sdouglas3

TSP Strategist

- Reaction score

- 8

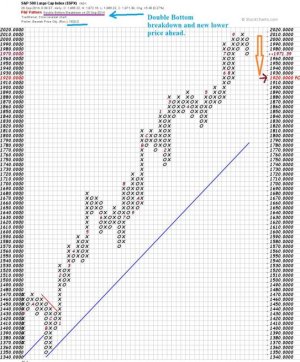

This thing has huge legs and may grind up for a long while.

TTB = triple top breakout I presume. We are currently in what is often the most bullish of all the patterns, a 3rd of a 3rd of a 3rd. It's uncharted territory from here on out with no overhead resistance. Are we in the start of another melt-up that will carry into 2014.