Hi James!

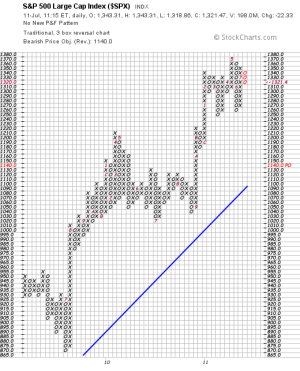

I agree with you. There could be a mild downturn but the uptrend is intact. The U.S. still holds the leadership in the traditional free world economies. We are the leaders of the global interdependency, a country that others look out for and respect as a serious safe haven for their assets. We will recover big time.

I agree with you. There could be a mild downturn but the uptrend is intact. The U.S. still holds the leadership in the traditional free world economies. We are the leaders of the global interdependency, a country that others look out for and respect as a serious safe haven for their assets. We will recover big time.