One Thursday, the market received a better-than-expected ADP Employment Report that showed private payrolls in June were up 157,000, which was well above the 60,000 increase economists were looking. That was suppose to set the tone for Friday's latest payrolls report as it suggested payrolls would see a healthy number.

But it didn't play out that way as the official data for June showed nonfarm payrolls were up only 18,000, while private payrolls increased by 57,000. Both numbers were well below estimates. And as if that wasn't enough bad news the headline unemployment rate ticked up to 9.2% from 9.1%.

That much negativity in the job sector was too much for a market that's been on an upward tear for almost two weeks as the market gapped lower by about 1% at the open. Stocks did manage to fight back over the course of the day as the major averages slowly chopped their way higher by the close. But it wasn't enough to avoid moderate losses across the board.

While stocks were getting pummeled, Treasuries tacked on some healthy gains all session with the 10-year Note seeing a gain of more than a full point. That put its yield back near 3.0%.

Here's the charts:

It's entirely possible, given the lofty levels NAMO and NYMO achieved, that momentum swings back down towards the neutral line or lower here. That should translate into lower prices over the coming days. Both signals are now flashing sells.

Big spike lower for both NAHL and NYHL has flipped these two signals to sells as well.

TRIN and TRINQ crossed back up through their respective 13 day EMAs, which puts them in sell conditions too. TRIN is suggesting modestly oversold conditions, while TRINQ is relatively neutral.

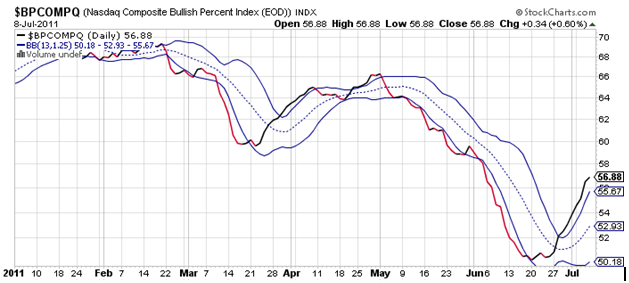

BPCOMPQ ebbed slightly higher, but it's a slower signal and does not always reflect a change in trend immediately. That's not to say the trend is changing, only that it's too early to know. It does remain in a buy condition.

So all buy one signal are now on sells, but the system remains on a buy.

Looking at these charts, I'm very inclined to believe lower prices are coming in the days ahead. But that was a powerful rally the market staged so any selling pressure may not last very long. In any event, I'll be watching these signals carefully for an opportunity to redeploy my capital back into stocks. I'm in no hurry to get reinvested though. Patience is key here.