on bias with broader participation; small caps and transports improved but trailed megacaps.

• MTD: Mixed drift: rates volatility eased, supporting multiples; dollar firmness capped cyclicals.

• 3-Week: Momentum improved as VIX trended lower; dollar headwind faded.

TSP Stats

TSP Stats

G-Fund Estimated Forward Returns • +0.0118% per session [4]

• 5 Sessions: +0.059% • November: +0.22% • 3 Months: +0.75% • 1 Year: +3.00%

FCSI Past-5 Sessions

• F-Fund +0.05% • C-Fund +2.32% • S-Fund +0.67% • I-Fund +1.42% [4]

Today's 1st Hour of Trading, What to Watch For

Today's 1st Hour of Trading, What to Watch For

• 10/29 WED 14:00 — [Fed] FOMC decision: expected −25 in 0.01 percent steps; guidance is the mover. [5]

• 10/29 WED 14:30 — [Fed] Powell presser: labor tone, balance-sheet path, and dot-path hints. [5]

• 10/29 WED — [Earnings] Alphabet, Meta, Microsoft after the bell: AI spend and margins in focus. [6]

Upcoming Headlines (5-Day Window, ET)

Upcoming Headlines (5-Day Window, ET)

• 10/29 WED 14:00 — [Fed] Rate decision and statement. [5]

• 10/29 WED 14:30 — [Fed] Powell press conference. [5]

• 10/30 THU 08:30 — [Macro] Q3 GDP (advance): soft-landing check. [7]

• 10/30 THU 17:00 — [Earnings] AAPL fiscal Q4 call. [8]

• 11/03 MON 10:00 — [Macro] ISM Manufacturing PMI. [9]

▶ Citation Block

[1] 29-Oct-2025: AP News: How major US stock indexes fared Tuesday, 10/28/2025

[2] 29-Oct-2025: MarketWatch: U.S. 10 Year Treasury Note Overview

[3] 29-Oct-2025: MarketWatch: U.S. Dollar Index (DXY) Overview

[4] 29-Oct-2025: TSPtalk.com: TSP Fund Prices (daily share prices)

[5] 29-Oct-2025: Federal Reserve: FOMC meeting calendar (Oct 28–29, 2025)

[6] 27-Oct-2025: MarketScreener: Earnings calendar for Oct 27–31, 2025

[7] 30-Oct-2025: BEA: Gross Domestic Product, 3rd Quarter 2025 (Advance Estimate)

[8] 30-Oct-2025: Nasdaq: Apple (AAPL) earnings date

[9] n.d.: ISM: ISM PMI release time (Manufacturing)

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Time: 29-Oct-2025 07:22 (ET)

• Fresh highs Tuesday: SPX +0.23% with tech leadership; tone hinges on Fed cut odds and Big Tech tonight. [1]

• 10-year sits near 4.0% heading into the decision, a key check on multiples. [2]

• Dollar a touch firmer premarket, a small headwind if it persists. [3]

• Futures slightly higher as AI bellwethers stay bid; VIX mixed; oil and gold firm. Link

• Nvidia gains again and nudges futures up, while traders eye a likely Fed cut this afternoon. Link

• Dollar index edges up and the 10-year hovers just under 4.0% into the open. Link

• SPX +0.23% to 6,890.89 as UPS and PayPal paced winners; small caps lagged. Link

• IXIC +0.80% to 23,827.49, third straight record close. Link

• DJI +0.34% to 47,706.37, steady ahead of the Fed. Link

• Top SPX Winner: UPS (United Parcel Service) +8.0% (Industrials: Air Freight & Logistics) Link

• Bottom SPX Loser: RCL (Royal Caribbean Group) −8.5% (Consumer Discretionary: Hotels, Restaurants & Leisure) Link

♔ Equities & ♛ Barometer

• Prior Session: SPX added +0.23% with megacaps leading; 10-year near 4.0%, VIX steady, DXY firmed slightly.

• WTD: Risk-on bias with broader participation; small caps and transports improved but trailed megacaps.

• MTD: Mixed drift: rates volatility eased, supporting multiples; dollar firmness capped cyclicals.

• 3-Week: Momentum improved as VIX trended lower; dollar headwind faded.

G-Fund Estimated Forward Returns • +0.0118% per session [4]

• 5 Sessions: +0.059% • November: +0.22% • 3 Months: +0.75% • 1 Year: +3.00%

FCSI Past-5 Sessions

• F-Fund +0.05% • C-Fund +2.32% • S-Fund +0.67% • I-Fund +1.42% [4]

• 10/29 WED 14:00 — [Fed] FOMC decision: expected −25 in 0.01 percent steps; guidance is the mover. [5]

• 10/29 WED 14:30 — [Fed] Powell presser: labor tone, balance-sheet path, and dot-path hints. [5]

• 10/29 WED — [Earnings] Alphabet, Meta, Microsoft after the bell: AI spend and margins in focus. [6]

• 10/29 WED 14:00 — [Fed] Rate decision and statement. [5]

• 10/29 WED 14:30 — [Fed] Powell press conference. [5]

• 10/30 THU 08:30 — [Macro] Q3 GDP (advance): soft-landing check. [7]

• 10/30 THU 17:00 — [Earnings] AAPL fiscal Q4 call. [8]

• 11/03 MON 10:00 — [Macro] ISM Manufacturing PMI. [9]

▶ Citation Block

[1] 29-Oct-2025: AP News: How major US stock indexes fared Tuesday, 10/28/2025

[2] 29-Oct-2025: MarketWatch: U.S. 10 Year Treasury Note Overview

[3] 29-Oct-2025: MarketWatch: U.S. Dollar Index (DXY) Overview

[4] 29-Oct-2025: TSPtalk.com: TSP Fund Prices (daily share prices)

[5] 29-Oct-2025: Federal Reserve: FOMC meeting calendar (Oct 28–29, 2025)

[6] 27-Oct-2025: MarketScreener: Earnings calendar for Oct 27–31, 2025

[7] 30-Oct-2025: BEA: Gross Domestic Product, 3rd Quarter 2025 (Advance Estimate)

[8] 30-Oct-2025: Nasdaq: Apple (AAPL) earnings date

[9] n.d.: ISM: ISM PMI release time (Manufacturing)

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.