After yesterday's follow-through downside action (Friday was down too), it wasn't unexpected to see a bounce like the one we got today as we were oversold in the short term.

Oil, which has become a focal point for the markets, saw volatile trade, but took a breather of sorts as it closed down by about 0.4%. A barrel of oil still hovers around $105 per barrel and there's no reason to think it's hit its peak.

There were no economic reports today so we'll get right to the charts.

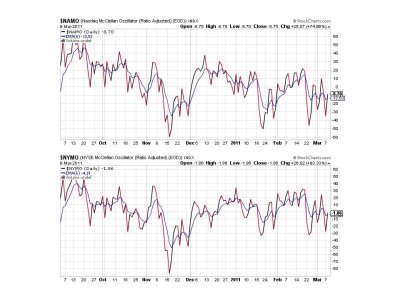

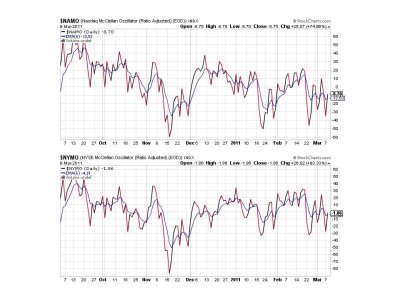

NAMO and NYMO flipped back to buys.

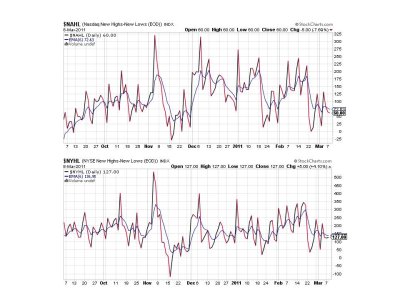

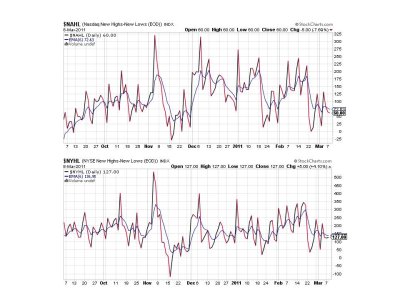

NAHL and NYHL remained on sells and suggest today's rally wasn't as healthy as it might seem.

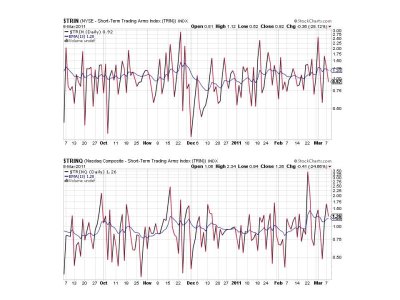

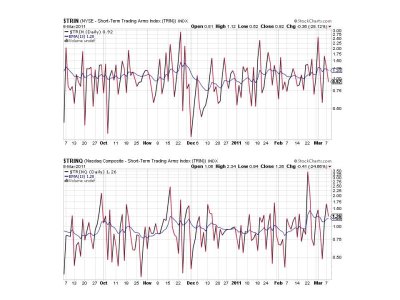

TRIN flipped to a buy, while TRINQ remained on a sell.

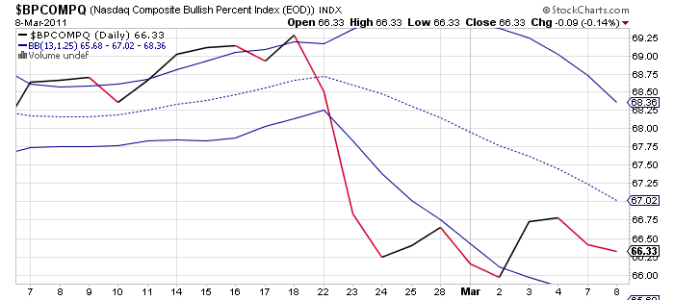

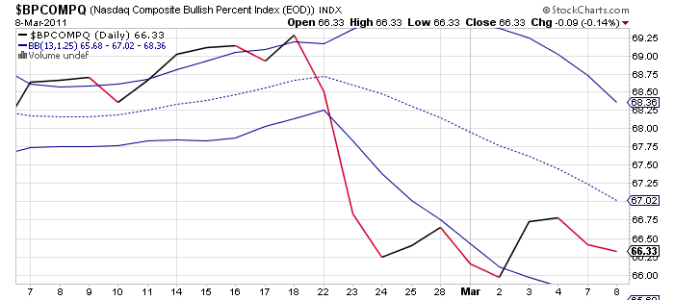

BPCOMPQ remains on a buy, but dipped a bit in spite of the rally. Since it's a trend indicator it is certainly showing market pressure over the past two weeks or so. But its movement has not been dramatic and that's somewhat of a positive for the market.

So the Sentinels are showing mixed signals, but the system remains on a buy. I have little to add after today's action. Nothing has really changed. Oil is still a market factor, QE2 is still being pumped (and will until the end of June), geopolitical pressures are still in evidence, and volatility continues. I think we'll move higher at some point, but perhaps not until we correct a little more. Assuming that will happen, I'll patiently wait before I redeploy my 50% G fund position back into stocks

Oil, which has become a focal point for the markets, saw volatile trade, but took a breather of sorts as it closed down by about 0.4%. A barrel of oil still hovers around $105 per barrel and there's no reason to think it's hit its peak.

There were no economic reports today so we'll get right to the charts.

NAMO and NYMO flipped back to buys.

NAHL and NYHL remained on sells and suggest today's rally wasn't as healthy as it might seem.

TRIN flipped to a buy, while TRINQ remained on a sell.

BPCOMPQ remains on a buy, but dipped a bit in spite of the rally. Since it's a trend indicator it is certainly showing market pressure over the past two weeks or so. But its movement has not been dramatic and that's somewhat of a positive for the market.

So the Sentinels are showing mixed signals, but the system remains on a buy. I have little to add after today's action. Nothing has really changed. Oil is still a market factor, QE2 is still being pumped (and will until the end of June), geopolitical pressures are still in evidence, and volatility continues. I think we'll move higher at some point, but perhaps not until we correct a little more. Assuming that will happen, I'll patiently wait before I redeploy my 50% G fund position back into stocks