After days of wondering what plan members of the EU Summit would come up with to address their debt crisis, we finally got our answer. Another delay that could take weeks. But that didn't seem to bother the broader market as it recouped a large measure of yesterday's losses.

There was one data point released today. September durable goods orders showed a decline of 0.8%, although it was higher by 1.7% minus transportation. Economists were looking for a 1.0% drop overall and a 0.4% increase minus transportation.

Here's today's charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL also flipped back to buys. They aren't showing much movement though.

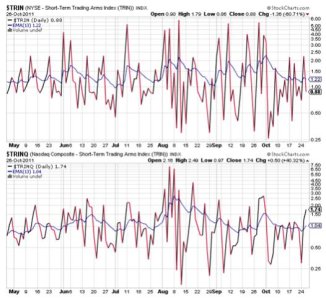

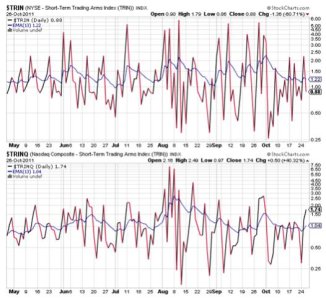

TRIN flipped back to a buy, while TRINQ remained in sell territory.

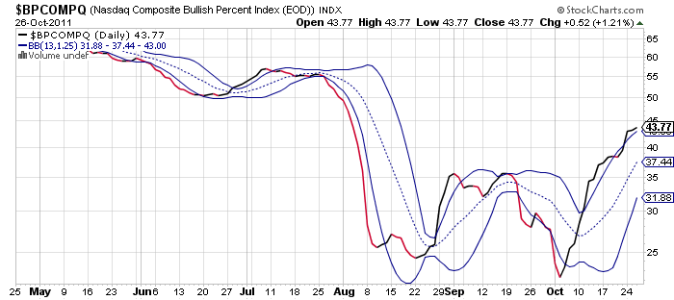

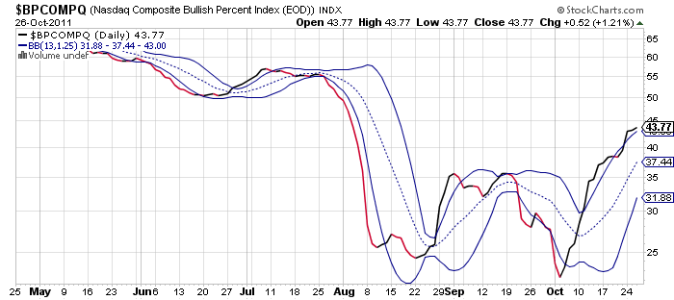

BPCOMPQ stretched to the upside a bit more today and remains in a buy condition.

So the signals are mixed, but the system remains in a buy condition.

Support has been holding, and today's advance in spite the EU Summit non-event has to be demoralizing for the bears. And while the Seven Sentinels hinted at possible lower prices yesterday, lower prices during today's intraday action only brought buyers. This strength has to be respected, and it's certainly possible we could melt up into the end of the year, although I would be surprised if we didn't have at least one good decline before the holidays.

There was one data point released today. September durable goods orders showed a decline of 0.8%, although it was higher by 1.7% minus transportation. Economists were looking for a 1.0% drop overall and a 0.4% increase minus transportation.

Here's today's charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL also flipped back to buys. They aren't showing much movement though.

TRIN flipped back to a buy, while TRINQ remained in sell territory.

BPCOMPQ stretched to the upside a bit more today and remains in a buy condition.

So the signals are mixed, but the system remains in a buy condition.

Support has been holding, and today's advance in spite the EU Summit non-event has to be demoralizing for the bears. And while the Seven Sentinels hinted at possible lower prices yesterday, lower prices during today's intraday action only brought buyers. This strength has to be respected, and it's certainly possible we could melt up into the end of the year, although I would be surprised if we didn't have at least one good decline before the holidays.