-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pension

- Thread starter gibsonman

- Start date

uscfanhawaii

TSP Pro

- Reaction score

- 18

What is everyone's appox pension going to be?

First, CSRS typically 67%, FERS typically 52%, of High Three salary.

Besides that, depends on salary, # of years, and sick leave left over.

Bullitt

Market Veteran

- Reaction score

- 75

FERS typically 52%, of High Three salary.

Please explain how a FERS employee can get 52% their high three.

losingmoney

First Allocation

- Reaction score

- 0

Sounds more like a PERS retirement than a FERS retirement.

Sent from my iPhone using TSP Talk Forums

Sent from my iPhone using TSP Talk Forums

PessOptimist

Market Veteran

- Reaction score

- 67

By having 47.28 years creditable fed service? If it was all civil service that would mean having converted to FERS. Could be the person started as FERS and bought back 13 years or so military time? Peace Corp time? I looked up the average and for 2016 it was 27%.Please explain how a FERS employee can get 52% their high three.

PO

Bullitt

Market Veteran

- Reaction score

- 75

Not a "typical" situation by any means.

Here's where 67% came from. Nothing about % of high-three.

https://federalnewsnetwork.com/mike.../how-average-are-you-and-what-does-it-matter/

First, CSRS typically 67%, FERS typically 52%, of High Three salary.

Here's where 67% came from. Nothing about % of high-three.

In FY 2018, more than 2.6 million people received civil service annuity payments, including 2,132,713 employee annuitants and 514,266 survivor annuitants. Of these individuals, 67% received annuities earned under CSRS.

https://federalnewsnetwork.com/mike.../how-average-are-you-and-what-does-it-matter/

weatherweenie

TSP Legend

- Reaction score

- 179

If they are in the FAA/LEO etc, they can get 1.7% for their first 20 years of service. Otherwise, 'regular' FERS will be able to get 1.1% if they have 30 years and 62+ years of age. Of course, that works out to over 47 years of service to get 52%.

No thanks. I'm going at my minimum retirement age, 56.5. I will have around 33 years of service. If you add Social Security, if it's still viable, I will receive over 50% of my current salary.

No thanks. I'm going at my minimum retirement age, 56.5. I will have around 33 years of service. If you add Social Security, if it's still viable, I will receive over 50% of my current salary.

Please explain how a FERS employee can get 52% their high three.

Buffalo_Nickle

Market Tracker

- Reaction score

- 14

Let's not forget, minus Health and Dental and Survivor Benefit if need be the case.

Frixxxx

Moderator

- Reaction score

- 131

FERS retirement ~31% Top 3 years at 56 3/4 yo

Military (reserve) ~41% base pay of E-8 over 33 years service at 60 yo

TSP - yearly withdrawals

Stocks (dividend paying)- Price dependent

Bonds - Price dependent

My estimated yearly income will be ~ 110% of current income

Assumptions:

1. No mortgage payment

2. No mortgage payment

3. No mortgage payment

Assumes 3.5% annual market value increase

Assumes % withdrawal will be adjusted on market performance

@70 yo take mandatory withdrawals and invest in CD/Municipal Bonds if viable

Last note: Since I never have trusted that SS would be around for my retirement, I've never added it in to my calculations (except as supplement for FERS).

If it is there that's a cruise every other month for me and the missus!

Military (reserve) ~41% base pay of E-8 over 33 years service at 60 yo

TSP - yearly withdrawals

Stocks (dividend paying)- Price dependent

Bonds - Price dependent

My estimated yearly income will be ~ 110% of current income

Assumptions:

1. No mortgage payment

2. No mortgage payment

3. No mortgage payment

Assumes 3.5% annual market value increase

Assumes % withdrawal will be adjusted on market performance

@70 yo take mandatory withdrawals and invest in CD/Municipal Bonds if viable

Last note: Since I never have trusted that SS would be around for my retirement, I've never added it in to my calculations (except as supplement for FERS).

If it is there that's a cruise every other month for me and the missus!

James48843

TSP Talk Royalty

- Reaction score

- 906

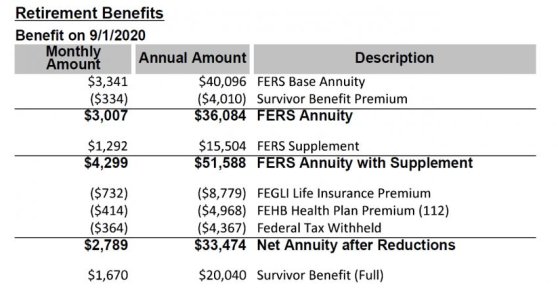

I got my final numbers this morning. Planning on retiring August 31.

Final FERS numbers for me are:

31 years 9 months 28 days of service

high three was $ $125,957

FERS will be: $ 3,007 per month

FERS Supplement will be : $1,292 /month

I intend to withdraw $5,000 per month from TSP until everything is settled, then probably back it down ti $4K a month or less until age 67, whe I get full SS.

I ran the numbers and if I earn 7% per year on tsp stock gains, I'll be able to take $5 K a month forever. I don' think I will be around "forever"

I also have $1400 a month from Guard retirement starting this month .

So....not bad.

So- not too bad.

Final FERS numbers for me are:

31 years 9 months 28 days of service

high three was $ $125,957

FERS will be: $ 3,007 per month

FERS Supplement will be : $1,292 /month

I intend to withdraw $5,000 per month from TSP until everything is settled, then probably back it down ti $4K a month or less until age 67, whe I get full SS.

I ran the numbers and if I earn 7% per year on tsp stock gains, I'll be able to take $5 K a month forever. I don' think I will be around "forever"

I also have $1400 a month from Guard retirement starting this month .

So....not bad.

So- not too bad.

weatherweenie

TSP Legend

- Reaction score

- 179

James,

Did you deduct anything from your FERS calculation? Based on the numbers you provided, your figure seems low.

Did you deduct anything from your FERS calculation? Based on the numbers you provided, your figure seems low.

I got my final numbers this morning. Planning on retiring August 31.

Final FERS numbers for me are:

31 years 9 months 28 days of service

high three was $ $125,957

FERS will be: $ 3,007 per month

FERS Supplement will be : $1,292 /month

I intend to withdraw $5,000 per month from TSP until everything is settled, then probably back it down ti $4K a month or less until age 67, whe I get full SS.

I ran the numbers and if I earn 7% per year on tsp stock gains, I'll be able to take $5 K a month forever. I don' think I will be around "forever"

I also have $1400 a month from Guard retirement starting this month .

So....not bad.

So- not too bad.

rangerray

TSP Pro

- Reaction score

- 209

This is an estimate for me from 2018:

Actual High-3 Salary = $77,545

Service Comp Date = 01/25/1989

Service Computation Date = 01/25/1993

Unreduced Monthly Annuity = $2,116.33

Gross Monthly Annuity = $2,116.00

Deductions, Health Insurance Premium = $558.59

Net Monthly Annuity = $1,557.41

FERS Annuity Supplement = $1,109.00

Total of Net Monthly & Supplement = $2,666.41

Monthly Survivor Annuity Selection = $0.00

Service Credits = 32 years, 9 months, 3 days

Estimate Basis Age at Retirement = 56 years, 2 months

Actual High-3 Salary = $77,545

Service Comp Date = 01/25/1989

Service Computation Date = 01/25/1993

Unreduced Monthly Annuity = $2,116.33

Gross Monthly Annuity = $2,116.00

Deductions, Health Insurance Premium = $558.59

Net Monthly Annuity = $1,557.41

FERS Annuity Supplement = $1,109.00

Total of Net Monthly & Supplement = $2,666.41

Monthly Survivor Annuity Selection = $0.00

Service Credits = 32 years, 9 months, 3 days

Estimate Basis Age at Retirement = 56 years, 2 months

James48843

TSP Talk Royalty

- Reaction score

- 906

James48843

TSP Talk Royalty

- Reaction score

- 906

I'm debating whether to lower the FEGLI. Currently I have 3X on that, and have had 5X until the last premium increase. Once you turn 60 it gets much more expensive.

I also am carrying another 350K in life insurance from WAEPA. That to was 500K until the last premium increase. I figure my wife is going to get a LOT of traveling after I die, unless we all are locked down for the next decade. If I live, great, but I wanted her to have a nice piggy bank if I didn't. I MAY lower my FEGLI to 2X right after I retire- I want to get the final OPM numbers all settled, and then see where I am at, before I fine tune the income/outgo stream around the end of the year.

Then I can start 2021 in a good place, intending to have positive cash flow and cross my fingers they come up with a good vaccine, so that I can do some traveling next year around Europe.

I also am carrying another 350K in life insurance from WAEPA. That to was 500K until the last premium increase. I figure my wife is going to get a LOT of traveling after I die, unless we all are locked down for the next decade. If I live, great, but I wanted her to have a nice piggy bank if I didn't. I MAY lower my FEGLI to 2X right after I retire- I want to get the final OPM numbers all settled, and then see where I am at, before I fine tune the income/outgo stream around the end of the year.

Then I can start 2021 in a good place, intending to have positive cash flow and cross my fingers they come up with a good vaccine, so that I can do some traveling next year around Europe.

weatherweenie

TSP Legend

- Reaction score

- 179

Everyone's situation is unique. I personally am in a position where I will not carry life insurance into retirement.

I'm debating whether to lower the FEGLI. Currently I have 3X on that, and have had 5X until the last premium increase. Once you turn 60 it gets much more expensive.

I also am carrying another 350K in life insurance from WAEPA. That to was 500K until the last premium increase. I figure my wife is going to get a LOT of traveling after I die, unless we all are locked down for the next decade. If I live, great, but I wanted her to have a nice piggy bank if I didn't. I MAY lower my FEGLI to 2X right after I retire- I want to get the final OPM numbers all settled, and then see where I am at, before I fine tune the income/outgo stream around the end of the year.

Then I can start 2021 in a good place, intending to have positive cash flow and cross my fingers they come up with a good vaccine, so that I can do some traveling next year around Europe.

Bullitt

Market Veteran

- Reaction score

- 75

I have friends in dual working households that brag about $1M insurance policies if they die. It makes me wonder how much they have saved if they need a policy of that magnitude.

FEGLI basic, free after 65, seems like a good deal. It will pay for the cremation, pizza and keg of beer for the family get-together when I die. My thing with insurance is I don't trust ANY person trying to sell me something financial.

Anyone have thoughts on a FERS survivor annuity?

FEGLI basic, free after 65, seems like a good deal. It will pay for the cremation, pizza and keg of beer for the family get-together when I die. My thing with insurance is I don't trust ANY person trying to sell me something financial.

Anyone have thoughts on a FERS survivor annuity?

weatherweenie

TSP Legend

- Reaction score

- 179

Anyone have thoughts on a FERS survivor annuity?

I will be selecting the 25% survivor annuity. The main/only reason is to give my wife access to health insurance.

mine after all deductions..taxes, insurance is 4320 monthly + My SS, Wifes pension her SS, my VA and if I take 1500 per month from my TSP ( will last 43 years at 1% return) ( leaving hers alone until RMD), my net income will be 2k more per month then I make now,,,saving VA monthly

flalaw97

TSP Strategist

- Reaction score

- 13

I'm debating whether to lower the FEGLI.

If you don't want to reduce the payout but want to reduce the premium, you might want to shop it around. I ran some quotes on USAA and they were significantly cheaper for the same payout. I have been told that when the Gov contribution goes away after you retire, FEGLI becomes a very expensive product. In fact, CPA Dan Jamison (FERSGUIDE) says FEGLI is "the most expensive life insurance on the planet, with no underwriting standards during open season or initial enrollment." Of course if you have pre-existing conditions, getting life insurance may be difficult/expensive but if you are in good health you might be able to find similar coverage at a much lower cost. Just a thought.

James48843

TSP Talk Royalty

- Reaction score

- 906

If you don't want to reduce the payout but want to reduce the premium, you might want to shop it around. I ran some quotes on USAA and they were significantly cheaper for the same payout. I have been told that when the Gov contribution goes away after you retire, FEGLI becomes a very expensive product. In fact, CPA Dan Jamison (FERSGUIDE) says FEGLI is "the most expensive life insurance on the planet, with no underwriting standards during open season or initial enrollment." Of course if you have pre-existing conditions, getting life insurance may be difficult/expensive but if you are in good health you might be able to find similar coverage at a much lower cost. Just a thought.

And therein lies the problem.

I'm age 60. Already had two heart attacks and triple bypass; have significant arthritis knocking me down, my wife is healthy and four years younger than me to begin with. That means I am far more likely to kick the bucket sooner, and I'd like to leave her with a decent pension. Nobody else will write me life insurance at this age/condition. What I have through WAEPAI got more than 20 years ago, and it is by far a good deal comparatively.

The FEGLI will have to get reduced, but not eliminated. I just am going to wait until everything is processed through to OPM before I scale that back.

Similar threads

- Replies

- 1

- Views

- 513