Normally I'd have a better set of a data to present, but since I'm on vacation, I'll make it short.

Off the cuff, when I see 9 consecutive positive sessions with a close above a descending Standard Deviation 2, I'd say this is a rare Top 1% event.

From a previous post #9,974 I showed that in a descending 63-Day Channel 7% of closes are in the range of our current close. Only 1% fall outside Standard Deviation 3-Resistance. So in theory we need time & price to adjust, and the channel to lift up.

Shifting into a long-term weekly view, there is a lot here, that looks appealing. About another 3.37% rise to the Center Fair Value line on a rising channel.

Although slight, we've also closed back above the 13&52 Week Moving Averages.

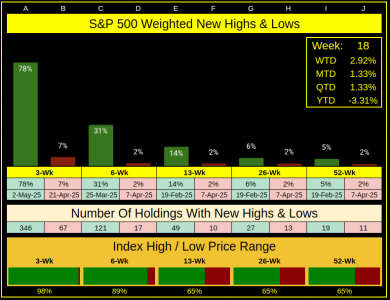

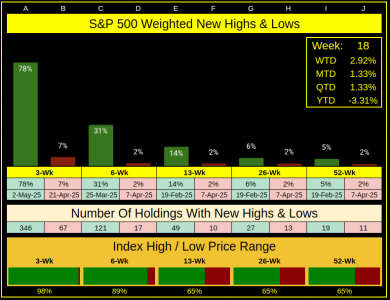

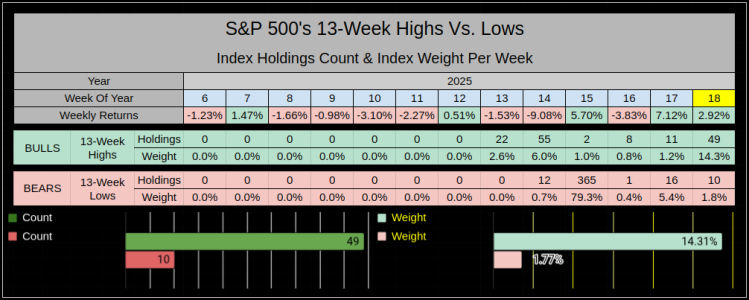

We can see here a good run into the 3 and 6 week High/Low price ranges, we have our toes dipped in the 13 but haven't yet jumped in.

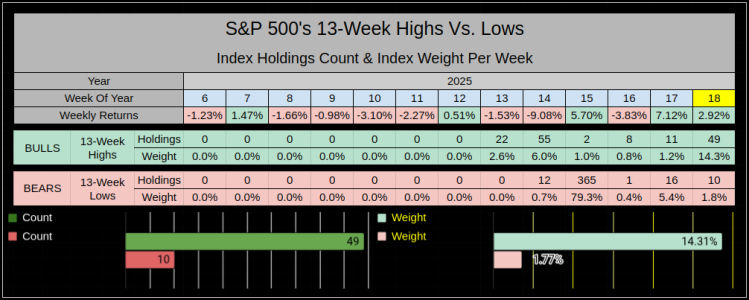

For Week 18 on the 13-week spectrum Bulls controlled the Index.

New 13-Week High/Low holdings with Bulls 49 vs. Bears 10 and by weight 14.31% vs. 1.77%

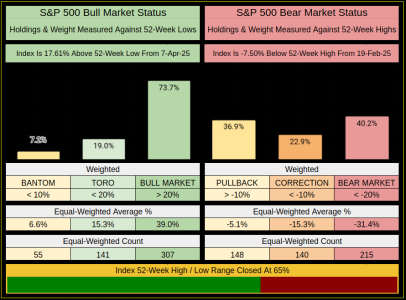

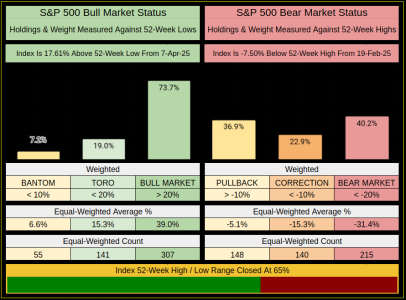

We are at 65% of our 52-Week High/Low range, not great, but a heck of lot better than weeks prior.

I'll be back to normal by Tuesday. True story, if you only type English, and see a really nice PC keyboard on sale, make sure it's not the DE (German) version.

Oh and if you buy a really nice tablet that comes with a keyboard make sure it's not the ES (Spanish) version. And when you buy a second keyboard to fix the ES problem don't fix it with a DE that's even worse....

Thanks for reading...Jason

Off the cuff, when I see 9 consecutive positive sessions with a close above a descending Standard Deviation 2, I'd say this is a rare Top 1% event.

From a previous post #9,974 I showed that in a descending 63-Day Channel 7% of closes are in the range of our current close. Only 1% fall outside Standard Deviation 3-Resistance. So in theory we need time & price to adjust, and the channel to lift up.

Shifting into a long-term weekly view, there is a lot here, that looks appealing. About another 3.37% rise to the Center Fair Value line on a rising channel.

Although slight, we've also closed back above the 13&52 Week Moving Averages.

We can see here a good run into the 3 and 6 week High/Low price ranges, we have our toes dipped in the 13 but haven't yet jumped in.

For Week 18 on the 13-week spectrum Bulls controlled the Index.

New 13-Week High/Low holdings with Bulls 49 vs. Bears 10 and by weight 14.31% vs. 1.77%

We are at 65% of our 52-Week High/Low range, not great, but a heck of lot better than weeks prior.

I'll be back to normal by Tuesday. True story, if you only type English, and see a really nice PC keyboard on sale, make sure it's not the DE (German) version.

Oh and if you buy a really nice tablet that comes with a keyboard make sure it's not the ES (Spanish) version. And when you buy a second keyboard to fix the ES problem don't fix it with a DE that's even worse....

Thanks for reading...Jason