I doubt it. Today's advance was probably more attributable to the Bernanke Put than anything else. A lot of traders and institutions know better than to trade against the Fed for too long, if at all. In fact, I'm much more inclined to go to cash on a sell signal (in my brokerage account) than open up short positions in this environment.

I had expected a bit more chop over the next couple of days, but apparently the market was ready to blow the S&P well past that psychological 1300 line. Its closing price was 1309.66. And it's end of quarter, so watch for institutional positioning during the final trading days of the month. It should be evident in higher volume trading days.

Today's advance actually began in Europe, where their major bourses tacked on gains of more than 1% in spite of a Moody's downgrade of about 30 banks in Spain.

On the domestic front, it was another relatively light reporting day. Durable goods saw a February decline of -0.9% overall and -0.6% less transportation. This was well below estimates.

Weekly initial jobless claims totaled 382,000, which was almost on target with estimates.

Oil remained relatively flat at $105.60 per barrel.

All seven sentinels remained on buys today, but NYMO did not hit a 28-day trading high. Still, that's two unconfirmed buy signals in as many days and that probably portends a bigger upside move coming, but probably not before we hit some air pockets. Here's the charts:

Looking good on the momentum front.

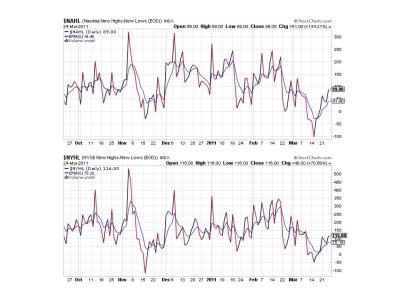

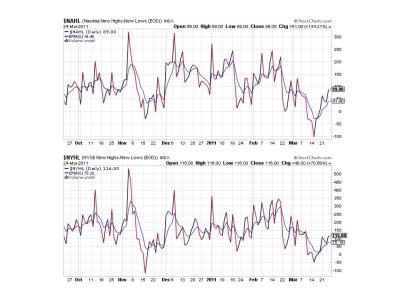

NAHL and NYHL look good too.

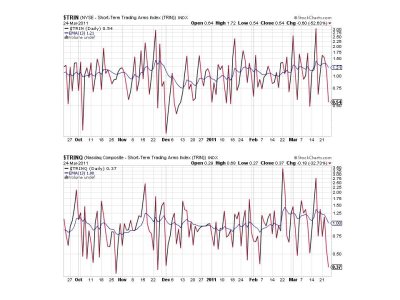

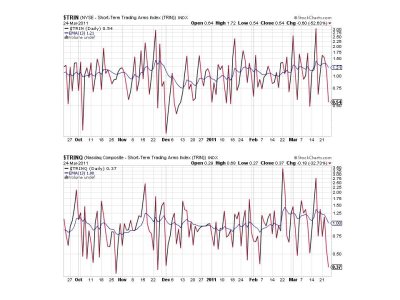

Here's where the airpockets come in. TRIN and TRINQ are screaming overbought market. Look for at least some volatility in the days ahead.

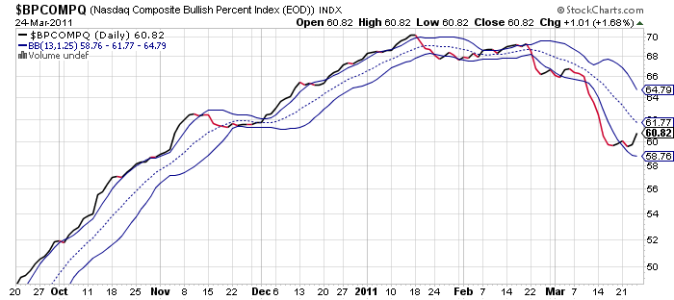

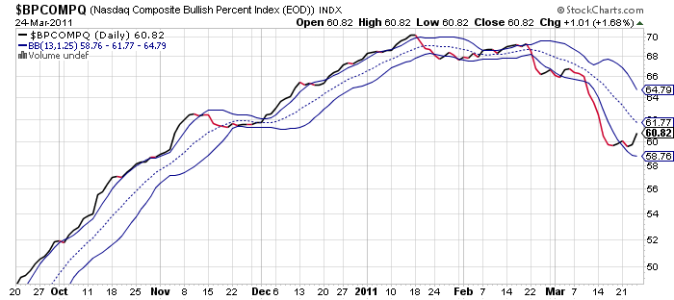

BPCOMPQ took a decided turn higher and is looking bullish once again.

So officially the system remains in a sell condition, but with two consecutive unconfirmed buy signals I'd be looking to buy dips here, assuming we get any over the next few days. As I already mentioned, window dressing may be at play and liquidity is still pouring into this market. That combination could mean we get silly on the upside over the next few days. But given the readings on TRIN and TRINQ I'm looking for dips regardless and I highly expect them to be bought. If it plays out like this, watch out for the 1st of April and the following Monday. They may be selling opportunities. But let's let this market play out one day at a time. We can never be sure when a curve ball gets thrown.

I had expected a bit more chop over the next couple of days, but apparently the market was ready to blow the S&P well past that psychological 1300 line. Its closing price was 1309.66. And it's end of quarter, so watch for institutional positioning during the final trading days of the month. It should be evident in higher volume trading days.

Today's advance actually began in Europe, where their major bourses tacked on gains of more than 1% in spite of a Moody's downgrade of about 30 banks in Spain.

On the domestic front, it was another relatively light reporting day. Durable goods saw a February decline of -0.9% overall and -0.6% less transportation. This was well below estimates.

Weekly initial jobless claims totaled 382,000, which was almost on target with estimates.

Oil remained relatively flat at $105.60 per barrel.

All seven sentinels remained on buys today, but NYMO did not hit a 28-day trading high. Still, that's two unconfirmed buy signals in as many days and that probably portends a bigger upside move coming, but probably not before we hit some air pockets. Here's the charts:

Looking good on the momentum front.

NAHL and NYHL look good too.

Here's where the airpockets come in. TRIN and TRINQ are screaming overbought market. Look for at least some volatility in the days ahead.

BPCOMPQ took a decided turn higher and is looking bullish once again.

So officially the system remains in a sell condition, but with two consecutive unconfirmed buy signals I'd be looking to buy dips here, assuming we get any over the next few days. As I already mentioned, window dressing may be at play and liquidity is still pouring into this market. That combination could mean we get silly on the upside over the next few days. But given the readings on TRIN and TRINQ I'm looking for dips regardless and I highly expect them to be bought. If it plays out like this, watch out for the 1st of April and the following Monday. They may be selling opportunities. But let's let this market play out one day at a time. We can never be sure when a curve ball gets thrown.