Pre-Bell  Brief

Brief

Time: 07-Nov-2025 05:44 (ET)

• Next week's federal holiday: Veterans Day on Tue 11-Nov, should thin volumes and leave trading choppy around headlines.

Key Takeaway

Key Takeaway

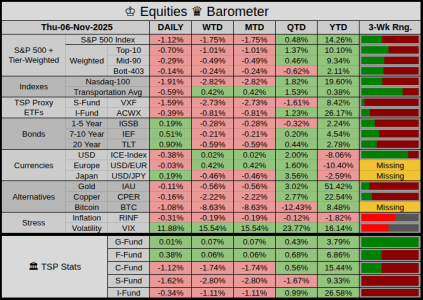

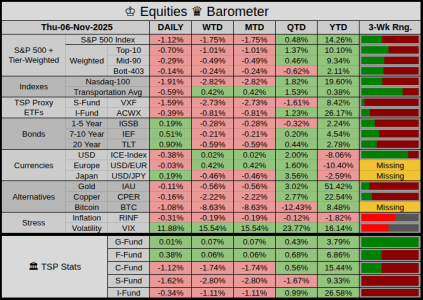

• U.S. session: SPX fell -1.12% and NDX dropped -1.91% as crowded AI trades got hit. [1]

• Asia: markets limped into the weekend, with tech-heavy indexes fading as AI bubble worries stayed front and center. [2]

• Europe: STOXX 600 is modestly lower, still on track to end a volatile week in the red as rate and growth jitters linger. [3]

• Cross-asset: futures are slightly green, but the shutdown-driven data blackout keeps uncertainty high around jobs and the Fed. [4][5][6]

What Moved Overnight

What Moved Overnight

• Asia – indexes mostly lower, led by weakness in AI and chip names as traders continue to de-risk high-multiple tech. [2]

• Europe – STOXX 600 flattish to lower, with defensives holding up better while cyclicals lag into the weekend. [3]

• U.S. Futures – ES00 and peers edge up, pointing to a mild rebound after yesterday’s tech-heavy selloff. [1][4]

• FX / Rates – DXY and 10Y Yield are calmer, but shutdown noise and missing data keep moves tentative. [4][5][6][8]

How the Prior Session Closed

How the Prior Session Closed

• Leadership: Mega-cap tech and AI infrastructure names led the downside, while energy and a few defensives offered the only real ballast. [1][2]

• Breadth: Losses reached well beyond the top tier, but the heaviest damage stayed in prior winners, suggesting more de-risking than panic. [1]

• Rates & Dollar: A pullback in yields and a softer dollar helped stabilize credit, but the Fed is still flying partly blind without labor data. [4][5][6][8]

• Commodities & Crypto: Modest dips in gold and copper and a heavier slide in crypto point to more cautious positioning across risk. [1]

• Volatility & Stress: VIX jumped by double digits, but levels still signal concern rather than outright fear.

• Top Gainer: DDOG surged +23.13% on strong earnings and upbeat cloud demand guidance. [1]

• Bottom Loser: DASH slumped -17.45% after heavier spending plans and cautious profit outlook. [1]

Today’s 1st Hour of Trading

Today’s 1st Hour of Trading

• No official 08:30 Employment Situation today, with BLS data releases frozen by the federal shutdown and jobs reports on hold. [5][6][7]

• Private trackers, ADP, and jobless claims now frame the labor story, but correlations to the missing BLS series are imperfect. [6][7][8]

• Headlines around shutdown talks and any hint of a deal or failed vote could swing the first hour more than usual macro prints. [5][7][8]

Upcoming Headlines

Upcoming Headlines

• 11/07 FRI – Ongoing federal shutdown, with Senate votes and deal rumors as primary intraday swing catalysts. [5][7]

• 11/07 FRI 10:00 – Univ. of Michigan Sentiment (Nov prelim), a key read on consumers while official data stay dark.

• Next 3–5 days – Most major federal releases, including jobs and trade, remain delayed until the shutdown ends. [6][8]

Off in the Distance

Off in the Distance

• Next FOMC meeting later this month, with policymakers forced to lean on private data and anecdotes instead of full BLS series. [6][8]

• Once funding is restored, a backlog of jobs, inflation, and activity reports will likely compress into a noisy catch-up window. [6][8]

Wrap

Wrap

• Futures are modestly firmer, but with the jobs report missing and shutdown talks in flux, traders are flying by feel more than data. [1][4][5][8]

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 07-Nov-2025: Nasdaq - Stock Market News for Nov 7, 2025

[2] 07-Nov-2025: MarketPulse - Asia Market Wrap - Asian Shares Ending a Shaky Week with Losses

[3] 07-Nov-2025: Reuters - Europe's STOXX 600 on track to end volatile week lower; ITV soars

[4] 07-Nov-2025: Markets Insider - Premarket Trading - November 07, 2025

[5] 07-Nov-2025: CBS News - Government shutdown drags on as Senate GOP eyes key Friday vote

[6] 06-Nov-2025: Reuters - Private reports suggest U.S. labor market weakened in October

[7] 07-Nov-2025: Wikipedia - 2025 United States federal government shutdown

[8] 17-Oct-2025: MarketPulse - US lack of labor market data due to government shutdown

Time: 07-Nov-2025 05:44 (ET)

• Next week's federal holiday: Veterans Day on Tue 11-Nov, should thin volumes and leave trading choppy around headlines.

• U.S. session: SPX fell -1.12% and NDX dropped -1.91% as crowded AI trades got hit. [1]

• Asia: markets limped into the weekend, with tech-heavy indexes fading as AI bubble worries stayed front and center. [2]

• Europe: STOXX 600 is modestly lower, still on track to end a volatile week in the red as rate and growth jitters linger. [3]

• Cross-asset: futures are slightly green, but the shutdown-driven data blackout keeps uncertainty high around jobs and the Fed. [4][5][6]

• Asia – indexes mostly lower, led by weakness in AI and chip names as traders continue to de-risk high-multiple tech. [2]

• Europe – STOXX 600 flattish to lower, with defensives holding up better while cyclicals lag into the weekend. [3]

• U.S. Futures – ES00 and peers edge up, pointing to a mild rebound after yesterday’s tech-heavy selloff. [1][4]

• FX / Rates – DXY and 10Y Yield are calmer, but shutdown noise and missing data keep moves tentative. [4][5][6][8]

• Leadership: Mega-cap tech and AI infrastructure names led the downside, while energy and a few defensives offered the only real ballast. [1][2]

• Breadth: Losses reached well beyond the top tier, but the heaviest damage stayed in prior winners, suggesting more de-risking than panic. [1]

• Rates & Dollar: A pullback in yields and a softer dollar helped stabilize credit, but the Fed is still flying partly blind without labor data. [4][5][6][8]

• Commodities & Crypto: Modest dips in gold and copper and a heavier slide in crypto point to more cautious positioning across risk. [1]

• Volatility & Stress: VIX jumped by double digits, but levels still signal concern rather than outright fear.

• Top Gainer: DDOG surged +23.13% on strong earnings and upbeat cloud demand guidance. [1]

• Bottom Loser: DASH slumped -17.45% after heavier spending plans and cautious profit outlook. [1]

• No official 08:30 Employment Situation today, with BLS data releases frozen by the federal shutdown and jobs reports on hold. [5][6][7]

• Private trackers, ADP, and jobless claims now frame the labor story, but correlations to the missing BLS series are imperfect. [6][7][8]

• Headlines around shutdown talks and any hint of a deal or failed vote could swing the first hour more than usual macro prints. [5][7][8]

• 11/07 FRI – Ongoing federal shutdown, with Senate votes and deal rumors as primary intraday swing catalysts. [5][7]

• 11/07 FRI 10:00 – Univ. of Michigan Sentiment (Nov prelim), a key read on consumers while official data stay dark.

• Next 3–5 days – Most major federal releases, including jobs and trade, remain delayed until the shutdown ends. [6][8]

• Next FOMC meeting later this month, with policymakers forced to lean on private data and anecdotes instead of full BLS series. [6][8]

• Once funding is restored, a backlog of jobs, inflation, and activity reports will likely compress into a noisy catch-up window. [6][8]

• Futures are modestly firmer, but with the jobs report missing and shutdown talks in flux, traders are flying by feel more than data. [1][4][5][8]

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 07-Nov-2025: Nasdaq - Stock Market News for Nov 7, 2025

[2] 07-Nov-2025: MarketPulse - Asia Market Wrap - Asian Shares Ending a Shaky Week with Losses

[3] 07-Nov-2025: Reuters - Europe's STOXX 600 on track to end volatile week lower; ITV soars

[4] 07-Nov-2025: Markets Insider - Premarket Trading - November 07, 2025

[5] 07-Nov-2025: CBS News - Government shutdown drags on as Senate GOP eyes key Friday vote

[6] 06-Nov-2025: Reuters - Private reports suggest U.S. labor market weakened in October

[7] 07-Nov-2025: Wikipedia - 2025 United States federal government shutdown

[8] 17-Oct-2025: MarketPulse - US lack of labor market data due to government shutdown