If you read this blog regularly, then you'll recognize a chart pattern that has been repeating itself in the Seven Sentinels since early May. But before I get to that, let's see what drove the markets today.

First, it was OPEX, which can be a guessing game anyway. And after the market tipped its hand at the open with a gap down, the market never looked back. Economic data didn't help either. The preliminary Consumer Sentiment Survey for July from the University of Michigan dropped to 66.5 from 76.0 in the prior month. This was much lower than the forecast 74.5. The Consumer Price Index (CPI) for June decreased 0.1%, which was in-line with estimates. But the Core CPI increased 0.2%, which was a bit more than the consensus of 0.1%.

Earnings have been decent so far in the early going, and this week there were 23 S&P 500 companies that reported earnings. Of those, 19 reported better-than expected earnings and 15 beat revenue estimates.

But Google reported earnings that were a bit below expectations, even though it grew revenue a more than expected.

Personally, I think the market is just looking for excuses to take profits.

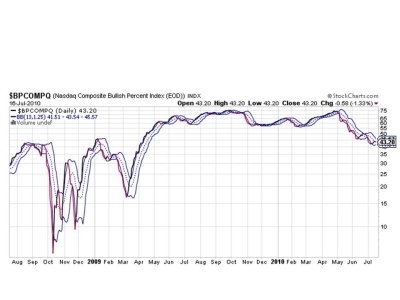

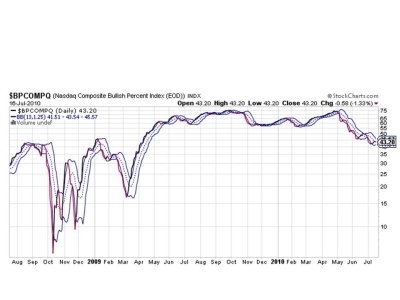

So let's go back the repeating chart pattern I had mentioned early on. In particular, BPCOMPQ is my focus. Here's the charts:

When the market dives as hard as it did today, you can usually expect to see some damage to the charts. NAMO and NYMO are certainly no exception and have both flipped to sells.

Same with NAHL and NYHL.

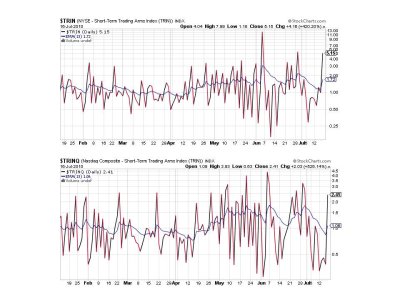

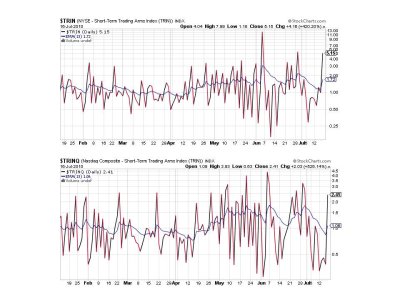

Two more sells here with TRIN and TRINQ.

While I'm still bullish overall (let's face it, this volatility seems to be par for the course now) as sentiment is generally bearish, the one chart that makes me take pause is this one. Since early May we've seen BPCOMPQ step ladder down with the market. And I'm concerned that it's about to take another dive now. The question is, will we make a lower low? We still have a ways to go to get there after the recent rally so it's too early to get overly concerned, but we need to keep in mind that more selling may yet occur before we bounce again.

This market is making wide swings, which can be devastating to our accounts with one misstep.

But we do remain on a buy as the SS have not yet rolled over. But next week the bulls need to take control again, hopefully before too much more damage is done.

As usual, I'll be posting the Tracker charts over the weekend. See you then.

First, it was OPEX, which can be a guessing game anyway. And after the market tipped its hand at the open with a gap down, the market never looked back. Economic data didn't help either. The preliminary Consumer Sentiment Survey for July from the University of Michigan dropped to 66.5 from 76.0 in the prior month. This was much lower than the forecast 74.5. The Consumer Price Index (CPI) for June decreased 0.1%, which was in-line with estimates. But the Core CPI increased 0.2%, which was a bit more than the consensus of 0.1%.

Earnings have been decent so far in the early going, and this week there were 23 S&P 500 companies that reported earnings. Of those, 19 reported better-than expected earnings and 15 beat revenue estimates.

But Google reported earnings that were a bit below expectations, even though it grew revenue a more than expected.

Personally, I think the market is just looking for excuses to take profits.

So let's go back the repeating chart pattern I had mentioned early on. In particular, BPCOMPQ is my focus. Here's the charts:

When the market dives as hard as it did today, you can usually expect to see some damage to the charts. NAMO and NYMO are certainly no exception and have both flipped to sells.

Same with NAHL and NYHL.

Two more sells here with TRIN and TRINQ.

While I'm still bullish overall (let's face it, this volatility seems to be par for the course now) as sentiment is generally bearish, the one chart that makes me take pause is this one. Since early May we've seen BPCOMPQ step ladder down with the market. And I'm concerned that it's about to take another dive now. The question is, will we make a lower low? We still have a ways to go to get there after the recent rally so it's too early to get overly concerned, but we need to keep in mind that more selling may yet occur before we bounce again.

This market is making wide swings, which can be devastating to our accounts with one misstep.

But we do remain on a buy as the SS have not yet rolled over. But next week the bulls need to take control again, hopefully before too much more damage is done.

As usual, I'll be posting the Tracker charts over the weekend. See you then.