nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

How about that E85 how's it's price looking? It seems corn prices have spiked and should drive the price up.Gasoline dropped a nickle overnight where I am- making it 20 cents cheaper than 2 weeks ago.

How about that E85 how's it's price looking? It seems corn prices have spiked and should drive the price up.

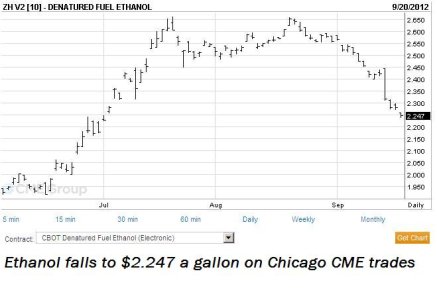

Wonderful Filler UP, I can't there is only 4 stations that carry E85 within 50 miles of here.Ethanol prices are falling- and Ethanol as a whole is now about 70 cents a gallon cheaper than gasoline- at least on the wholesale market at Chicago Board of Trade CME pits:

View attachment 20397

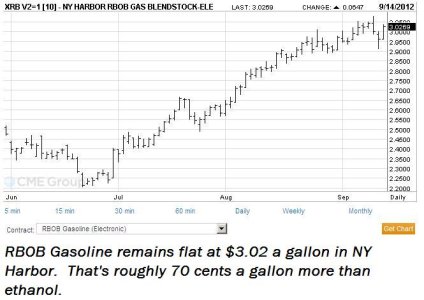

As for RBOB gasoline futures, they've been pretty flat, even though we've gotten a little break on the price of a barrel of oil. RBOB continues to hover right around $3 a gallon in New York Harbor barges:

View attachment 20398

In answer to your question- E85 is priced below gasoline right now, and it is slowly falling.

Just like gasoline, it seems to go up faster than it comes down, but it is coming down to remain cost-competitive.

Criminal investigation at Chevron refinery

Source: San Francisco Chronicle

Federal authorities have opened a criminal investigation of Chevron after discovering that the company detoured pollutants around monitoring equipment at its Richmond refinery for four years and burned them off into the atmosphere, in possible violation of a federal court order, The Chronicle has learned.

Air quality officials say Chevron fashioned a pipe inside its refinery that routed hydrocarbon gases around monitoring equipment and allowed them to be burned off without officials knowing about it. Some of the gases escaped into the air, but because the company didn't record them, investigators have no way of being certain of the level of pollution exposure to thousands of people who live downwind from the plant.

"They were routing gas through that pipe to the flare that they were not monitoring," said Jack Broadbent, executive director of the Bay Area Air Quality Management District, whose inspectors uncovered what Chevron was doing and ordered the bypass pipe removed.

The U.S. Environmental Protection Agency's criminal enforcement unit opened an investigation in early 2012, more than two years after the local inspectors made their discovery, according to air-quality officials and others familiar with the probe. The investigation is still open, and Chevron employees have been interviewed.

RIGZONE - The Role of Shale Gas in Deciding the US Presidential ElectionPresident Obama faces a shale gas dilemma that threatens to damage his bid to secure a second term in the White House, stated the latest report from natural resources experts GBI Research.

The United States is currently endowed with a wealth of natural gas following years of overproduction, and while allowing exports would win friends within the industry and potentially boost the economy, it would anger those seeking to keep domestic prices low, says the new report*.

The past few years have seen natural prices falling to around $3 to $4 per million British thermal units (MMBtu), and the U.S. Energy Information Administration EIA expects the annual wellhead natural gas price trend to remain at around $5 per MMBtu until 2025.

I hate when that happens. (hic)'Drunken' Broker Sent Oil to 8-Month High in 2009: Report

Source: CNBC

On June 30, 2009, oil mysteriously jumped by more than $1.50 a barrel during the night, to reach its highest price in eight months, the kind of swing that is caused by a major geopolitical event.

The amazing, true cause of this price spike has now been released by a Financial Services Authority investigation (FSA).

Although not authorized to invest company cash in trades, Steve Perkins, a long standing, senior broker at PVM Oil Futures, had managed to spend $520 million on oil futures contracts throughout the night, the FSA said.

On the morning of the 30th, an admin clerk called Perkins to ask why he had bought 7 million barrels of crude during the night. Perkins had no recollection of the transactions, and it turned out that he had made the trades during a “drunken blackout," according to the FSA.

By the time PVM realized the transactions had not been authorized by a client, they had incurred losses of $9,763,252.

...

The FSA has said that they will re-approve his license after the five-year period, if he has recovered from his drinking problem, although they warned that,“Mr Perkins poses an extreme risk to the market when drunk.”