[TABLE="class: tablewrapper"]

[TR]

[TD="class: econo-reportname, colspan: 2"]

EIA Petroleum Status Report

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]

Economic Calendar - Bloomberg

| | |

[TABLE="class: actual_consensus_box"]

[TR="class: actual_consensus_toprow"]

[TD] | Prior | Actual |

| Crude oil inventories (weekly change) | | |

| Gasoline (weekly change) | | |

| Distillates (weekly change) | | |

[TD="class: econo-releaseinfo"] Released On 2/18/2016 11:00:00 AM For wk2/12, 2016 [/TD]

[TD="class: actual_consensus_box_numbers"]-0.8 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"]

2.1 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]1.3 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"]

3.0 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]1.3 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"]

1.4 M barrels

[/TD]

[/TD]

[/TR]

[/TABLE]

[/TD]

[/TR]

[TR]

[TD="colspan: 2"] Highlights

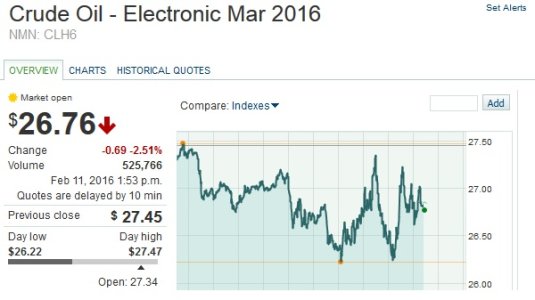

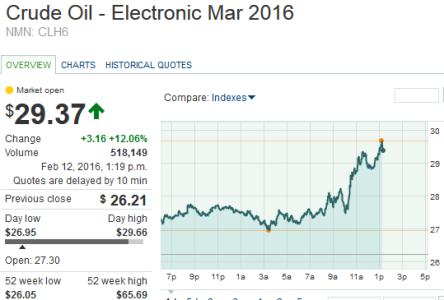

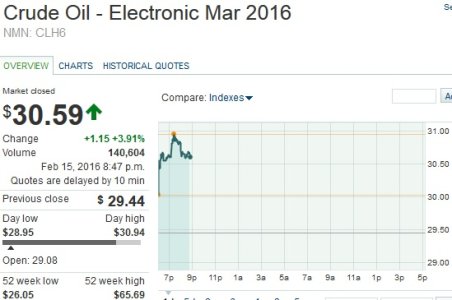

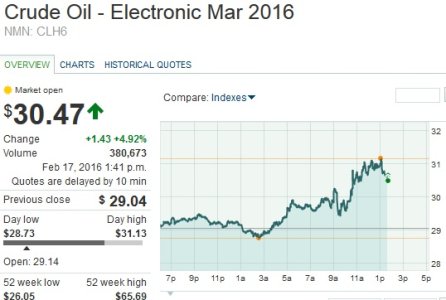

The petroleum glut continues to build. Oil inventories rose 2.1 million barrels in the February 12 week and further above 500 million barrels to 504.1 million. Product inventories are also increasingly heavy with gasoline up 3.0 million barrels and distillates up 1.4 million. WTI is falling sharply in immediate reaction to the run of builds, down about 75 cents to test $31 per barrel.

[/TD]

[/TR]

[TR]

[TD="class: econo-defaultpara, colspan: 2"] Definition

The Energy Information Administration (EIA) provides weekly information on petroleum inventories in the U.S., whether produced here or abroad. The level of inventories helps determine prices for petroleum products.

Why Investors Care [/TD]

[/TR]

[TR]

[TD="colspan: 2"][/TD]

[/TR]

[TR]

[TD="class: econo-charts, colspan: 2, align: center"] [TABLE="class: econo-charts"]

[TR]

[TD]

[/TD]

[/TR]

[TR]

[TD] As is evident from the chart, crude oil stocks can fluctuate dramatically over the year. When oil prices nearly reached $50 per barrel in August 2004, financial market players began to monitor crude oil inventories. It is not surprising to see sharp price hikes in crude oil when inventories are falling. Conversely, one would expect price declines when inventories are rising.

Data Source: Haver Analytics[/TD]

[/TR]

[/TABLE]

[/TD]

[/TR]

[/TABLE]