Market action today featured another early attempt to take prices down followed by a successful attempt to drive them back up. By the close the major averages were sporting modest gains.

Overseas, the European Central Bank announced its decision to keep its target lending rate at 1.00%. That was not a surprise. The Bank of England also held its target rate steady at 0.5%, but expanded its lending program.

Here at home, the latest initial weekly jobless claims number came in at 358,000, which was lower than estimates looking for 370,000.

News does not seem to be driving the markets at the moment. I think it's more about momentum and that is slowing down. And the relatively dull action could cause traders and investors alike to become complacent given the low volatility. While I'm not quite bearish yet, I am getting more wary of this market as you'll see in tonight's charts, but I'm not calling any tops. This slow grind upward could continue for awhile yet too.

Here's today's charts:

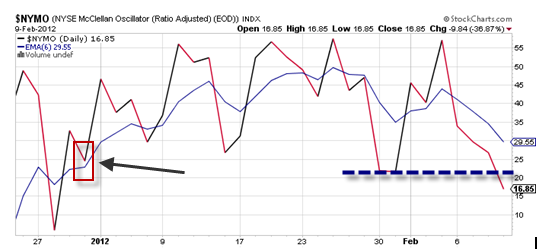

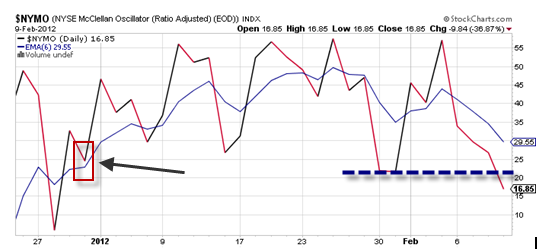

NAMO and NYMO are the signals that are concerning me the most right now. Both dropped again and remain in sell conditions. More importantly, NYMO hit a fresh 28 day trading low. More on that below.

NAHL remains on a sell, while NYHL remains on a buy.

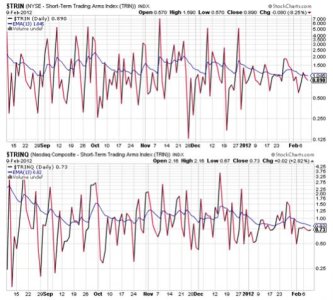

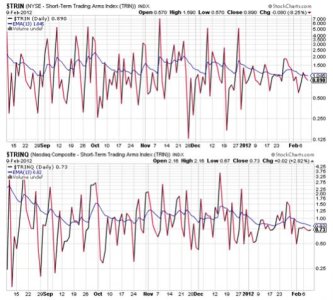

TRIN and TRINQ both remain in buy conditions and that counts for something.

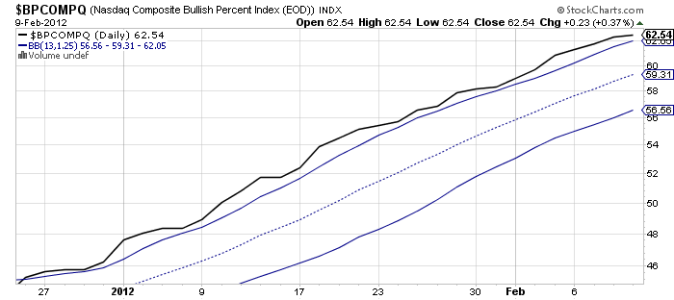

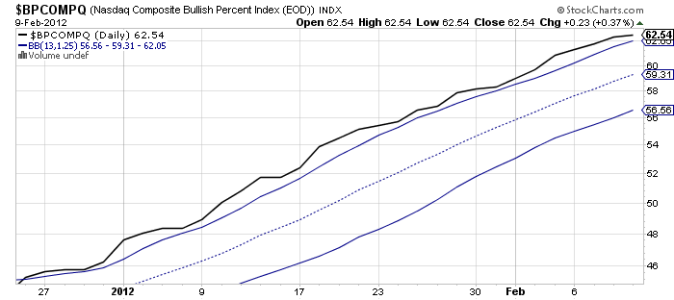

BPCOMPQ continues its slow tack higher, although it was most flat today. It remains on a buy though.

So the signals are mixed again and that keeps the Seven Sentinels in a buy condition.

Here is another chart of NYMO. The red box to the left of the chart shows where the 28 day point was today. The dotted line crosses along the lowest point of this signal these past 28 trading days and you can see that today's reading fell below that line. That means we hit a fresh 28 day trading low.

Quite some time ago when volatility wasn't as much of a factor in the market, a buy or sell signal didn't require a 28 day trading high or low to confirm the signal. It was only added to the metric to help avoid whipsaws. Right now volatility is low so the 28 day trading low has limited meaning in the current market environment. More importantly however, is that all seven signals have not triggered sells simultaneously. That's what is keeping the system on a buy right now. And it still wouldn't take a lot of selling pressure to roll it over to a sell. But for now the dip buyers are preventing that from happening. We could also get another spike higher, which would help strengthen the charts as they are showing signs that this buy signal is getting weaker.

So that's where we're at right now. It's up until it's not, but don't get complacent. Things could change at any time.

Overseas, the European Central Bank announced its decision to keep its target lending rate at 1.00%. That was not a surprise. The Bank of England also held its target rate steady at 0.5%, but expanded its lending program.

Here at home, the latest initial weekly jobless claims number came in at 358,000, which was lower than estimates looking for 370,000.

News does not seem to be driving the markets at the moment. I think it's more about momentum and that is slowing down. And the relatively dull action could cause traders and investors alike to become complacent given the low volatility. While I'm not quite bearish yet, I am getting more wary of this market as you'll see in tonight's charts, but I'm not calling any tops. This slow grind upward could continue for awhile yet too.

Here's today's charts:

NAMO and NYMO are the signals that are concerning me the most right now. Both dropped again and remain in sell conditions. More importantly, NYMO hit a fresh 28 day trading low. More on that below.

NAHL remains on a sell, while NYHL remains on a buy.

TRIN and TRINQ both remain in buy conditions and that counts for something.

BPCOMPQ continues its slow tack higher, although it was most flat today. It remains on a buy though.

So the signals are mixed again and that keeps the Seven Sentinels in a buy condition.

Here is another chart of NYMO. The red box to the left of the chart shows where the 28 day point was today. The dotted line crosses along the lowest point of this signal these past 28 trading days and you can see that today's reading fell below that line. That means we hit a fresh 28 day trading low.

Quite some time ago when volatility wasn't as much of a factor in the market, a buy or sell signal didn't require a 28 day trading high or low to confirm the signal. It was only added to the metric to help avoid whipsaws. Right now volatility is low so the 28 day trading low has limited meaning in the current market environment. More importantly however, is that all seven signals have not triggered sells simultaneously. That's what is keeping the system on a buy right now. And it still wouldn't take a lot of selling pressure to roll it over to a sell. But for now the dip buyers are preventing that from happening. We could also get another spike higher, which would help strengthen the charts as they are showing signs that this buy signal is getting weaker.

So that's where we're at right now. It's up until it's not, but don't get complacent. Things could change at any time.